by John Kernan

Many of our clients have been asking questions about the (real or imagined) “peaking” of the market. They have seen one of the longest continuous bull markets in history and are telling themselves that the party must end sometime. One of the more confusing pieces of this puzzle is the role of the Federal Reserve and its interest rate policy. The Fed plays a delicate game with interest rates. It seems like the markets live or die by the Fed’s moves, and what the Fed does with rates has real consequences for all kinds of investors and businesses.

What is the “game,” exactly? What makes an interest rate “too low”? Wouldn’t we want the economy to grow as much as possible, all the time?

by John Kernan

We believe automation in factories, self-driving big rigs, self-driving cars, drones, automated warehouses, and countless more are going to reshape retail and the economy of this and every country in the world. This is a long-term view, but we believe it is not as long-term as one might think. The ripple effects will be profound. For example, the occupation of “truck driver” holds a plurality in every or almost every state in this country. Entire towns have sprung up and have economies based on truck stops (think Breezewood, PA). What’s more, artificial intelligence has advanced to a point where the technologies that IBM and Google have right now would have been science fiction just a decade ago. We at Tufton Capital tend to believe that the pace of this change is going to take large swathes of the population by surprise (including the government).

However, the interplay and timing of these factors are impossible to predict. We have seen the rise of populism and a leader who may not consider the long-term economic consequences of legislation and executive orders. For instance, say that Amazon and Uber are successful in driving truck drivers out of the supply chain. There are an estimated 3.5 million professional truck drivers in the country, and 8.7 million employed in the trucking industry. Suddenly we would have millions of former truck drivers who focus their blame on Amazon for “taking their jobs.” Amazon might be broken up, or a restriction or onerous tax on self-driving technologies could be levied. None of this would ultimately prevent the march of technology, of course, but it would be very bad for Amazon, or whatever player finds itself at the receiving end of displaced workers’ ire.

We are not saying any of the above will happen to Amazon or Uber. In fact, those two companies have teams of the brightest innovators in their respective spaces (the other standout being Google). But these are examples of what could happen to any given company.

As it is right now, we can’t say who the winners and losers will be. In Tech, it seems that any company that has any modicum of proven “cloud” or “hyperscale data technology” gets immediately launched into the stratosphere of valuation by West Coast investors who also see these trends coming.

Our last caveat is timing. We are confident these changes are coming, but do not know when they will take hold.

A final macroeconomic point is that the Roald Dahl-inspired idea that these workers can “get new jobs programming the trucks” is misguided. First, it will take only a handful of programmers to maintain the code on an entire fleet of trucks. Second, those who are losing the trucking jobs are far from qualified to transition into advanced computer science applications. This shift in job requirements will create a massive amount of friction in the labor market, and unemployment will be inevitable.

So, what is the investment strategy? A general overweighting in the Tech sector might be warranted, but even something as broad as that would be exposed to political moves. We expect the digital revolution to be bumpy.

Greetings from Tufton Capital, where the summer heat is finally abating, the leaves are quickly changing, and—in keeping with Baltimore business etiquette—Fridays around the office are taking on a distinctly purple hue.

With the tumult of this summer’s “Brexit” ordeal now firmly in the rear view, market commentators are busy parading new boogeymen through the headlines. And in case you haven’t heard: there’s an election going on.

As a quick glance at the morning newspaper (or five minutes in front of the television) suggests, uncertainty over our country’s next president has crept into the financial sector. From corporate taxation, to industry regulation, to international trade policy and everything in between, the implications of the outcome on November 8th are keeping plenty of capital stuck on the sidelines.

To an extent, this “wait and see” approach is appropriate: as the Brexit episode adequately illustrated, divisive macro-economic events can prove troublesome to captains of industry and individual investors alike. Yet, to paraphrase the Brits themselves, our team here at Tufton Capital is taking a more measured approach to election jitters—by keeping calm, and by carrying on.

As strident fans of hard data, as opposed to political hysteria, we are encouraged by the fact that the current bout of hand-wringing in the marketplace is, from a historical perspective, entirely unremarkable. In fact, one could even go so far as to argue that 2016 is going well. Since 1928, the S&P 500 has dropped an average of 2.8% in election years such as this one, in which an incumbent does not seek re-election. So far this year, that same index is up over 6%—not too shabby, considering the sky is meant to be falling any day now!

Of course, that’s not the sort of information you’re likely to read with the mornings news. After all, positive thinking does not sell papers. But as faithful stewards of your hard-earned capital, we encourage you to remain calm, and perhaps even cautiously optimistic, as the din grows louder in the weeks ahead. No matter what happens on November 8th, we are confident that our thoughtful, time-tested, and emphatically long-term investment approach will prove fruitful through this election cycle…and through many more to come.

by Eric Schopf

The third quarter proved to be somewhat docile for the stock market when compared to the first and second quarters. There was no interest rate increase hangover like we experienced in January, and no Brexit panic that rocked the market in June. A total return of 3.85% for the three months leaves the S&P 500 up 7.84% for the year. The bond market was much more volatile. The 10-year U.S. Treasury started the quarter with a yield of 1.47%. Interest rates steadily climbed during the quarter and peaked at 1.69% on September 21st, the day the Federal Reserve released its meeting minutes. To put the increase in interest rates into perspective, investors buying the 10-year note at a yield of 1.47% at the beginning of the quarter would have lost 3.8% of their principal when rates reached their intra-quarter peak. This 3.8% is the equivalent of over two and one half years of interest income. With only ten years to collect interest payments, there is little margin for error. Interest rates have retraced some of their gains, and the 10-year Treasury closed the quarter at 1.58%. The Fed’s dovish stance, reflective of the low growth and low inflation environment, continues to keep interest rates low and stock prices high. The S&P 500 reached all-time highs through July and August.

