What’s On Our Minds:

Continuing with the employment theme, the economic team at Tufton presented research to the investment committee about the unemployment rate and how it relates to historical levels.

We are cautious when comparing to past numbers both the current U-6 unemployment rate (see definitions below) as well as the labor force participation rate. We believe that these two figures could reflect a structural change in the nature of employment as low-paying jobs become scarcer as automation increases. We believe that the U-3 rate, which is the “headline” figure, will be affected by these trends less than the U-6 rate.

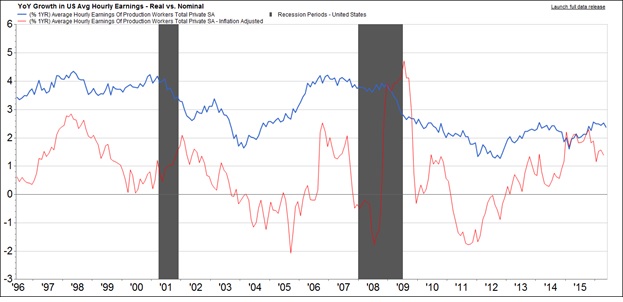

Tufton is also watching trends in hourly earnings. Economic theory states that when unemployment reaches or goes below its natural (equilibrium) level, wages begin to pick up as employers seek to attract employees. We see in the chart below that inflation-adjusted wages (in red) have been picking up for about the last two years, a sign that the economy is strong and employers are having to pay more for qualified candidates.

U-3: total unemployed, as a percent of the civilian labor force (this is the definition used for the official unemployment rate).

U-6: total unemployed, plus all marginally attached workers, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all marginally attached workers.

Civilian Labor Force: The subset of Americans who have jobs or are seeking a job, are at least 16 years old, are not serving in the military and are not institutionalized.

Last Week’s Highlights:

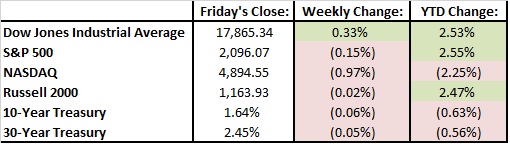

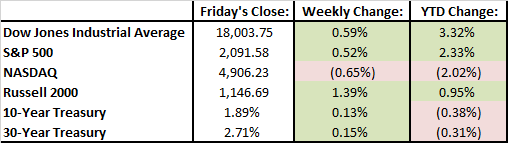

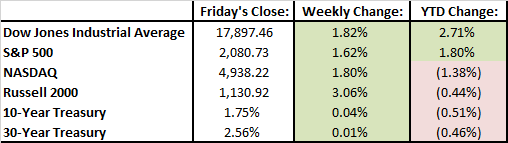

Last week, the major markets again ended mixed. The Dow was up 0.33%, the S&P 500 was mostly unchanged a -.15%, and the Nasdaq was down 0.97%, with some weakness in a few big tech names.

Many commentators poked fun at the Fed last week, noting that for all of Janet Yellen’s talking points and data, no real commitments or information were given.

Looking Ahead:

This week, we’ll be looking at China’s industrial and retail numbers on Monday. The Chinese growth story continues to affect worldwide markets, and numbers coming out of the country, while valuable, have been met with some skepticism in the past.For a checkup on the consumer, we’ll get US retail sales numbers on Tuesday. Another increase would mean consumers are less and less scared of spending their hard-earned cash. And, importantly, we will hear from Janet Yellen at the conclusion of the Fed meeting on Wednesday. We expect no real changes.

What’s On Our Minds:

As first quarter earnings season has wound down, investors’ eyes have been glued on economic data that could influence the Federal Reserve’s decision on whether or not to raise interest rates at their June 14-15 meetings. Last week, the markets were focused on the Nonfarm Payrolls (Jobs) Report that was released on Friday morning. Wall Street was expecting an addition of 160,000 jobs to the US economy. Unfortunately, the report showed that only 38,000 jobs were created in the month of May. Following the announcement, the markets saw a “risk-off” feel as the Dow Jones Industrial Average fell 135 points mid-Friday morning and the yield on the US 10-Year Treasury fell from 1.79% to 1.73% in a matter of minutes. In addition, the market’s view for a probability of an interest rate hike in June dropped from 20% pre-report to 3% after the report was released.

Breaking down the Jobs Report, the headline number was not as horrible as it appears. Verizon employees were recently on strike and hurt job growth by 37,000 jobs. Adjusting for Verizon, the economy added 75,000 jobs – still well below the Wall Street estimates and below the Federal Reserve’s sweet spot for raising rates (which is estimated to be monthly growth of 145,000 to 175,000 jobs.) Federal Reserve Chair Janet Yellen has stated “to simply provide jobs for those who are newly entering the labor force probably requires under 100,000 jobs per month.” Nevertheless, the May number may still be somewhat low.

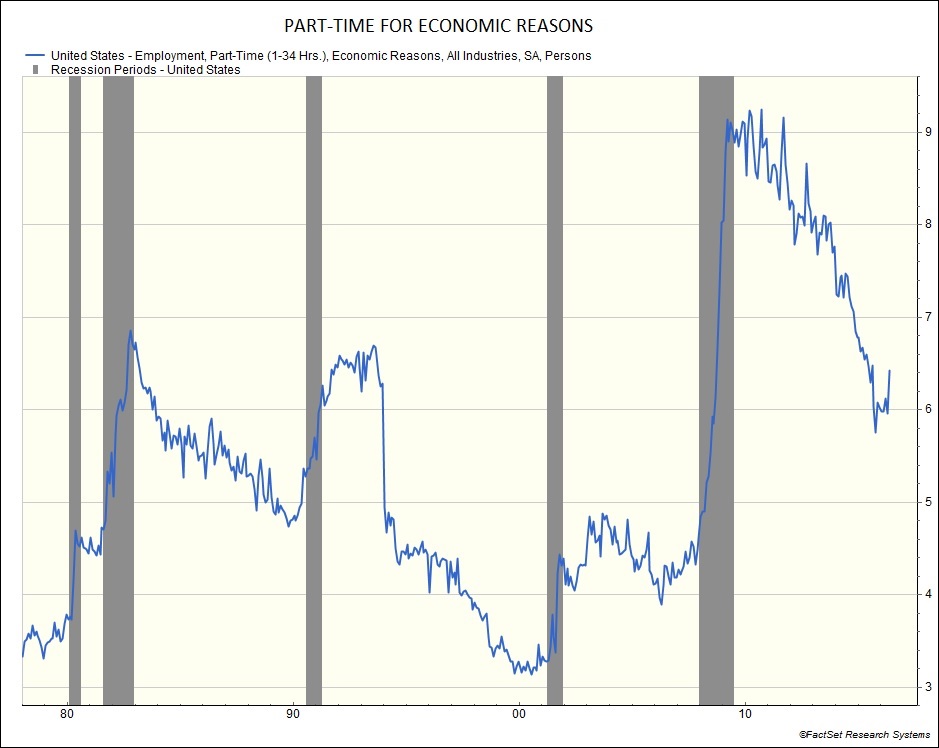

Other than the weak job growth in May, another negative trend is the rise in the amount of jobs categorized as “part-time for economic reasons” after bottoming in October of 2015. According to the Bureau of Labor Statistics, “these individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.” This implies there are still many people underemployed, leading to lower wages and thus lower spending from those consumers.

