The Weekly View (9/26/16 – 9/30/16)

What’s On Our Minds:

Since our firm was founded in 1995, there has always been a saying floated around the Tufton offices that, “crude is king”. Even with vast changes in the oil business over the last couple of years, oil arguably remains the world’s most important commodity and companies involved in the business play a major role in our clients’ portfolios.

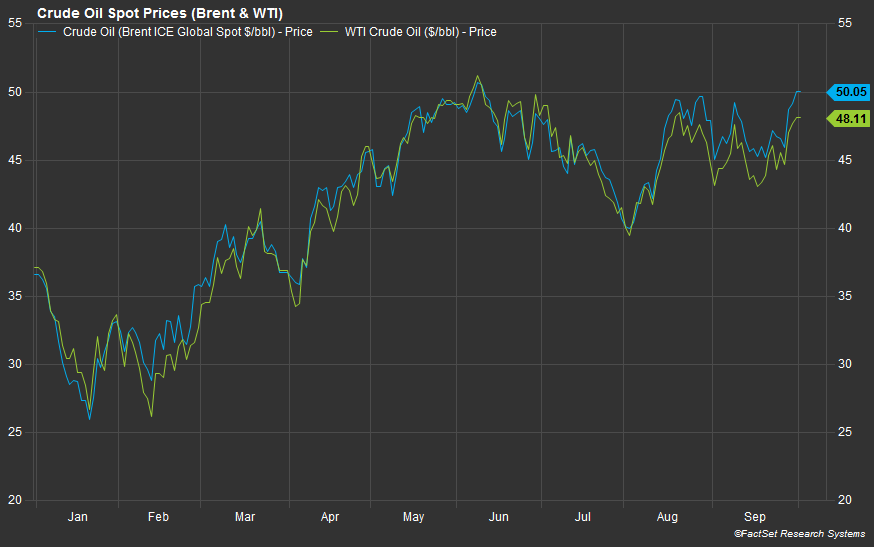

Since oil prices collapsed two years ago thanks to the rise of U.S. shale producers, OPEC has struggled to keep prices inflated and has not made a deal to cut production since 2008. Rather, since the oil collapse, Saudi Arabia has been pumping oil nonstop in attempt to put smaller producers out of business. At home, smaller producers aren’t making the money they were two years ago as the Saudis have attempted to pump them out of business. That all changed last week. A deal was made to bolster oil prices.

Last week OPEC met in north Africa’s Algiers, and after 2 years of arguing, the cartel agreed that they needed to collectively make a cut to their crude output. In reality, the deal is being made between Saudi Arabia and Iran who are OPEC’s most powerful members. According to Iran’s oil minister, Bijan Zanganeh, “OPEC made an exceptional decision”. They didn’t actually cut production yet though but decided to create a committee that will determine how much each country would have to cut. So, OPEC hasn’t succeeded yet.

All that came of the meeting in Algiers is that OPEC agreed to make an agreement and there are still questions as to whether or not the agreement goes through. No actual cut is going to be made until their next meeting in November where they plan on finalizing the agreement. So, oil prices are tracking higher, but we are going to have to wait and see OPEC’s next move.

Many analysts are citing OPEC has found itself stuck with a huge dilemma where they will lose revenue no matter what they do. On one hand, if they cut production and oil prices move higher, U.S. competitors will bring wells back online at prices where they are profitable and OPEC will lose market share. On the other, if they don’t cut production, oil prices will move back lower and they will continue hemorrhaging revenue on their oil sales.

Last Week’s Highlights:

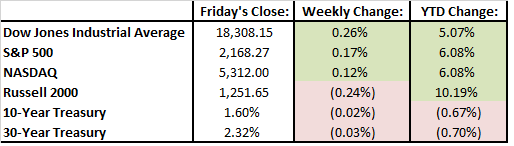

With the 3rd quarter wrapping up last week, we can take a look at market performance. Even though volatility picked up towards the end of the quarter, we saw strong returns of 3.5% in the S&P 500. This run marks the 4th consecutive quarter of gains.

Volatility was the theme of last week and investors seemed to be on an emotional roller coaster as the Dow moved by triple digit figures each day. Worries included a potential rate hike that didn’t go through, a heated presidential debate, and concerns over global economic health. A rally in oil prices brought some optimism to the market which helped it remain in the green for the week.

In company news, the U.S. Department of Justice announced that Germany’s Deutsche Bank was being fined $14 billion for its involvement in sales of mortgage backed securities that factored into causing the financial crisis. The company’s stock hit a record low point as investors were worried it would need to seek additional capital (a bailout of sorts). Then on Friday, the stock rallied 14% when news broke that the fine may actually be settled for just $5.4 billion.

Looking Ahead:

News broke Monday morning that outdoor superstore Cabela’s (CAB) had been bought by privately owned rival Bass Pro Shops for $5.5 billion. The stock opened up on Monday 19% above its closing price on Friday.

Investors will be focusing on numerous data points being released later this week. Economic indicators being released include ISM, automotive sales for September, ISM non manufacturing, weekly jobless claims and non farm payrolls. On Tuesday night, Vice Presidential candidates will square off in their debate. Furthermore, all eyes will be on Deutsche Bank’s situation as they try to make an official settlement with the U.S. justice department. As we stand now, most investors seem to be agreeing that weak corporate profits and election uncertainty are keeping markets from breaking out higher.