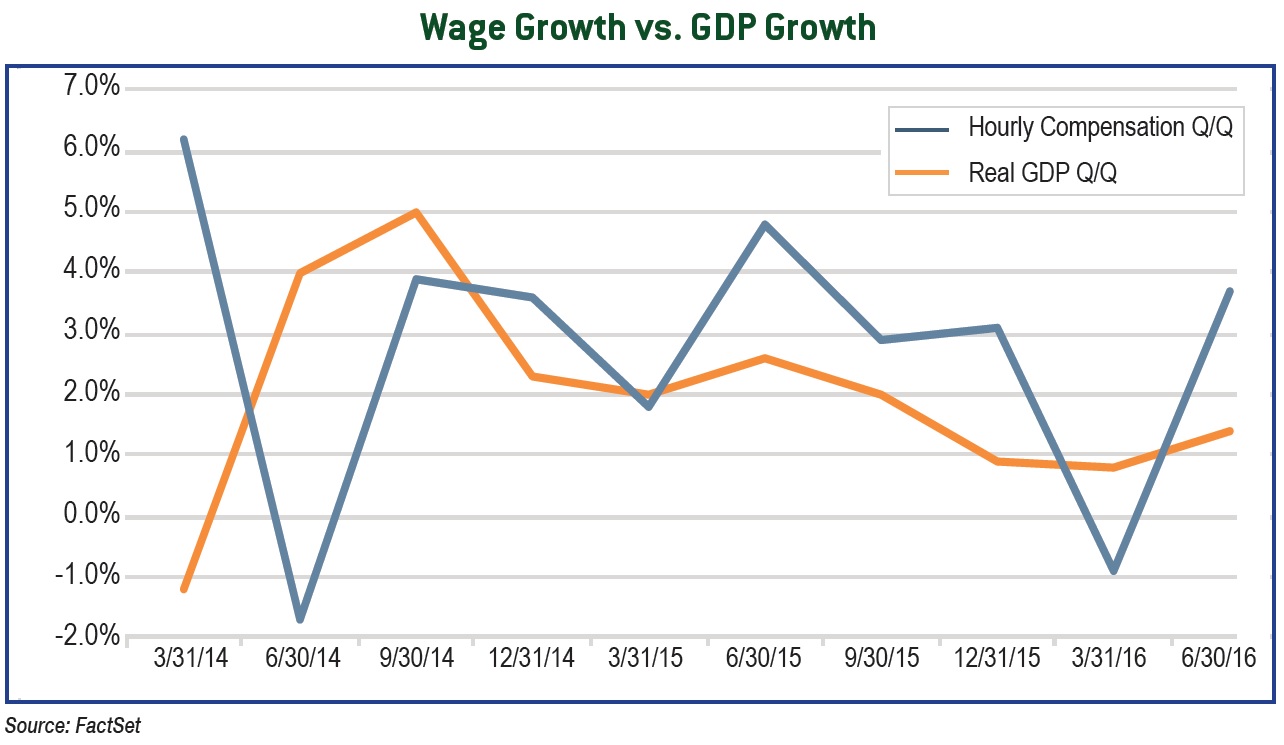

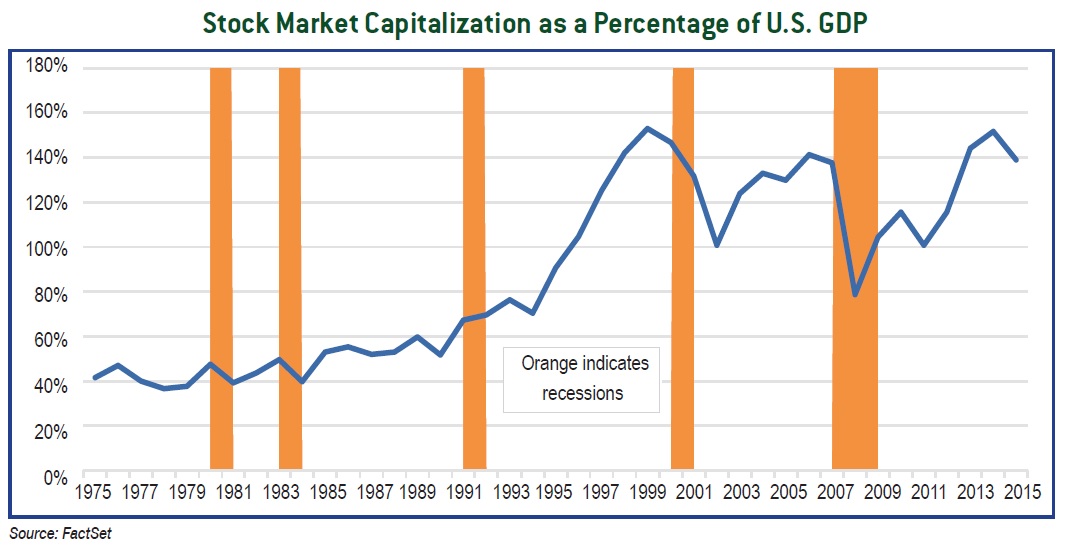

Although the market was more placid during the third quarter, we continue to remain on high alert. S&P 500 earnings will likely fall for a sixth consecutive quarter as we close the books in September. Corporations have responded by reducing fixed investment and slowing the rate of hiring. Productivity has slipped when comparing wage growth to the growth in GDP. If the situation does not improve, we may see a shift from slow hiring, to no hiring, to outright layoffs as corporations take measures to maintain profitability. Despite the difficult earnings environment, the S&P 500 is down only 2% from the all-time high reached in August. Equity valuations, a function of earnings and prices, are stretched. Many corporations have supported the cause by leveraging their balance sheets to repurchase shares. For the first time since before the market correction of 2000, the market capitalization of U.S. stocks is close to 150% of GDP.

Accommodative monetary policy is having a profound impact on global bond and stock markets. However, alternative views are beginning to emerge on the usefulness of ultra-low, and in some cases, negative interest rates. Rather than spurring demand, we are finding that low interest rates lead to greater savings rates as rational individuals act to offset their drops in investment income. The Bank of Japan has shifted its monetary policy to move closer to a zero interest rate instead of a negative rate. The U.S., in a position to learn from Japan’s experience, is less likely to travel down the same negative interest rate path.

The third quarter may have been the calm before the fourth quarter storm. The presidential election has the potential to be the eye of that storm. If nothing else, the rise in Mr. Trump’s popularity is an indication that fiscal austerity has lost its punch. Many members of the electorate feel disenfranchised and are ready for change. Regardless of who wins, deficit control may give way to tax cuts and expanded benefits. The Federal Reserve would then have to reassess its accommodative position in the face of fiscal policy actually being expansionary instead of neutral or negative. Higher interest rates would shift the current tailwind into a headwind for richly valued stocks.

The changing economic and political landscape has kept us busy this year. As you have noticed in your portfolio, we have sold or reduced numerous stocks over the past nine months. As always, we have been cautious and selective when buying new positions and adding to existing names. We took the opportunity in mid-September to increase bond positions in balanced portfolios when interest rates moved higher leading up to the Federal Reserve Open Market Committee meeting. Given the uncertainty that prevails and the solid equity returns, our focus has been to maintain asset allocation targets in the face of risk.

by John Kernan

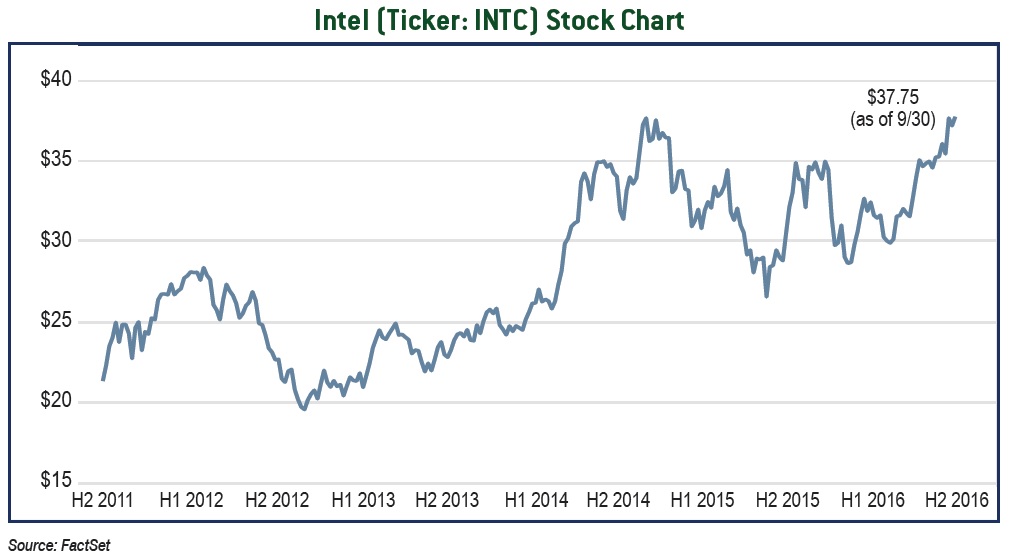

We have held shares of Intel (Ticker: INTC) for many years at Tufton Capital. Intel has undergone fundamental changes and continues to adapt to the future of computing. We think that these changes merit a closer look at what is a trophy company.