So while Chair Yellen may have a lot on her plate, many workers still do not.

Last Week’s Highlights:

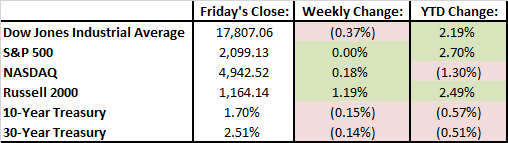

For the week of Memorial Day, the major market averages showed a mixed picture. The Dow was down 0.37%, the S&P 500 was unchanged, while the Nasdaq was up 0.18%. Year-to-date, the Dow and S&P 500 are up 2.2% and 2.7% respectively, not including dividends. With dividends, the S&P 500 Total Return Index actually hit an all-time high last week – showing the advantage of investing in dividend stocks.

With the jobs report blurring the near-term interest rate hike picture, the utility sector was the best performer while financials lagged as anticipated lower rates would continue to help the capital intensive utility companies, but compress bank net interest margins. The energy sector was also down as the OPEC countries did not agree on an oil production freeze last Thursday.

Looking Ahead:

Today, the markets are focused on Federal Reserve Chairman Janet Yellen as she speaks in Philadelphia at 12:30. Investors believe she will have a more “dovish” tone on the economic outlook, implying lower-for-longer interest rates. Investors will also gain insight on China’s economy with the release of several reports throughout the week. The Presidential Primaries will also wrap up on Tuesday with Donald Trump and Hillary Clinton both leading their respective parties in California.

What’s On Our Minds:

Following the 2008 market collapse, hedge fund managers were sometimes viewed as the bad guys who profited from others’ misfortune or perhaps the good guys who were smart enough to realize something wasn’t right in the financial system. Since then, the media and television shows (i.e. Billions) have glamorized the hedge fund industry. Stories about the few managers who predicted the housing market collapse and went on to produce high enough returns for them to retire ten times over have become nothing short of legendary.

Often considered the “smart money” in the world of Wall Street, hedge funds, have struggled in recent years and some investors have been pulling their money noting they are too complicated and too expensive. You may remember in September of 2014 when the California Public Employees Retirement System (Calpers) announced it would liquidate $4 billion it had invested with 24 different hedge funds. Considering Calpers is the nation’s largest pension fund, managing roughly $300 billion, this announcement was particularly newsworthy.

You see, good old traditional investing has outperformed a good portion of hedge funds since 2008. While the S&P 500 is up roughly 11% in the past 5 years, the HFRX global hedge fund composite is down about 1%. The struggle to produce alpha in clients’ portfolios and the traditional hedge fund fee model of 2% on assets and 20% on profits has put a strain on the fund industry. In the 4th quarter of 2015, investors pulled $26.77 billion out of hedge funds and then $14.35 billion during the first quarter of this year. These flows of assets show how critical investors have become of performance and fees.

Last Week’s Highlights:

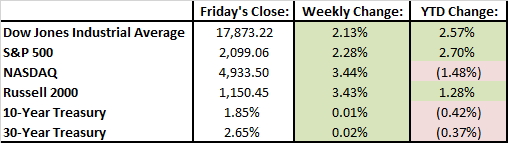

The market had a very strong week with the Dow and S&P both up over 2%. The NASDAQ went on a tear and was up 3.44% but the index is still down about 1.5% YTD. Based on these moves, it’s clear the market is no longer worried about the the Federal Reserve potentially increasing interest rates in June. Higher crude oil prices also helped the market rally with crude topping out around $50 per barrel. (A tough break for folks looking to make trips back and forth to the beach this summer in gas guzzling SUVs.) In company news, Hewlett Packard Enterprise announcing that it is planning on spinning off its services business. CEO Meg Whitman said of the deal, “It is always better to be on the front end of consolidation.”

Looking Ahead:

Markets were closed on Monday for Memorial Day in honor of those Americans who have paid the ultimate sacrifice. During the abbreviated week of trading, some important data will come across the wire. The European Central Bank is meeting on Thursday to discuss target inflation levels which could go on to influence interest rate and stimulus decisions. OPEC is meeting in Vienna on Thursday. Friday, U.S. nonfarm payrolls are reported. A good number could seal the deal on a June interest rate hike.

What’s On Our Minds:

This week, we take a step back from the financial workings of the economy and instead look at a macro trend that’s been getting a lot of attention but whose market implications haven’t been discussed as much: the phenomenon of self-driving cars. Sure, there has been plenty of attention given to the long term effects on markets like truck driving and shipping (they will be completely overhauled), but how do we get from here to there?

“Truck driver” is the #1 job in a majority of states. When all those jobs go away, it will mean big changes. It will dramatically drive down the cost of shipping, but it will also result in some 3.5 million truck drivers finding themselves out of a job. There will still be plenty of folks working in shipping, but no one will be driving. A ~3% increase in the unemployment rate is no small matter. It will put stress on politicians to do something to help those who are out of work, compounded with economic stresses from the changing US economy.

The question is, when? The technology is mostly here now, but it needs to be implemented, which is no small task. We expect, though, for large shippers to push hard to get regulations streamlined and trucks on the road because of the massive savings. Business Insider projects a major driver shortfall in the coming years (below) as the Millennial generation turns away from truck driving as a profession.

In the coming few years, we expect to see major changes from automation. Many industries and businesses are not prepared. We constantly scan our portfolios for these potential weaknesses – or strengths. Those who have major investments in artificial intelligence, like Google, stand to profit. The loser? Working-class Americans who cannot or will not re-train for a new career.

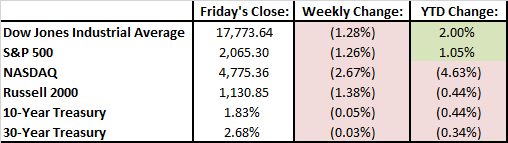

Last Week’s Highlights:

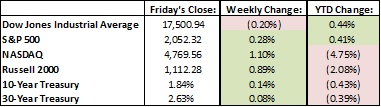

Stocks were mixed and mostly flat, as the Dow Jones Industrial Average fell .2% and the S&P 500 rose 0.3%. This marked the fourth consecutive week that the Dow has been in the red. On Monday, Warren Buffet disclosed that he had taken a one Billion dollar position in Apple which helped its stock after it has struggled lately. Later in the week, all eyes were on the Federal Open Markets Committee (FOMC) meeting on Wednesday. The federal reserve surprised the market and came out with a hawkish stance on further rate increases in June which caused stocks to fall, treasury yields to increase, and the dollar to gain strength.

Looking Ahead:

With last week’s wake up call from the Fed, investors will continue to weigh the changes that a June interest rate increase could bring to the market. Last time the fed raised rates by 25 basis points in December, the market sold but then recovered. It will be interesting to see how to market reacts to another increase or if the Fed continues to “kick the can down the road”. Internationally, the Eurozone and Japanese economy will be in focus this week as German GDP is released and Japan is hosting the G7 summit.

What’s On Our Minds:

Last week, investors received two very different perspectives on retail sales. The government report released on Friday stated that retail sales grew 1.3% in the month of April, which was the largest growth rate the US economy has seen in over a year. On the other hand, the large department stores reported first quarter earnings and offered lower than expected guidance for sales in the second quarter. Beaten up retailers such as JC Penney and Sears have struggled for years, but now their hardship seems to be spreading. For the week, Macy and Nordstrom were both down 17% and 18.5% respectively on the surprising sales guidance.

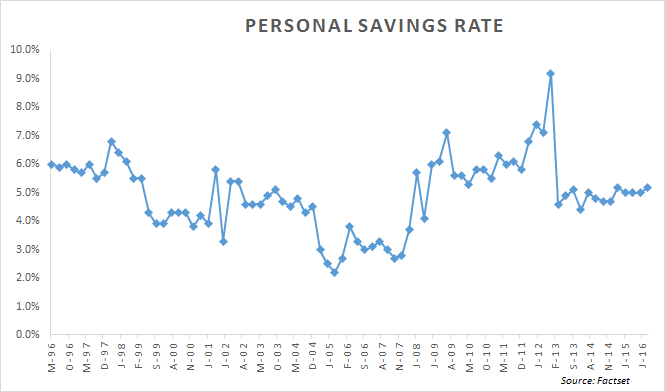

The retail sales report showed that “nonstore retailers” (i.e. online shopping) rose 10.2% on a seasonally adjusted basis from $41.1 billion in April of 2015 to $45.2 billion last month. Some analysts speculate that the day of reckoning is here for the brick and mortar department stores and that online shopping and Amazon are here to stay. Other analysts believe that the consumer is still not spending as the personal savings rate sits at 5.2% of disposable income, above the 20-year average of 4.9%. Perhaps the retail story is a mixture of both.

Nevertheless, the department stores have begun to pivot. Without a doubt, the US department store leader in the online space is Nordstrom. In 2011, the company acquired HauteLook which offers “flash-sales” and limited-time discounts from well-known brands. Last year, they launched Rack.com in order to sell apparel online from their Nordstrom Rack business. They also acquired clothing service company Trunk Club that provides customers with their own personal stylist and ships them handpicked clothing free of charge.

Internationally, department stores have made more radical moves to the ever-changing landscape. Selfridges in London realizes that in order to drive foot traffic, their stores need to become more of a destination. Recently, their London store provided Jedi training sessions that corresponded with the debut of the new Star Wars movie. In Japan, the Isetan Mitsukoshi Group is planning on opening stores in the center of large cities, as well as airports, residential areas and train stations.

Whatever the correct answer may be, we certainly think we’ve seen “The Brighter Side of Sears.”

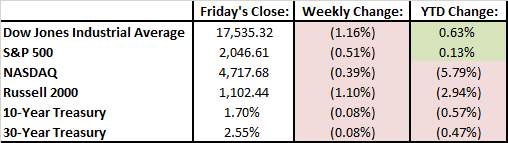

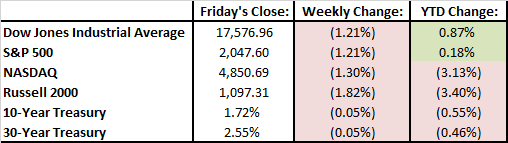

Last Week’s Highlights:

Stocks struggled last week as the Dow Jones Industrial Average fell 1.2% and the S&P 500 slipped 0.5%. In addition to the retail struggles, investors received weak credit data out of China and feared a stronger dollar. Another merger deal collapsed as the Federal Trade Commission blocked the combination office suppliers Staples and Office Depot. As a result, Staples was off 19% for the week while Office Depot was down an astonishing 40%! West Texas Intermediate Crude Oil rose 3.5% despite reports that Saudi Arabia, the world’s largest producer, was attempting to increase market share. The oil market appeared to be more focused on the supply disruptions in Canada and Nigeria.

Looking Ahead:

This week will bring additional news from the retailers with T.J. Maxx and Home Depot reporting first quarter earnings on Tuesday. Target and Home Depot’s rival Lowe’s will release their results on Wednesday and Walmart will polish off the retail news before the opening bell on Thursday. On the macro front, investors will be watching inflation with the release of the April Consumer Price Index reading at 8:30 on Tuesday morning. Analysts are expecting year over year growth of 0.4%. Janet Yellen and the Federal Reserve will certainly continue to watch this number closely as they decide on whether or not to raise interest rates at their meeting in June. Lastly, investors will also get a gauge of the housing sector with the release of April Housing Starting and April Existing Home Sales on Tuesday and Friday, respectively.

What’s On Our Minds:

Whether the going is tough or the market is hitting all-time highs, it’s important for investors to get back down to basics and remember their long term strategy. As a value focused investment firm, Tufton follows an investment strategy pioneered by Benjamin Graham during the 1930s, 40s, and 50s. During his time, he revolutionized the investment business by harping on the important difference between “investing” versus “speculating”. Rather than purchasing trendy companies and betting on the success of their emerging products, he focused on companies with good book values, which temporarily traded below their intrinsic value. In his books, Security Analysis (1932) and The Intelligent Investor (1949), he shares his insights on stock evaluation and the mindset needed for value investing. Even though it’s tough to purchase a stock that the rest of the market seems to hate, Graham explains how it’s essential to go against the grain when using his strategy. While markets have become much more efficient since Graham’s era, and it is not as easy to uncover mispriced securities, his strategies are still useful today. Just ask Warren Buffet.

Last Week’s Highlights:

The stock market struggled last week for the second week in a row. It wasn’t horrible though with the the S&P 500 selling off by 0.4%, finding support at its 50-day moving average on Friday. In company news, oil field service companies, Baker Hughes and Halliburton, cancelled their merger plans. The US Dept. of Justice had filed an anti-trust law suit against the merger last month. Economically, the big news was a miss on the US jobs number. Our economy added only 160,000 jobs in April which was the smallest gain we have seen since last September. With unemployment stuck at 5%, it is likely that the Fed will hold off on raising rates in June. In politics, Donald Trump became the presumptive Republican nominee after a win in Indiana. On the Democratic side of the isle, Hilary Clinton lost to Bernie Sanders in Indiana, but she is close to locking up all the delegates she needs for the Democratic bid. On Saturday, the Kentucky Derby favorite, Nyquist, took home $1.24 million. The horse will be arriving in Baltimore on Monday as our town prepares to host the Preakness on May 21st.

Looking Ahead:

We will be a watching a few more reports coming across the wire. Israeli based generic drug producer, Teva Pharmaceuticals, reports earnings on Monday. Disney, which many consider a bellwether for the cable television business, reports earnings on Tuesday. On Wednesday, Macy’s and Wendy’s will report. With analyst expecting a 1% increase, retail sales numbers will be released on Friday. With earnings wrapping up, analysts are likely to shift their focus on the Fed’s Open Market Committee meeting on June 15th.

There’s nothing quite like springtime in Maryland. As the temperature slowly rises, our community returns to the pursuits that we hold dear. Gardening plans are launched into action, outdoor grilling resumes, and, in keeping with local fashion etiquette, wardrobes that for months relied on royal purple abruptly shift in favor of orange and black.