Intel is the leader in its field, has a strong balance sheet, and carries an above-market yield. Furthermore, Intel is the greatest second-party beneficiary to the automation as well as the “Internet of Things” (having many types of devices connected to the Internet), trends that are coming more quickly than many realize.

We believe that the addition of more high-performance computers in daily life (e.g., cars and trucks) and the exponentially expanding need to process all of this data in large datacenters will create a huge market opportunity for Intel.

While the excitement around self-driving cars seems like a lot of hype, Intel has put down some convincing numbers for us to consider. In ten years, Intel estimates cars will need to process 250 gigabytes (GB) per second of data. For scale, an iPad holds in total 32-128 gigabytes of data. Other areas, such as manufacturing, will also adopt large-scale processing and automation. Furthermore, by 2020, Intel estimates each self-driving car will generate 4000 GB of data per day. All together, it believes that self-driving technology will require $2000-3000 worth of silicon in every car. How many cars will get this amount of silicon? The low end of Intel’s estimate for 2020 is 100 million cars in the total addressable market. That sounds like a lot, but we must remember that there are ~1.3 billion vehicles on the road today.

Some of the growth in these segments is likely priced in to the stock, especially vis-à-vis the declining PC market. However, the current valuation does not look stretched by any means, and the PC market’s decline seems to be slowing. We believe that this decline of Intel’s legacy market has led to a severe depression in the valuation given to the Client Computing segment. While the segment’s current customer base (Dell, HP, etc.) is in decline, the same infrastructure can be used for Intel’s growth markets. We believe that the stock, while not depressed to the point we would recommend buying more, is at least in part undervalued.

We are recommending that clients continue to hold Intel. It is already a significant holding in our accounts. We will continue to watch valuation and developments in the semiconductor chip industry, but we do not anticipate recommending a sale of the stock in the near future.

by Rick Rubin

The U.S. economy has grown for seven consecutive years since the Great Recession ended in 2009, marking one of our country’s longest economic expansions ever. It’s reasonable to conclude that this level of growth would have satisfied investors, workers, retirees and politicians alike. Unfortunately it hasn’t, due to factors like record low interest rates weighing on savers and retirees, as well as growing income and wealth inequality. In general, individuals at the top of the income scale have enjoyed higher real wage growth as compared to the rest of workers. In fact, real median U.S. household income peaked in 1999 and remains well below that level today. The struggle of the middle class has given rise to populist messengers… enter Donald Trump and Bernie Sanders.

We believe that U.S. investors have fared well given the challenges of uneven global growth, a strong U.S. dollar, and declining corporate profits. After all, investment returns have been strong since the financial crisis ended, with the S&P 500 and Dow Jones Industrial Average Indexes reaching all-time record highs in August. What accounted for the disparity between positive investment returns and consistently sub par economic growth? In our opinion, corporate capital allocation decisions have been, and may continue to be, a significant driver of both.

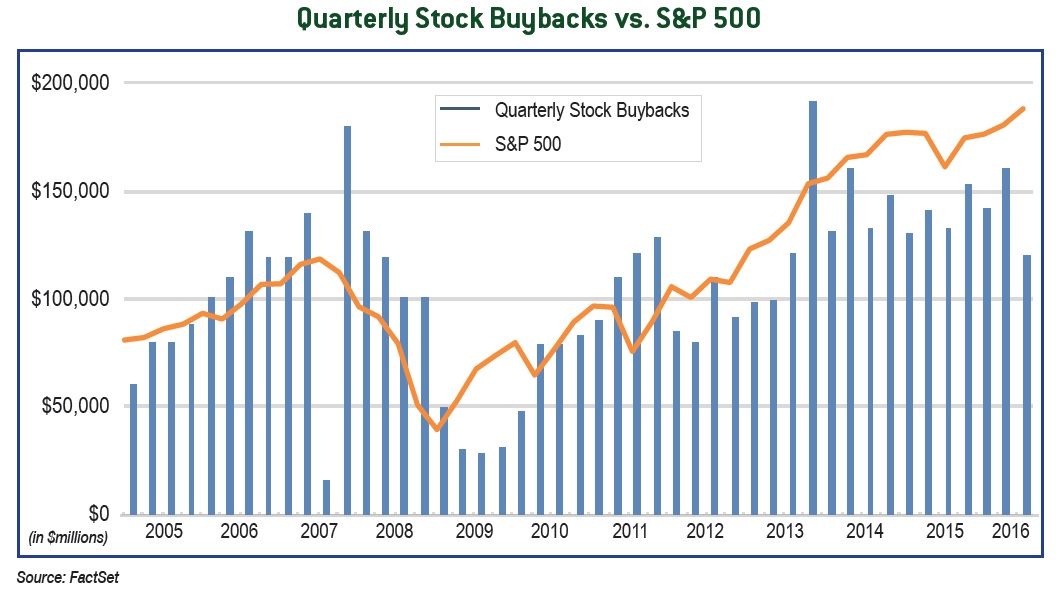

Public companies have a fiduciary responsibility to maximize shareholder returns. The management team decides how to allocate profits and what level to reinvest back into the business. For example, companies may increase capital spending (plants and equipment), raise workers’ wages, and step up hiring. Such investments should boost future profit growth and the economy over time. Unfortunately, many companies are holding off on long-term investments because of deep scars from the financial crisis. Instead, managements have increasingly selected a “safe path” by returning profits to shareholders through stock buybacks and dividends. Stock buybacks rose to $561 billion in 2015, a 40% increase from the prior year and the highest since 2007’s $721 billion.

At Tufton Capital Management, we are value investors, and we believe dividends and share buybacks are crucial to an investor’s returns. However, we believe many companies have relied too heavily on buybacks and dividends and have underinvested in their businesses, reducing growth prospects. How did we get here? Stock buybacks reduce the number of shares on the market and increase a company’s earnings per share (EPS) without the risk inherent in a new project. Further, companies are happy to leverage the balance sheet with cheap debt used to buy back more stock. Buybacks were a great use of cash when stock prices traded at a discount coming out of the financial crisis. But the market appears fully valued now, and there should be better uses of capital available to many companies.

In our view, company buybacks are a main source of the current demand for U.S. stocks. Buybacks have provided support for stock prices in the face of weak global growth and five consecutive quarters of year-over-year EPS declines for S&P 500 companies. Fortunately, stock buybacks have started to slow. Quarterly buybacks declined nearly 7% in 2Q 2016– the smallest quarterly buyback amount since 3Q 2013. We believe it’s time for companies to move away from stock buybacks and to start reinvesting in their business for long-term growth!

Before cashing out a profitable investment, consider making efficient use of its full value by donating it directly to charity.

Charitable giving provides donors with tax relief every tax season in the form of deductions. In an effort to encourage positive social action, the IRS provides incentives for all kinds of charitable contributions, from monetary donations to used cars. You can even donate your appreciated securities (stocks, bonds, mutual funds, etc. that have risen in value) to the charity of your choice. Long-term appreciated securities are the most common non-cash donations, and they can be the best way for donors to give more to their chosen charities. The tax advantages to donating stocks are such that both the donor and the charity benefit.

What are the benefits?

Donating appreciated securities yields two tax benefits for the donor. The first tax benefit is the elimination of capital gains tax. Normally when you sell an appreciated stock, you pay capital gains tax on the amount your securities have increased in value since being purchased. For example, if you bought stocks for a total of $1,000 and then sold them years later for $5,000, you would owe capital gains tax on $4,000 of income from the sale. This tax can add up significantly depending on what tax bracket you fall under, how many stocks you sell and how much they’ve appreciated over time. When you donate appreciated securities, however, you don’t owe any capital gains tax, no matter how much they’ve increased in value. The charity receiving your donation is free from capital gains tax on your contribution as well.

Tax Deductions

The second tax benefit is writing off the donation on your tax return. As long as you itemize, you can deduct charitable contributions on your return, and the more you donate, the more you can deduct. In this case, you’ll be donating more since you can donate the entire value of the asset, not the value minus taxes. Thus, your tax write-off will be greater. In other words, you can take a charitable deduction on money that hasn’t been taxed. This also benefits the charity, because they’ll get a larger donation than they’d otherwise receive.

There is a limit to how much you can deduct for charitable contributions, which varies depending on what you’re giving and what organization you’re donating to. Most organizations are subject to a 50 percent limit, meaning your charitable tax deduction cannot exceed 50 percent of your adjusted gross income. Other organizations have a 30 percent limit. You can check with the IRS or ask the organization themselves to be sure. These limits apply to monetary charitable donations. If you’re donating appreciated securities, the limits change; a 50 percent organization’s limit becomes 30 percent for appreciated securities, and a 30 percent organization’s limit moves to 20 percent.

Reducing Risk

Another benefit to donating your appreciated securities is reducing risk in your portfolio. If too much of your portfolio is dedicated to a certain kind of investment, your risk increases because your portfolio is less diversified, so your assets are all relying on that one kind of investment to succeed. To decrease that risk, you’d normally have to sell the stocks and pay capital gains taxes. Donating them, on the other hand, is a tax-free way to rebalance your portfolio.

The Details

To make this type of donation, it’s important to examine the details and learn the nuances that apply to these particular tax benefits:

• In order for a security to apply, you must have owned it for at least one year prior to donating. If not, your charitable deduction would be limited to the security’s original cost.

• If your stock is worth less now than when you bought it, donating it directly to charity won’t help you or the charity—you’d be better off selling it first, deducting the loss and gifting your charity with a cash donation.

• Not all charities can and will accept stock donations, especially small ones. Make sure your chosen charity can accept your donation ahead of time.

If you have applicable stocks, bonds or mutual fund shares and want to maximize your tax benefits, donating them to a charitable organization is one of the best things you can do. You’ll save money in taxes, the charity will receive more in donations and it’s all completely legal. The IRS creates these incentives to encourage charitable contributions, so consider taking advantage by including appreciated securities in your charitable giving strategy. n

This article was written by Advicent Solutions, an entity unrelated to Tufton Capital Management. The information contained in this article is not intended for the purposes of avoiding any tax penalties. Tufton Capital Management does not provide tax or legal advice. You are encouraged by your tax advisor or attorney regarding any specific tax issues. Copyright 2013 Advicent Solutions. All rights reserved.

The toasty temperatures and lengthy days of June, July and August have long been called the Dog Days of Summer. While the summer months usually mark a slow period for Wall Street and the financial markets, the business newswires have been anything but quiet.

Between political concerns at home and volatility abroad, the market continues to keep investors on their toes. Nowhere was this more apparent than in Britain’s surprise decision to part ways with the European Union, resulting not only in the disappearance of trillions of dollars from global capital markets, but also, and more dangerously, the appearance of nearly as many breathless “Brexit” headlines.

In the late days of this past June, even the most optimistic observer could be forgiven for believing that the sky was falling. And while the market went on to regain the ground it gave up—and then some—the question now looms: with instability potentially lurking in the next news cycle, what should you do?

In a word: you should go on vacation and enjoy the summer months, even if the market refuses to follow suit. In times like these, filled to the brim with short-term uncertainty, we believe that our firm’s careful, disciplined, and emphatically long-term investment outlook is more important than ever—and that, while all investors look at current events, great investors strive to look through them. So whether this letter finds you at your desk or your dock, rest assured: our team here at Tufton Capital remains hard at work on your behalf…Dog Days of Summer be darned!

We begin this edition of Tufton Viewpoint with our firm’s outlook for the economy and financial markets beginning on page two. As you’ll read in our investment analyses throughout Viewpoint, we continue to be cautious but still positive on the equity markets even as we approach new highs for the Dow Jones and S&P 500 indexes. And while we anticipate a slightly positive second half of 2016 for equities, we anticipate another period of volatility in getting there.

Every four years, politics and finance converge as Americans elect a president and investors attempt to forecast how the outcome will affect their portfolios. Our article on page four, “Trump vs. Clinton: Who is Better for the Markets”, concludes that the uncertainty surrounding the outcome may have a larger short-term impact on the financial markets than who ultimately wins.

We hope that you find these and the other articles throughout Tufton Viewpoint interesting and thought- provoking and encourage you to reach out to our financial team to discuss any of these topics in more detail. All of us at Tufton Capital wish you and your families an enjoyable rest of the summer, and we sincerely thank you for your continued support!

Chad Meyer, CFA

President

by Eric Schopf

Fireworks came early this year as the United Kingdom voted in favor of leaving the European Union. The outcome of the nationwide referendum was not what the markets expected, leading to a wild ride in the stock market and tremendous price volatility, both down and up. The outcome of the June 23 vote was not apparent until the following day. The stock market reaction was swift, with the S&P 500 declining 3.6%. After taking the weekend to digest the news, investors extended their selling mood the following Monday, resulting in an additional drop of 1.8%. When the dust settled, the S&P 500 was sitting at levels first reached in the fall of 2014.

Fixed income markets reacted in similar fashion, with the safe-haven 10-year U.S. Treasury note dropping in yield from 1.74% prior to the vote to 1.43% the following Monday. Later in the week, the realization that the immediate economic impact of the U.K.’s departure would not be calamitous had investors rushing back into the market. The final three trading days of the month provided strong gains and led to a recovery of nearly all initial Brexit-related losses. We closed June exactly where we started and are again within 1.5% of the record high set last July. The 10-year U.S. Treasury yield, however, has remained low with a month-end close of 1.47%.

The stock market posted respectable results for the second quarter, with the S&P 500 delivering a total return of 2.5%. Year to date, the total return is 3.8%. The Federal Reserve continues their accommodative stance thanks to an economy that just can’t seem to find the next gear. A weak Bureau of Labor Statistics payrolls report for the month of May combined with steep downward revisions to March and April figures kept the Fed on their back foot and appears to have eliminated any possibility of an interest rate hike in the near term. Interest rates quickly reflected the Fed’s new dovish outlook. As a reminder, the 10-year U.S. Treasury started the year at 2.3%.