Of course, we aren’t the only ones sporting a new outfit: Mother Nature, after a few weeks of chilly indecision, has at last decided to put on her Spring dress. Nowhere is that more apparent than from our office’s vantage over the Tufton Valley, which is becoming greener by the day.

As you may have heard, the view isn’t the only thing that has changed around here. On February 23rd, after months of careful deliberation, we officially changed our firm’s name to Tufton Capital Management. And as we settle into our new look, I want to assure you that while the lettering on the door may have changed, the values that define us have not. We remain, as a team, deeply committed to protecting your today, growing your tomorrow, and honoring the trust you have placed in us—and we believe our new name more accurately reflects the strength of that shared commitment.

With our new firm name comes the inaugural issue of Tufton Viewpoint, which begins with our outlook for the economy and financial markets. In this article, we remind our readers that equity investing is a long-term proposition, as evidenced by the recently completed first quarter. Timing the market earlier this year could have led to big losses (through early February) while missing the market’s impressive recovery through March.

Also included in Viewpoint is a timely discussion regarding active versus passive investing and the rise in popularity (and pitfalls!) of ETFs. As active investors, the financial professionals at Tufton Capital believe that “being average” is not enough. We seek to provide our clients with returns higher than the relevant benchmarks over a full market cycle without taking any undue risk.

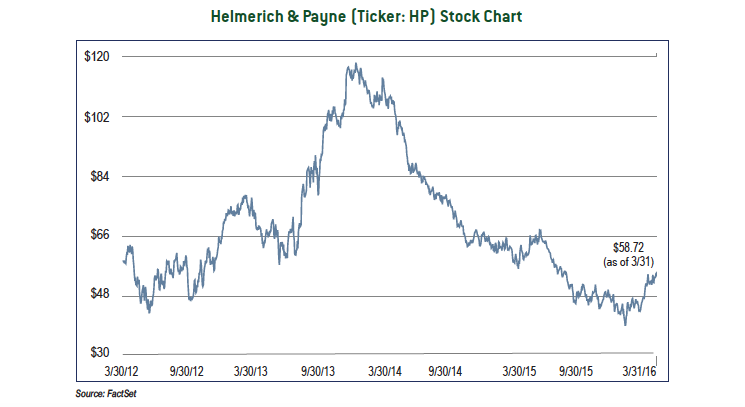

This quarter’s Tufton Viewpoint analyzes one of our favorite stock ideas: onshore oil rig driller Helmerich & Payne (HP). Finally, Trusts as a Planning Strategy, discusses how a properly structured trust can help you transfer wealth in the most efficient way possible.

As we enter our third decade in business, we’re as optimistic and excited as ever about the outlook for our firm and our clients. We wish all of you a very happy spring, and thank you again for your continued support!

The first quarter started with a bang as the stock market began a precipitous decline. By the end of the fifth trading day of the year, the Dow Jones Industrial Average and Standard & Poor’s 500 indexes had recorded losses of 6.2% and 6.0%, respectively. The losses are both records for the time period. The selling persisted and the market continued to head lower. The trough was reached in mid-February, but not before the major averages gave back over 11%. As stomach churning as the first six weeks were, the markets bounced back very strongly. After all the gyrations, we closed the quarter almost exactly where we started.

Interest rates were a sharp contrast to the stock market during the quarter. The 10-year U.S. Treasury bond started the year at 2.3%. As the stock market was reaching a low in mid-February, interest rates were also falling with the 10-year reaching 1.66%. As interest rates fall, the price of bonds rise. Bond prices have remained strong, and we closed the quarter with a 10-year treasury yield of 1.81%.

If we view the first quarter as a voting booth for the Federal Reserve’s decision to raise interest rates last December, we find that investors voted “nay.” The Fed has gotten the message and has turned more dovish with regards to monetary policy. The new stance was punctuated during a speech that Fed Chair Janet Yellen delivered to the Economic Club of New York on March 30, where she articulated that only gradual increases in the federal funds rate are likely to be warranted in coming years.

The first quarter reinforces some valuable lessons in investing. First, equity investing is a long-term proposition. Timing the market in January and February may have led to big losses while missing the market’s recovery. Second, fixed income securities, whether they are Treasury bonds, corporate bonds or certificates of deposit, provide valuable diversification that helps reduce an investment portfolio’s volatility.

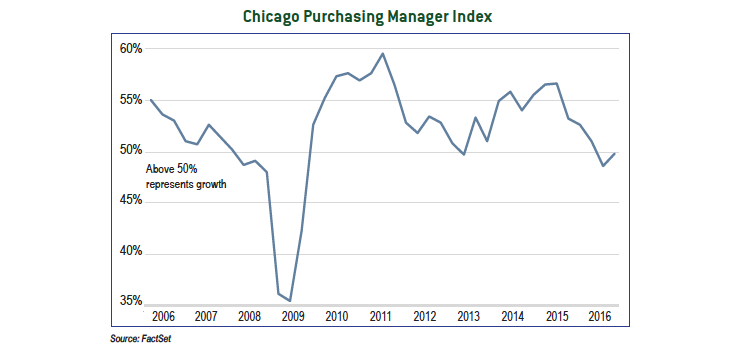

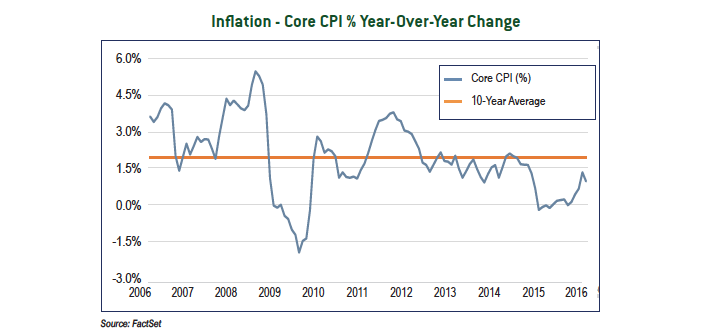

The economic environment continues to improve slowly. Employment numbers remain at impressive levels, and housing starts and housing permits are trending higher. More importantly, manufacturing, which has been volatile and generally weak over the past year, demonstrated strong growth in March. The combination of moderate economic growth with little inflation continues to be a winning combination for the stock market. Although inflation is low today, we closely monitor the situation for change. The Fed’s accommodative policy has provided a strong tailwind for nine years. An unanticipated increase in inflation could lead to a shift in Fed policy, resulting in headwinds. The dramatic collapse in the price of West Texas Intermediate crude oil from about $140/barrel in 2008 to $33/barrel earlier this year is clearly disinflationary. The price of energy percolates through many goods and services. However, the lowest prices are most likely behind us as supply and demand have worked towards equilibrium. A rise in energy prices will be inflationary to some degree. The response of supply and demand to higher prices will dictate pricing levels and the impact on future inflation.

The stock market gets more attractive as prices continue to languish. Obstacles to profit growth like a strong U.S. dollar and weak international markets are now being lapped, making year-over-year earnings comparisons easier. Valuations remain reasonable and are supported by the low interest rate environment. Bonds, on the other hand, are less attractive given the big drop in interest rates over the past three months. We are more selective in maturity patterns given the higher prices.