Volatility in reaction to the future of the European Union will likely persist. The United Kingdom’s exit negotiations with the EU will stretch out a number of years and there is no telling the composition of the final agreement. Trading relationships, potential tariffs, and investment flows are all now in question. Consumer and business confidence will suffer until there is some clarity on these important issues. It is also difficult to project the future standing of the remaining EU members. Immigration curbs in England will place additional pressures on member countries to accommodate refugees. In addition, should the U.K. somehow manage to flourish under their EU independence, more members may defect.

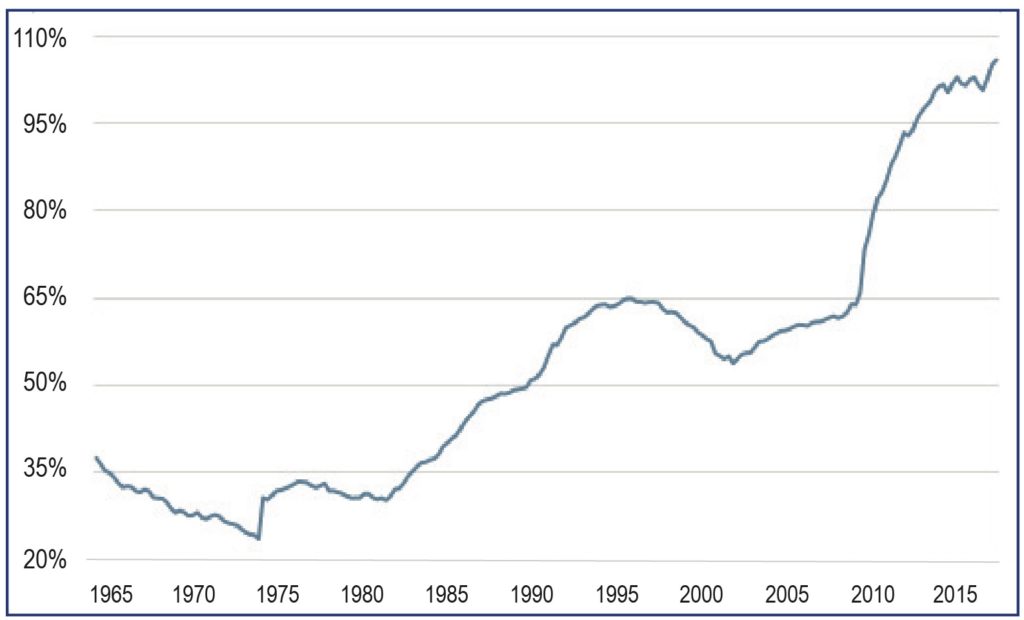

General US Government Debt as a % of GDP

The United Kingdom’s exit will not greatly impact the global economy, as the sovereign state represents less than 4% of the global gross domestic product. The EU, on the other hand, collectively represents 23% of global gross domestic product. The general health of the EU is a bigger concern than the decision by the U.K. to exit. This we do know: the U.K.’s vote to leave the EU will result in a lower standard of living vis-a-vis a lower relative currency valuation. The Pound/Euro conversion shot from .76 to .83. Prior to the vote it took .76 Pounds to buy 1 Euro. The same Euro now requires .83 pounds. That trip through the Chunnel into France will now be 9% more expensive. The same is true for conversion to the U.S. Dollar. .75 Pounds are now required for 1 U.S. Dollar, up from .67 Pounds. A trip to New York is now 12% more expensive.

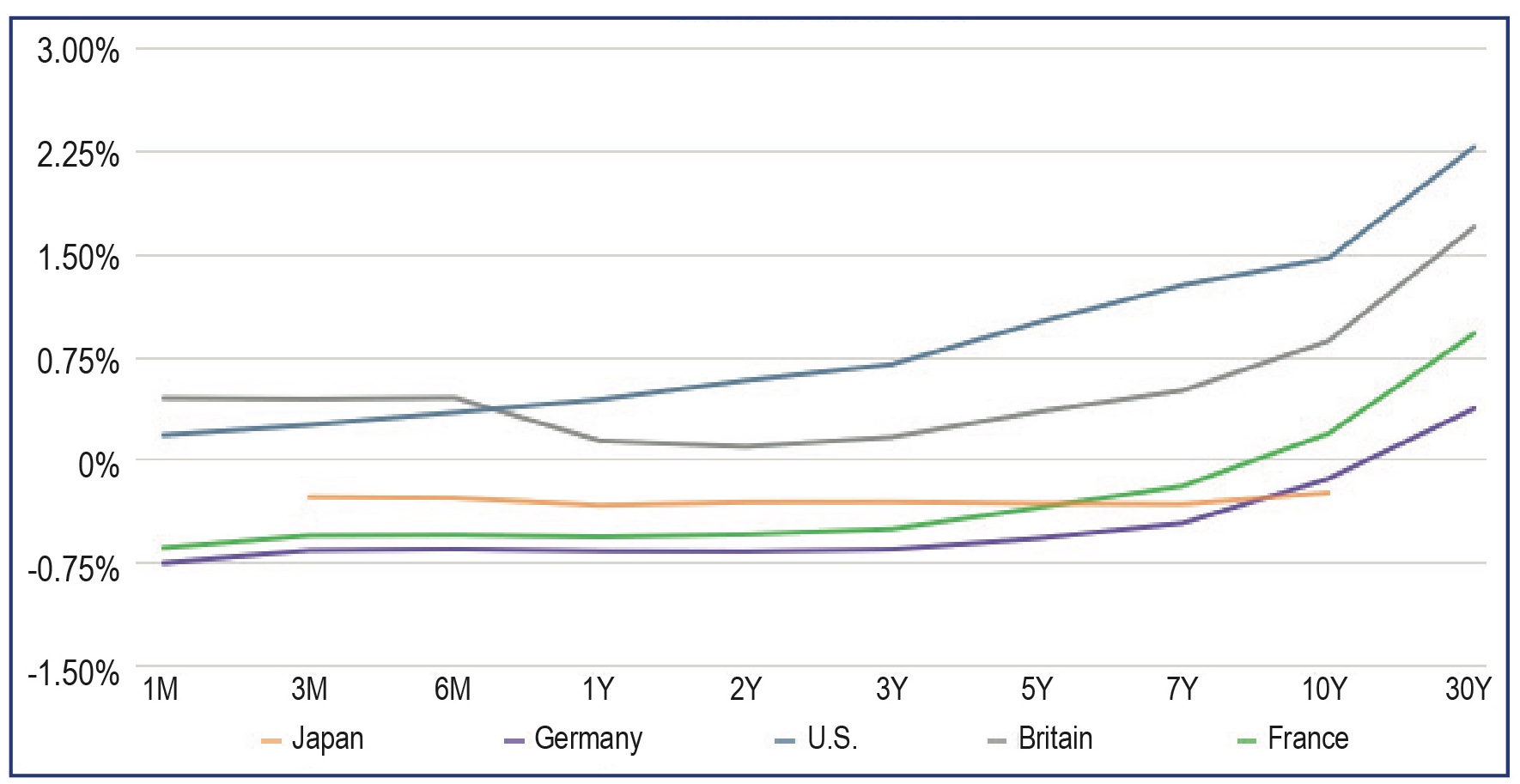

Back home, the Federal Reserve continues to greatly influence the fixed income and equity markets. The steady drumbeat of bad news from around the world has the Fed looking beyond the U.S. economy when making interest rate decisions. Brexit and its potential to disrupt economic activity in the short term are just the latest obstacles. Slow growth in China and Japan, uneven growth throughout the Eurozone, and sickly economies in South America have central bankers working overtime implementing monetary policy. The European Central Bank expanded their asset purchase plan in June to include corporate bonds. The massive bond purchases have pushed interest rates into negative territory throughout Europe. That’s right – bond holders, instead of receiving interest payments, are actually paying creditors for the privilege of holding their debt. The Fed is in no position to increase interest rates in the current global environment. The beneficiary of current monetary policy has been shareholders. Equities become more attractive as interest rates fall. The most disconcerting aspect of the whole exercise is the fact that economic growth has been so anemic despite the extraordinary monetary efforts.

It appears that there may be limits to the effectiveness of monetary policy. The Federal Reserve has noted on numerous occasions that fiscal policy plays an equally important role in influencing the economy. The government’s tax and spend policies, however, have been capped due to government debt reaching its permissible levels relative to the size of our economy. It was just five years ago when sequestration reentered our financial lexicon. The automatic budget cuts were a way of reducing the federal budget without being directly tied to the legislature. Unless the new administration is willing to alter fiscal policy to generate more growth, we may continue to be stuck in our current low interest rate environment.

The investment environment continues to be challenging. Corporate profit growth has slowed, and interest rates remain low. The upcoming presidential election promises to keep investors on edge. Regardless of the environment, we continue working hard to find attractive investments worthy of your portfolio while maintaining suitable balance to reduce risk.

Global Yield Curves

by John Kernan

There are many hotly debated topics concerning the presidential candidates. One that people come to us about time and again is, “Who would be better for the markets?”

Markets hate uncertainty. Even uncertainty about two outcomes that are mostly neutral can push markets lower. While Trump supporters may believe that his pro-defense, conservative stance might provide more stability, Clinton supporters fire back with the fact that Trump is an unknown quantity and brings uncertainty. Clinton would be a known quantity, for good or for ill, and is often viewed as an extension of the current administration.

It is tempting to look to historical averages to get a better idea of what result would have the best effect on the market. Indeed, we found plenty of articles online that do just that. However, some very basic statistical analysis- just looking at the numbers- shows us we can’t rely on those averages. There are simply far too few elections for any average to make sense.

To analyze the effects on the market, we need to look at elections where no incumbent was running, of which there have been only eight in the last century. One of those, in 1928, had a 49% gain- which had more to do with speculative trading and the roaring 20’s than the election of Herbert Hoover. Similarly, it was the housing crash and financial crisis, not the election of Barack Obama, that led to a 31% loss in 2008. So, we look elsewhere.

Trump’s plan for a wall and increased immigration policing can be partially offset by decreased military spending. His plans are to support larger, more powerful armed forces with less money. However, his proposal to institute big tax cuts that are revenue neutral are under intense scrutiny (and sometimes ridiculed) by professionals. The Committee for a Responsible Federal Budget (CRFB) estimates Trump’s plan will reduce federal revenues by $10.5 trillion in the first decade, and increase debt by $11.5 trillion. Trump counters that his plan would generate enough growth that it would more than pay for all of the spending. The CRFB disagrees.

Clinton also looks to increase spending, but would increase debt by $250 billion, close to where it would be without any changes at all to the current plan. The difference is a tax increase on high earners and businesses. Without the promises of large tax reductions, her budget plans look much easier to realize.

There simply is not enough to go on here to justify a change in investment policy. Whether Clinton means lower growth, or Trump means higher borrowing costs, or vice versa, anything that is knowable is already priced in to the market. While some investors might believe they have a special understanding of the international debt markets, for example, and can earn a premium over the next several months, that is not how we believe most people should be investing.

We find it very unlikely that either candidate will by themselves cause the financial markets to change their patterns of risk and return. We continue to watch individual stocks for their exposure to tax plans that may affect their business—aerospace companies like Lockheed Martin, for example. But no election result would likely cause us to reallocate money out of, or into, different asset classes. Furthermore, because indexes like the S&P 500 are market capitalization weighted, as the price of a stock increases, the stock receives a greater weighting in the index. This conflicts with what we focus on as value investors – buying securities as they fall in price.

by Scott Murphy

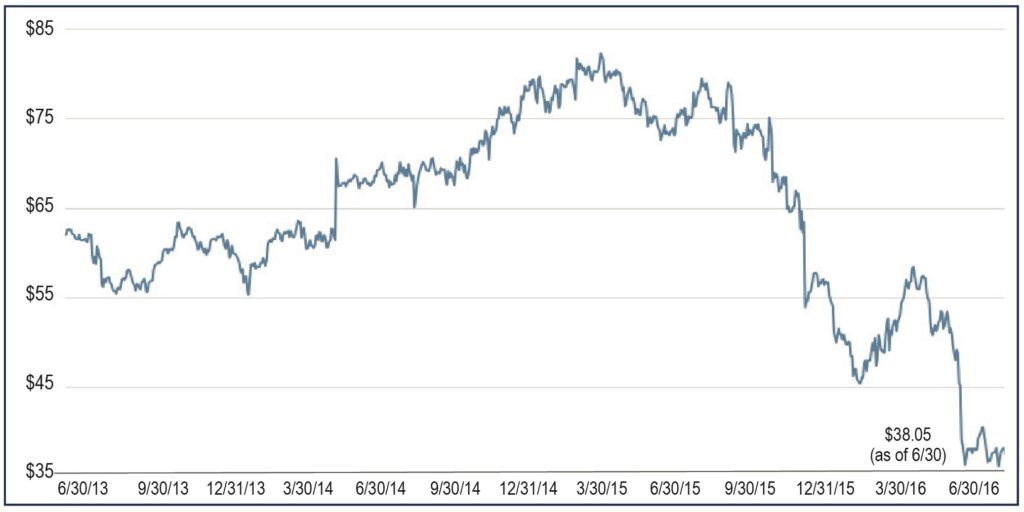

It is a well-known fact that Nordstrom (Ticker: JWN) is the retailer with the greatest return policy in the industry: if you are not happy with your purchase, return it for a no-questions-asked refund. This laser focus on the customer experience is what separates Nordstrom from its competitors and inspires the customer loyalty that is the envy of the retailing world. With its headquarters in Seattle, Washington, it is currently operating 315 stores in the U.S. and Canada. These include 121 full-line stores and 194 Nordstrom Racks located in 38 states with good prospects for store growth in underserved regions of the country.

The stock price has fallen 20% year to date due to a significant reduction in its sales forecast and expected earnings per share for 2016. Nordstrom certainly isn’t alone in this consumer-led stock selloff, and of those in its industry that have sold off, Nordstrom retains a leading position. Management is pulling back store openings and will cut its corporate staff by 10% in order to better position the company for rosier times. As value-oriented investors, we will continue to monitor this investment and stay patient. We believe our original thesis is still intact, and more time is needed for the underlying business of this great company to recover.