The lessons learned in the first quarter may continue to serve investors well over the balance of the year. Risks and volatility are ever-present. The terrorist attacks in Belgium are a reminder of the geopolitical tensions around the world. The political landscape at home remains unsettled. The presidential election includes a cast of characters with political views that run the gambit and party infighting is headline news. The uneven economic recovery has left many citizens angry and ready for radical change. The uncertainty of the outcome may weigh on the markets as we get closer to the election. As always, we will use the volatility to uncover opportunities as we seek to add value to your portfolio.

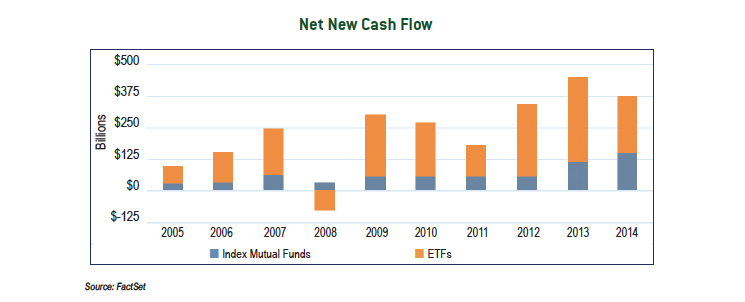

Over our twenty year history, Tufton Capital Management has followed a disciplined investment process where we focus on taking advantage of investors’ emotions and identify mispriced securities. As long-term value investors, we are happy to move against the herd and purchase securities when the market has given up on them, and later sell them when sentiment has improved. While we are fully committed to sticking with our strategy, we pay close attention to trends emerging in the money management business. One such trend is the popularity of passive investments including index funds and exchange-traded funds (ETFs), which investors have piled into since the bull market began in March 2009. While indexing may be an appropriate, low-cost option for retail investors, we believe a portfolio constructed entirely of these products is suboptimal for investors with sizable assets. Quite simply, these passive products in and of themselves are not tailored to meet a client’s specific financial objectives or risk parameters.

So why have investors (and financial advisors) moved towards passive indexing? First off, indexing is easy. You can purchase a few products and get a broadly diversified portfolio. Secondly, you don’t need to spend a lot of time or have expertise researching or monitoring the funds, as compared to the fundamental research we perform on our individual securities. Finally, most index funds and ETFs have lower management fees when compared to their actively managed counterparts. It’s no secret that only one out of five actively managed mutual funds typically beats its respective benchmark in a given year. Considering the poor performance and high fees of active funds, we consider the move towards indexing to be a logical one for small investors, but it has its drawbacks.

A fundamental flaw with passive indexing is that, by nature, the funds often buy high and sell low to mirror the performance of a specific index. For example, when a company has done well and is added to an index, typically its business has been thriving, which would likely have already propelled shares higher. On the flip side, when a company’s business has underperformed and it is removed from an index, an index fund is forced to sell and their investors have no opportunity to profit once a company’s prospects start to improve. Furthermore, because indexes like the S&P 500 are market capitalization weighted, as the price of a stock increases, the stock receives a greater weighting in the index. This conflicts with what we focus on as value investors – buying securities as they fall in price.

Another issue with index investing comes when indexes and ETFs are forced to trade securities only after an index’s plan to add a new stock is announced to the market. Traders can “front-run” these additions and buy shares beforehand, as they know the index funds will be buying the shares when the company is officially added to the index. An example of this occurred last year on Monday, March 16th when it was announced that American Airlines would be joining the S&P 500 that Friday. Come Friday, the stock had risen 11%. Index funds were thus forced to buy the stock at a higher price. Similar to the way high-frequency traders are able game the market, this is an example of smart money taking advantage of an index fund. Over time these events may erode the returns of investing in these low-cost products.

While riding the momentum in index funds feels great during a bull market, index investors may be left exposed from a risk perspective when the market inevitably heads south. This is because an index fund may have larger positions in companies with high valuations, and smaller positions in lowly valued companies. Thus, even though index investors are able to manage risk relative to their benchmark, they may struggle managing risk on an absolute basis. One of our goals is to provide our clients a higher return on their equities than the S&P 500 over a full market cycle, without taking any undue risk. Hence, we will stick to our guns and continue seeking to buy a dollar’s worth of assets for fifty cents.

Helmerich & Payne (Ticker: HP) is a contract driller that provides well-drilling services for oil and gas exploration and production, specializing in meeting the unconventional needs of the Shale Boom. Counting some of the best oil and gas companies among its clients, HP leads the market in unconventional onshore drilling rig services, having developed a rig uniquely suited to drill horizontal shale wells with outstanding efficiency. The company primarily operates through its 343 US-based onshore rigs, though it also operates offshore and internationally in Latin America.

Since the 1990s, the rig specialist has secured a position at the forefront of the Shale Revolution through a history of principled innovation, anticipating the demands of the market to make drilling faster, safer, more adaptable, more mobile, and exploit any opportunity to increase the output on a drilling site. The company first introduced its FlexRig technology in the late 1990s to provide the market with a rig that has increased mobility and an ability to drill at a range of depths. The first two models of the FlexRig line, FlexRig1 and the FlexRig2, were designed to drill at depths between 8,000 feet and 18,000 feet. In 2001, HP introduced the FlexRig3 with enhanced safety features and an even wider range of depth capability – from 8,000 to 22,000 feet. The company next focused on increasing the efficiency of the drill site as a whole. The FlexRig4 in 2006 introduced a “skidding” feature that gave improved mobility, allowing up to 22 wells to be drilled on a single pad space. In 2011, the FlexRig5 continued this trend and facilitated long lateral drilling of multiple wells in a single location. But the most important contribution of recent years has been the FlexRig’s ability to adapt to unconventional horizontal shale wells with staggering efficiency. The rigs, in fact, are capable of fetching daily rates nearly 50% higher than their peers.

Despite uncertainty in the energy markets, Helmerich & Payne is trading at an attractive valuation. Though forecasting the sales and earnings may prove to be difficult, conventional valuations of onshore drilling companies can be calculated on the basis of the value per rig and per unit of horsepower. Given the company’s market share and the exceptional efficiency delivered by their rigs relative to competitors’, Helmerich & Payne is more than likely to command a premium rate on either basis. Previously, acquirers have paid as much as $24 million per rig in precedent transactions, according to investment bank Johnson Rice. At a valuation of $24 million per rig, Helmerich & Payne is worth $87 per share. On a basis of horsepower, acquirers have paid as much as $17,500 per unit. Based on this valuation, the company is worth nearly $97 per share.

More than likely, Helmerich & Payne will not be acquired, but their market position and current valuation provide a solid margin of safety for investors. Its management has proven to be prudent and conservative with their capital, distinguishing the company as one of the few in the energy universe that entered the downturn without any debt. Further, Helmerich & Payne has paid a dividend every year since 1977, and the stock is currently yielding about 5%. In a no-to-low growth world, we would be happy to be “paid to wait.”

Find your plan of attack. Read on to decode the acronyms of wealth transfer and clear the mystery.