We still feel Nordstrom is a solid company and will trade higher as the industry conditions improve. The company has a strong balance sheet, is selling at five-year lows using Price/Earnings and Price/Cash Flow metrics and has a generous 4% dividend yield. Sometimes it takes patience for a great company to work out to be a great investment. Brick and mortar retailers are not “in fashion” right now on Wall Street, but we believe that fact means a good value for our clients.

Nordstrom (JWN) Price Performance

by Rick Rubin

At Tufton Capital, we allocate portfolios based on our clients’ financial objectives, risk tolerance and time horizon, and we factor in our expectations for long-term investment returns. For most clients, we manage balanced accounts that consist of diversified portfolios of stocks, bonds and cash. Occasionally, a client asks us whether all their investments should be fully invested in stocks, because stocks have higher returns over time. Our answer is usually … NO! A key reason to diversify your assets is related to a concept known as “correlation.”

How do we apply this concept to managing money? Correlation quantifies the strength of the association between two variables. Correlation is expressed as a value between -1 and 1, with 1 indicating perfect positive correlation and -1 indicating perfect negative correlation. Our ultimate goal is to identify a portfolio of securities with high return expectations and with high negative correlation to each other (-1 or slightly under). Said differently, we want to own securities that perform well in the long run and whose price changes do not track each other closely.

For example, we invest in stocks across a wide range of economic industries such as technology companies, utilities, financials, etc. We like the long-term value characteristics of many technology companies (Microsoft, Oracle, Qualcomm), and yet we continue to have sizable investments in slower-growth utility and telecommunications sectors. In part, we can justify these seemingly differing investment positions because of the “correlation” benefits. That is, the technology sector’s stock prices behave quite differently than stocks in the other two sectors in the short term.

As compared to stocks, we view bonds and cash as “defensive” investments. Typically, bonds we purchase tend to perform well when the stock market is weak. In particular, U.S. Treasury bonds are viewed as a safe haven by investors, and these bond prices rise sharply during times of stock market turmoil (think 2008-2009 financial crisis). Thus, we invest a portion of our clients’ money in U.S. Treasuries because these bonds have high negative correlation to the stock market.

We use stocks as the primary vehicle of producing capital appreciation, income and dividend growth for clients. Stocks prices are volatile, and they can add stress to investors’ lives as they watch their investments fluctuate. As your portfolio manager, we work to lower your portfolios’ volatility by using a balanced allocation and purchasing value-oriented stocks that offer a margin of safety. It’s important to remember that even though stocks can be volatile in the short term, historically, stock returns far exceed the returns of bonds and cash. Also, stocks protect a portfolio’s purchasing power against the negative impacts of inflation.

We believe above-average dividend yields of high-quality companies provide huge benefits to a portfolio. One of the biggest advantages of reinvesting dividends is a compounding wealth effect. Albert Einstein realized this concept when he said “compound interest is the eighth wonder of the world. He who understands it, earns it … He who doesn’t … pays it.” Although slowly compounding dividends may not be as exciting as your friend’s hot stock tip, this strategy helps build and preserve your wealth over time. We believe in owning shares of well established companies that consistently pay and grow their dividends!

Learn how to use charitable giving tools to grow a donation through investment, possibly allowing you to donate more than by gifting directly.

When making a sizable donation as a direct gift, you know exactly how much you can afford to give and how it will affect your overall finances, but you may wish you could do more. If so, charitable trusts and annuities provide ways for you to make a major charitable donation while simultaneously receiving reimbursements that can help provide financial security.

Charitable Gift Annuities (CGAs)

With a normal annuity, donors fund the annuity with an initial payment, this payment receives gains from investment and then the donor is paid a fixed income throughout the year using this money. With a CGA, the charity, rather than an investment firm, serves as the management company, and any profits the investment earns go to the charity rather than the donor.

Essentially, CGAs allow a charity to borrow the money put into the annuity for investment growth before returning the majority of it back to the holder through annuity payments. CGAs usually have lower return rates than other annuities, but can compensate for these low returns through the tax benefits that they offer. The charitable donation deduction amount is equal to the present value of the charity’s “remainder interest” of the donation, or the excess of the fair market value of the donation over the present value of the annuity. This allows the donor to receive an income tax deduction as well as a portion of the donation back through annuity payments.

As with any investment, CGAs do have some downsides. They can tie up a large portion of your retirement funds and are costly to terminate outside of their set term. Before you enter into a CGA, you should be completely sure that you will not need the funds you are contributing in the immediate future. CGAs can also be risky because they will terminate if the charity you donate to goes bankrupt. In order to avoid this, it’s crucial to research the charity you will donate to and make sure that it is financially stable.

Charitable Remainder Trusts (CRTs)

CRTs provide a different way to grow charitable donations through investment. The donor makes an initial donation to the trust, which is then invested and makes annual distributions to a beneficiary (usually the grantor), giving the remainder to the chosen charity. CRTs offer more security than CGAs because they don’t make the donation until the end of their term, so donors can give to smaller and potentially less stable charities without putting their income at risk.

CRTs offer many tax benefits, including an income tax deduction and the fact that the trust itself is not taxed for income. However, the beneficiary is taxed on any income distributed to him or her.

Many people nearing or at retirement age choose to donate through a CRT because it can provide them with an annuity for a number of years. For those donors who have estate planning concerns, CRTs may be especially attractive, as they offer a full estate tax deduction if created at the grantor’s death. When considering CRTs, grantors should keep in mind that they are required to distribute between 5 and 50 percent annually to the beneficiary of the trust.

Charitable Lead Trusts (CLTs)

CLTs are similar to CRTs, except that they make their annual distributions to the charity and hold the remainder for the grantor or beneficiary instead of the other way around. If the grantor receives the remainder, it is referred to as a “grantor trust,” while if a beneficiary or third party receives the remainder, it is referred to as a “non-grantor trust.”

Grantor trusts offer an income tax deduction, while non-grantor trusts provide an estate tax deduction. Additionally, with a grantor trust, the grantor is taxed for income not given to the charity. With a non-grantor trust, the trust itself is taxed for this income. Grantor trusts are usually used if an individual wants to donate during his or her lifetime, while non-grantor trusts are used to provide a gift to an individual’s family after his or her death while still providing money to charity.

Annuities versus Unitrusts

CRTs and CLTs both come in two different forms, annuity and unitrust. The only difference between the two is how annual payments are calculated. With CRATs (charitable remainder annuity trusts) and CLATs (charitable lead annuity trusts), the beneficiary receives annual payments of fixed dollar amounts. With CRUTs (charitable remainder unitrusts) and CLUTs (charitable lead unitrusts), the beneficiary receives annual payments at a fixed percentage of the trust’s value for that year. CRATs and CLATs offer more consistency, while CRUTs and CLATs give the beneficiary the opportunity to potentially receive larger (or smaller) payments depending on the trust’s value that year.

Choosing a Giving Method

Charitable trusts and annuities can allow you to make a larger contribution to charity than a simple gift, because they allow your money to grow over the trust’s term. However, these options can be expensive and difficult to manage. They also create an extended timeline, which delays the full benefit of your donation from reaching the charity until a number of years have passed. Yet, for donors that would otherwise have to sacrifice their charitable goals to protect their own finances, trusts and annuities may be a more appealing option.

Before deciding to integrate these types of giving vehicles into your charitable strategy, interested donors should seek financial and legal advice to avoid any potential complications. n

This article was written by Advicent Solutions, an entity unrelated to Tufton Capital Management. The information contained in this article is not intended for the purposes of avoiding any tax penalties. Tufton Capital Management does not provide tax or legal advice. You are encouraged by your tax advisor or attorney regarding any specific tax issues. Copyright 2013 Advicent Solutions. All rights reserved.

There’s nothing quite like springtime in Maryland. As the temperature slowly rises, our community returns to the pursuits that we hold dear. Gardening plans are launched into action, outdoor grilling resumes, and, in keeping with local fashion etiquette, wardrobes that for months relied on royal purple abruptly shift in favor of orange and black.

Of course, we aren’t the only ones sporting a new outfit: Mother Nature, after a few weeks of chilly indecision, has at last decided to put on her Spring dress. Nowhere is that more apparent than from our office’s vantage over the Tufton Valley, which is becoming greener by the day.

As you may have heard, the view isn’t the only thing that has changed around here. On February 23rd, after months of careful deliberation, we officially changed our firm’s name to Tufton Capital Management. And as we settle into our new look, I want to assure you that while the lettering on the door may have changed, the values that define us have not. We remain, as a team, deeply committed to protecting your today, growing your tomorrow, and honoring the trust you have placed in us—and we believe our new name more accurately reflects the strength of that shared commitment.

With our new firm name comes the inaugural issue of Tufton Viewpoint, which begins with our outlook for the economy and financial markets. In this article, we remind our readers that equity investing is a long-term proposition, as evidenced by the recently completed first quarter. Timing the market earlier this year could have led to big losses (through early February) while missing the market’s impressive recovery through March.

Also included in Viewpoint is a timely discussion regarding active versus passive investing and the rise in popularity (and pitfalls!) of ETFs. As active investors, the financial professionals at Tufton Capital believe that “being average” is not enough. We seek to provide our clients with returns higher than the relevant benchmarks over a full market cycle without taking any undue risk.

This quarter’s Tufton Viewpoint analyzes one of our favorite stock ideas: onshore oil rig driller Helmerich & Payne (HP). Finally, Trusts as a Planning Strategy, discusses how a properly structured trust can help you transfer wealth in the most efficient way possible.

As we enter our third decade in business, we’re as optimistic and excited as ever about the outlook for our firm and our clients. We wish all of you a very happy spring, and thank you again for your continued support!

The first quarter started with a bang as the stock market began a precipitous decline. By the end of the fifth trading day of the year, the Dow Jones Industrial Average and Standard & Poor’s 500 indexes had recorded losses of 6.2% and 6.0%, respectively. The losses are both records for the time period. The selling persisted and the market continued to head lower. The trough was reached in mid-February, but not before the major averages gave back over 11%. As stomach churning as the first six weeks were, the markets bounced back very strongly. After all the gyrations, we closed the quarter almost exactly where we started.

Interest rates were a sharp contrast to the stock market during the quarter. The 10-year U.S. Treasury bond started the year at 2.3%. As the stock market was reaching a low in mid-February, interest rates were also falling with the 10-year reaching 1.66%. As interest rates fall, the price of bonds rise. Bond prices have remained strong, and we closed the quarter with a 10-year treasury yield of 1.81%.

If we view the first quarter as a voting booth for the Federal Reserve’s decision to raise interest rates last December, we find that investors voted “nay.” The Fed has gotten the message and has turned more dovish with regards to monetary policy. The new stance was punctuated during a speech that Fed Chair Janet Yellen delivered to the Economic Club of New York on March 30, where she articulated that only gradual increases in the federal funds rate are likely to be warranted in coming years.

The first quarter reinforces some valuable lessons in investing. First, equity investing is a long-term proposition. Timing the market in January and February may have led to big losses while missing the market’s recovery. Second, fixed income securities, whether they are Treasury bonds, corporate bonds or certificates of deposit, provide valuable diversification that helps reduce an investment portfolio’s volatility.

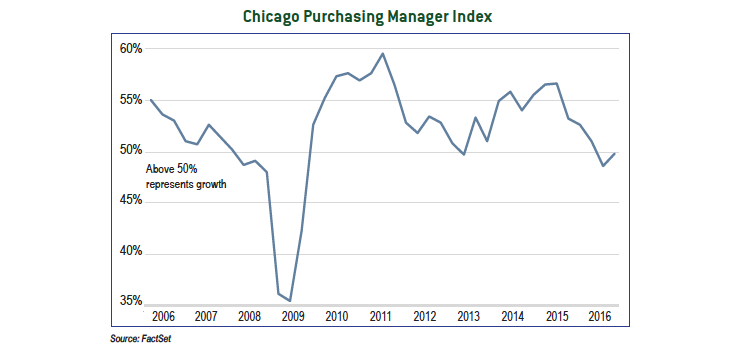

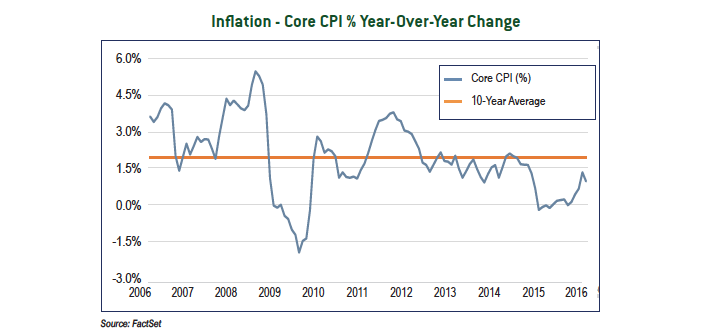

The economic environment continues to improve slowly. Employment numbers remain at impressive levels, and housing starts and housing permits are trending higher. More importantly, manufacturing, which has been volatile and generally weak over the past year, demonstrated strong growth in March. The combination of moderate economic growth with little inflation continues to be a winning combination for the stock market. Although inflation is low today, we closely monitor the situation for change. The Fed’s accommodative policy has provided a strong tailwind for nine years. An unanticipated increase in inflation could lead to a shift in Fed policy, resulting in headwinds. The dramatic collapse in the price of West Texas Intermediate crude oil from about $140/barrel in 2008 to $33/barrel earlier this year is clearly disinflationary. The price of energy percolates through many goods and services. However, the lowest prices are most likely behind us as supply and demand have worked towards equilibrium. A rise in energy prices will be inflationary to some degree. The response of supply and demand to higher prices will dictate pricing levels and the impact on future inflation.

The stock market gets more attractive as prices continue to languish. Obstacles to profit growth like a strong U.S. dollar and weak international markets are now being lapped, making year-over-year earnings comparisons easier. Valuations remain reasonable and are supported by the low interest rate environment. Bonds, on the other hand, are less attractive given the big drop in interest rates over the past three months. We are more selective in maturity patterns given the higher prices.

The lessons learned in the first quarter may continue to serve investors well over the balance of the year. Risks and volatility are ever-present. The terrorist attacks in Belgium are a reminder of the geopolitical tensions around the world. The political landscape at home remains unsettled. The presidential election includes a cast of characters with political views that run the gambit and party infighting is headline news. The uneven economic recovery has left many citizens angry and ready for radical change. The uncertainty of the outcome may weigh on the markets as we get closer to the election. As always, we will use the volatility to uncover opportunities as we seek to add value to your portfolio.