Trust Options

There are many different types of trusts that can help alleviate the effects of gift and estate tax and direct the flow of your wealth transfer. By designing a wellplanned trust strategy, you can transfer your wealth in the most efficient way possible.

Grantor retained annuity trusts (GRATs)

A GRAT is a type of trust that makes annuity payments back to its grantor over a number of years and then transfers any remaining value to a beneficiary. When a GRAT is created, the IRS uses a set growth rate (called the 7520 rate) to estimate the trust’s future value. It then subtracts the annuity payments from the future value to determine the remainder—the only portion taxed as a gift. Because GRATs are taxed upfront, any excess growth (growth above the 7520 rate) will be not be subject to gift taxes. Therefore, grantors often select annuity payments that equal the IRS’s expected future value, creating a GRAT that incurs no gift tax and leaves all excess growth as the remainder.

Common recommendations include keeping the term length of a GRAT relatively short, depending on the time horizon, or creating several short-term GRATs rather than one long-term GRAT. The reason for this is that if the grantor dies prior to the expiration of the GRAT term, the GRAT will fail in its purpose and all assets will remain subject to estate tax. For this reason, many opt for a “rolling GRAT;” which is a series of consecutive short-term GRATs. This technique also helps to hedge some of the risk of market fluctuations. However, short-term and rolling GRATs require larger annuity payments, so if there isn’t a large amount of liquid assets available, a long-term GRAT may be more effective.

Things to keep in mind when considering GRATs:

- GRATs are still subject to income taxes.

- GRATs are irrevocable—they cannot be changed or terminated.

- GRATs are legally required to pay annuities, regardless of growth.

Grantor retained unitrusts (GRUTs)

GRUTs are almost identical to GRATs, with the only difference being in how annual payments are determined. Instead of returning a fixed amount, GRUT annuities are a percentage of the trust’s value that year. That means that the income distributions will be less stable and may be higher one year, but lower the next.

Irrevocable life insurance trusts (ILITs)

ILITs are trusts designed to hold the life insurance policy of their creator. An ILIT essentially removes your life insurance policy from your official property, thereby protecting it from estate taxes. This type of trust also provides the surviving beneficiaries with funds while not passing into their estates, which helps avoid estate taxes as well. ILITs can help grantors feel secure because they guarantee that no matter how much a grantor spends in their lifetime, their beneficiaries will still receive an income after their death from their life insurance policy.

When considering ILITs, keep in mind the following:

- It takes three years after the ILIT is created for the IRS to consider the trust as outside the grantor’s estate.

- A provision known as Crummey powers allows beneficiaries to take small gifts annually from the trust for a brief period of time (usually 30 days). This allows beneficiaries to avoid gift taxes by taking the funds out in small amounts rather than receiving the total value of contributions as a large gift once the grantor dies.

Intentionally defective grantor trusts (IDGTs)

IDGTs are trusts that make the grantor the owner of the trust for income tax purposes but not for estate tax purposes. Using a trust with the word “defective” in its name may seem counterintuitive, but this simply refers to the fact that the grantor is taxed on the income the trust receives. The “intentional” part of the trust hints at the fact that this type of taxation allows the trust itself to remain untouched, leaving more money for the grantor’s future heirs. This “defect” in the trust is what makes it such a useful tool for generational wealth transfer.

This type of trust essentially freezes assets for estate tax purposes by allowing them to grow outside of their estate without income tax reductions, as the trust income tax is applied to the grantor instead of the trust itself. Since the tax rates escalate much more quickly for trusts than for individuals, this type of trust helps to save on overall income tax by putting the taxes in a lower bracket. As of 2016, trusts that earn over $12,400 will be taxed at a 39.6 percent rate—an individual would have to make over $415,051 before he or she was subject to those same rates.

Choosing a trust to aid your wealth transfer plan can be tricky, so it’s important to work with legal and financial professionals to do so. You should consider the unique aspects of each trust and whether or not they fit with your wealth transfer plan and your family’s needs. Whether you choose one type of trust or a combination of trusts, the most important thing is that you pass on your money in a way that makes you feel secure about the future of your legacy.

This article was written by Advicent Solutions, an entity unrelated to Tufton Capital Management. The information contained in this article is not intended for the purposes of avoiding any tax penalties. Tufton Capital Management does not provide tax or legal advice. You are encouraged by your tax advisor or attorney regarding any specific tax issues. Copyright 2013 Advicent Solutions. All rights reserved.

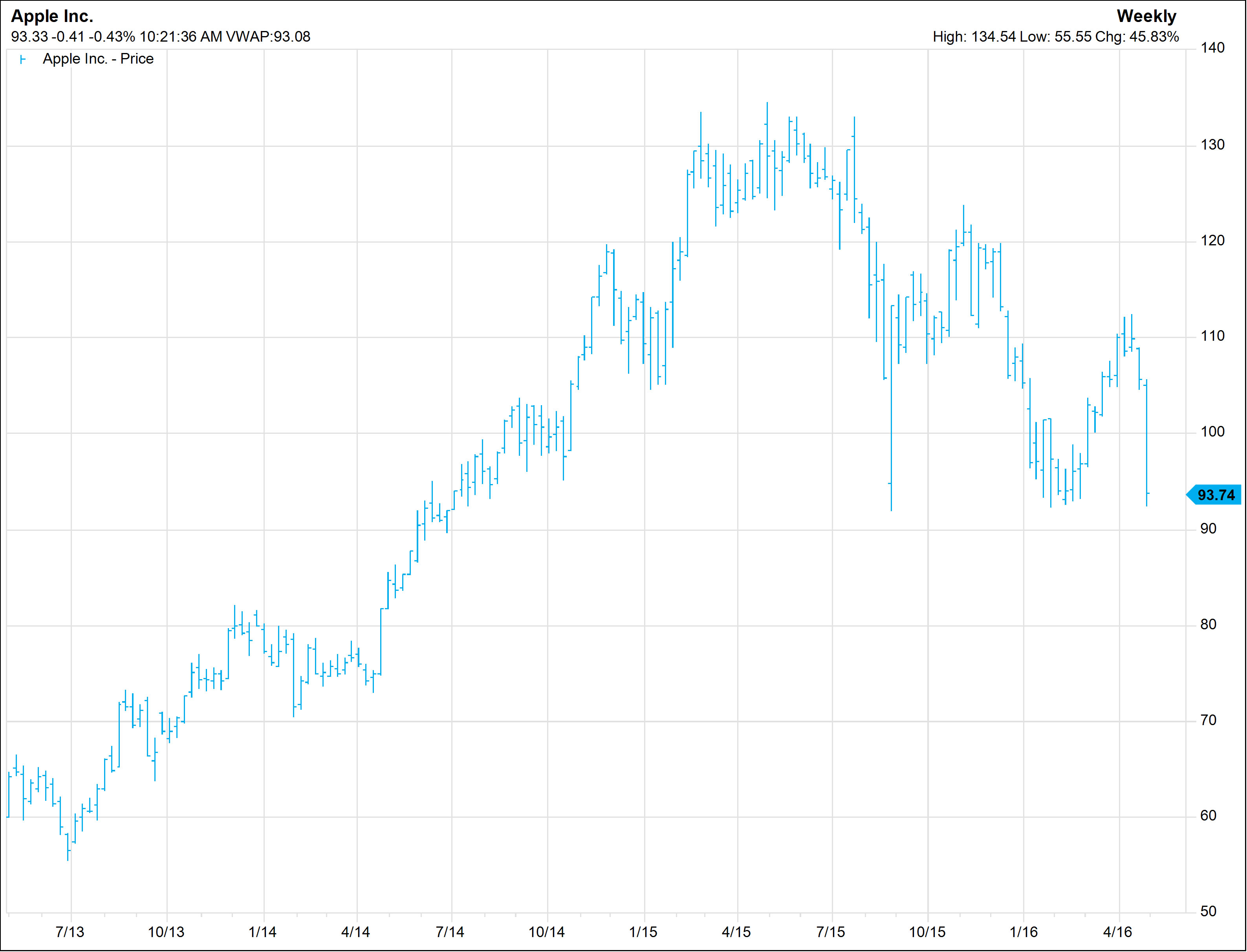

What’s On Our Minds:

Apple, the world’s largest company by market value, reported disappointing earnings last Tuesday which caused it to fall 11% over the week to $93.74 per share. The company’s quarterly revenue dropped 13% year-over-year to $50.6 billion. This decline goes to show that not everyone can overcome strict government regulations in China. (The Chinese government banned Apple’s iBooks and iTunes Movies sales last month.) Along with the earnings miss, activist investor, Carl Icahn, announced that he had sold his position in the company. The billionaire specified that he had grown concerned with Apple’s growth prospects in China. Last year, when he owned 53 million shares, Icahn was a huge proponent of owning the stock and even went as far as calling his position a “no-brainer”. Icahn estimates that his hedge fund made a $2 billion profit on the stock and he probably wanted to cash in on those big gains.

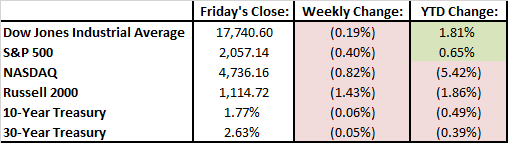

Last Week’s Highlights:

It was a tough week on Wall Street as the Dow Jones and S&P 500 both slipped 1.2%. The Federal Reserve met last week and announced that it had decided to hold off on raising interest rates, but did not give a clear answer as to whether or not they would make a move at their next meeting in June. The Bank of Japan decided that it would not pursue further stimulus. There were three big pharma deals announced last week. Abbot is planning a $30 billion takeover of St. Jude Medical, Sanodi’s plans on purchasing Medivation for $9.3 billion, and AbbVie is making a deal to acquire Stemcentrx for $5.8 billion.

Looking Ahead:

Economic data is heavy this week with manufacturing PMI coming out on Monday, Service Sector PMIs on Wednesday, Eurozone retail sales on Wednesday, and US employment numbers on Friday. The street is expecting that our economy gained 200,000 jobs in April which would be on track to continue the healthy additions we have seen over the last few months.

What’s On Our Minds:

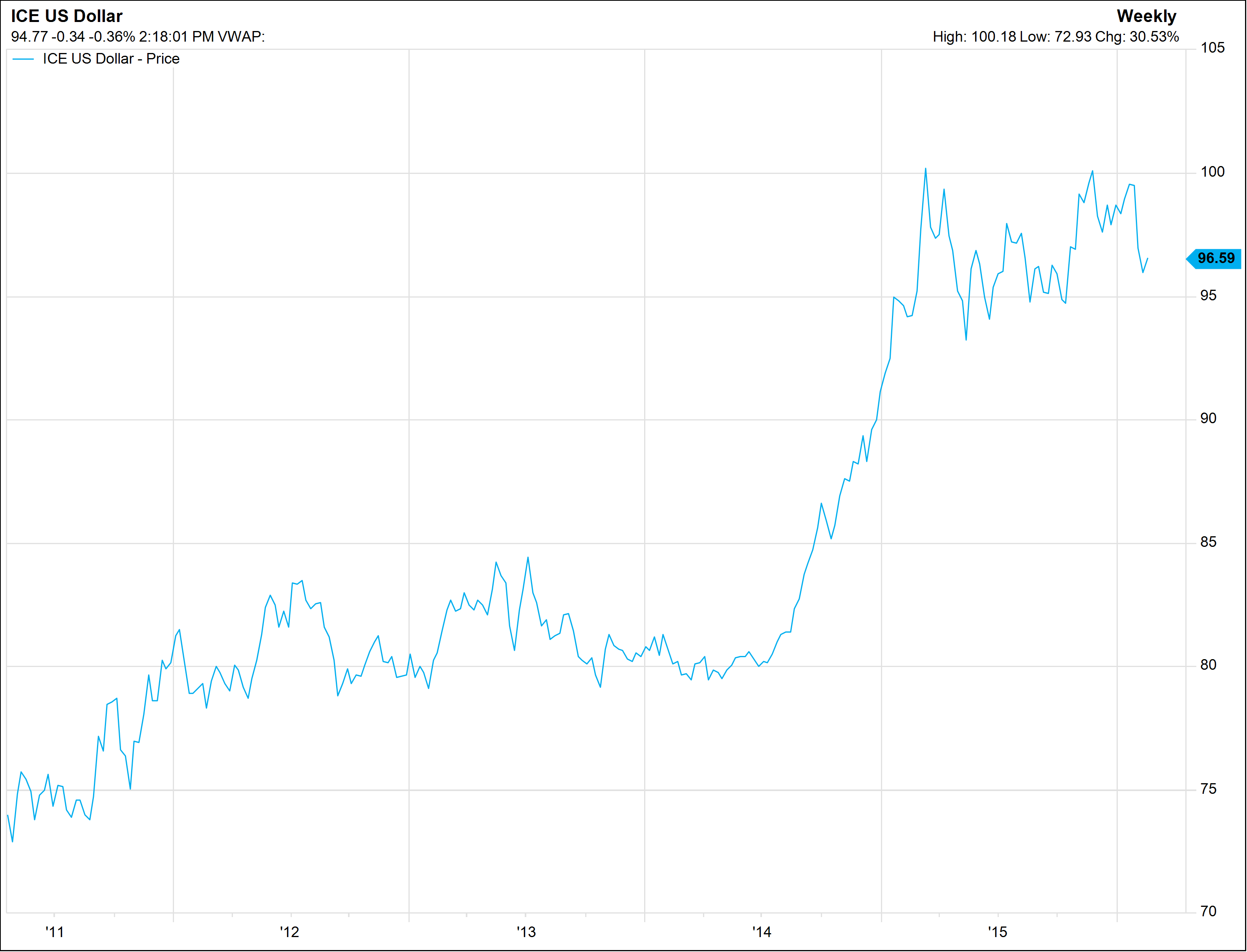

Is a strong dollar a good thing? It’s a bit of a mixed bag. The dollar’s strength in recent years has been good for the American consumer, but it’s a double edged sword in that it is a disadvantage for American companies who export products, services or equipment abroad.

The strength of the US dollar can be attributed to the strength of our economy. The most obvious benefit of a strong dollar is that your dollars go further abroad or when purchasing imported goods. In theory, a trip to Europe or a car imported from abroad should be more affordable for US consumers in the current environment. Furthermore, because imported goods are cheaper in the US, domestic products will have to come down in price to remain competitive. Thus, the consumer’s dollars go further. But producers and manufacturers suffer the opposite effect.

US companies operating abroad are paid in foreign currency. When they convert this revenue back into dollars, their profits are worth less at home. Also, exported US products are more expensive for foreign consumers, which can curb demand for US exports. Manufacturing companies’ revenues and profitability are hit especially hard from a strong greenback. On the other hand, companies that import equipment or goods from abroad and do business at home stand to benefit from a strong dollar.

All in all, strength in the US dollar is great for U.S. shoppers and travelers, but it hurts big U.S. companies operating abroad. If these companies’ profits remain low for long, they will be forced to lay off employees, and then it isn’t good for the consumer, either.

Last Week’s Highlights:

The week started off strong on Monday as the Dow rose above 18,000 for the first time since last July. Markets witnessed a pullback as the week progressed while a heap of earnings announcements were released. In tech, Alphabet (Google), Netflix, and Microsoft reported earnings that disappointed investors. Caterpillar, which is often viewed as bellwether of global manufacturing, reported disappointing earnings that were weaker than analysts’ forecasts. Baltimore based Under Armour beat earnings expectations as the company’s footwear revenue jumped 64%. McDonald’s gamble to serve breakfast all day has paid off as same store sales increased 5.4% in the first quarter.

Looking Ahead:

Earnings season is in full swing again this week with notable releases from Proctor and Gamble, Capital One, and Apple on Tuesday and Chevron and Exxon on Friday. Federal Reserve policymakers are meeting on Tuesday and Wednesday where they will announce interest rate policy moving forward. The market is currently pricing in a 0% chance of a rate hike at this meeting. Weakness in retail sales, concern about China’s economy and weak international trade are factors the will likely keep the Fed on the fence. The Fed will release first quarter GDP numbers on Thursday following their meeting. Locally, Democrat and Republican primaries are held in Maryland on Tuesday. Baltimore City’s Democratic primary race for mayor will be particularly interesting.

What’s On Our Minds:

Over the weekend, some of the world’s largest oil producers met at the center of the Middle East in Doha, Qatar to discuss a potential production “freeze” from each participant. Going into the weekend, signs of the freeze deal collapsing began as the oil representative from Iran decided not to attend. Late Sunday afternoon, it was announced that the freeze deal had in fact collapsed as the Saudi Arabian oil ministers got up from the table apparently stating that they would not freeze unless their political rival Iran agreed to take the same actions.

The oil price crash began in mid-2014 when Saudi Arabia refused to cut production as oil prices declined. This coincided with US Shale Oil production rising to a record 9.6 million barrels of production per day. Many speculated that the oil kingdom’s refusal to cut was to regain market share and put the growing US shale companies out of business. Others speculated that the Saudis took action to prevent rival Iran from funding their own operations and nuclear ambitions. Like Saudi Arabia, much of Iran’s income is derived from oil sales.

Now, the ladder theory appears to be evident. Since the lifting of federal and international sanctions last year, Iran has ramped oil production by 600,000 barrels per day and continues to develop for further production. A future production freeze or even cut among large producers is still not entirely out of the question. However, without Iran’s cooperation, expect the soap opera to continue…

Last Week’s Highlights:

Last week, the S&P 500 rose 1.62% while the Dow rose 1.82%. Financial stocks helped drive the major averages higher as the big banks reported better than expected earnings. JPMorgan Chase, the largest US Bank in terms of assets, has stated that even if the Federal Reserve does not increase interest rate, they can still expect to grow their net interest income by $2 billion – an impressive feat for any financial institution in a low interest rate environment.

Investors also received some good news out of China. The world’s second largest economy reportedly grew 6.7% in the first quarter. This was slightly down from the 6.8% increase in the fourth quarter, but still a welcoming relief to investors as growth in China has recently been a concern.

Looking Ahead:

Looking forward to this week, more first quarter earnings reports will be on the docket. After the bell on Monday, technology companies Netflix and IBM will report. Subsequently to being a “high flyer” in 2015, Netflix is down 4.3% this year – under performing the market by 6.5%. On Tuesday morning, investors will hear about earnings and future plans from internet company Yahoo!. The company is shopping it’s core search business to potential bidders as a breakup of the company appears to be imminent. The week will finish off with results from industrial bellwethers Caterpillar and General Electric. As Jim Hardesty would say, “Pushing dirt is good business.” Let’s hope we hear the same from Caterpillar.

What’s On Our Minds:

Last Wednesday the United States Department of Labor unveiled its fiduciary rule in its final form. You would think it would be obvious, but the new rule requires retirement plan advisors to put their clients’ interests ahead of their own. The rule includes both investment products and fees.

Up until now, brokers (or “financial advisors”) and insurance salesmen who provided advice to retirement accounts and 401K plans were only required to follow a “suitability” standard, which allowed them to receive undue trail fees and commissions from mutual funds and insurance products. As one can imagine, these lucrative fees and commissions can influence a broker’s decision making process: they may make their suggestions based on what gets them a higher payout. The new rule forces brokers to follow a fiduciary standard, mandating that they suggest products that are truly in the client’s best interest.

Although the new rule has been met with opposition from the industry, it will inevitably benefit the average person who puts money away in a retirement account because over time, compounding costs will mathematically exceed compounding interest. As a registered investment advisor (RIA), our firm follows a fee-based business model and we have always acted as a fiduciary for our clients since our founding. Because this new rule forces others in the industry to put clients’ interests ahead of their own, we view this rule change as a positive development for Americans saving for retirement.

Last Week’s Highlights:

Both the S&P 500 and Dow Jones were down 1.2% last week. Oil prices surged 8% to $39.72 per barrel, which propelled energy stocks upwards. Investors worried about an increase in the value of the Japanese Yen while Japan’s central bank has been failing to drive its exchange rate lower with their negative interest rate policy.

In merger and acquisition news, Alaska Airlines agreed to purchase Virgin America for $57 per share. The $160 billion merger between Allergen and Pfizer collapsed. The deal had received criticism from President Obama because it would have allowed Pfizer to move offshore to Ireland and cut its corporate tax bill.

The Baltimore Orioles started the season off on Monday at Camden Yards. The team remained undefeated (5-0) in their first week of play. In golf, Englishman Danny Willett took home the coveted green jacket following Jordan Spieth’s meltdown on the the 12th hole at Augusta National.

Looking Ahead:

It is going to be a busy week on Wall Street as first quarter earnings season kicks off on Monday afternoon with aluminum producer Alcoa. Analyst are expecting a third consecutive quarter of negative earnings growth primarily attributed to lower oil prices and the strong dollar. We will get a glimpse of how this year’s persistently low interest rates, reduced trading revenue, and the IPO decline has effected big financial firms when JPMorgan reports earnings on Wednesday followed by Bank of America on Thursday. We will also see key economic data this week with Retail Sales on Wednesday and Consumer Price Index on Thursday. New York will hold its primaries on Tuesday, where Trump and Clinton have long been favored.