What’s On Our Minds:

Are mounting Student Loans the next bubble?

Many Americans—specifically Millennials—are being crushed under the weight of student loans; currently, outstanding student loan debt in the United States totals more than $1.3 trillion. The average graduate from the Class of 2016 has over $37,000 in student loan debt. Stemming from this, there are concerns that student loan debt could represent the next “bubble” for the economy — even drawing comparisons to the housing market collapse that led to the Great Recession. Just how does the current state of student loan debt compare to the collapse of the housing market?

Understanding the student loans crisis

It is no secret that the cost of college is rising at a seemingly unsustainable rate. Since 1980, college-related costs have increased tenfold, while inflation itself has only tripled. Additionally, wage growth has only kept pace with inflation. Rapidly increasing tuition costs paired with low wage growth means that students must go further into debt while generally not benefiting from proportional salary growth.

Aside from the debt itself, the default rate on student loans is among the highest it has been in decades. In fact, the percentage of Americans who were in default on their student loans increased by more than 150 percent from 2003 to 2013. Given these factors, it is easy to understand the concern that some have regarding how the student loans crisis may affect the economy.

Comparing student loans to the housing market collapse

Of the many possible contributing factors to the housing market crisis, there is one that sticks out as being remarkably similar to the current economic conditions surrounding student loan debt: loan accessibility.

In the late 1990s and early 2000s, the American government enabled low- and middle-income families to access mortgages more easily than before. Between the American Dream Down payment Assistance Act and HUD Secretary Andrew Cuomo announcing a 10-year plan to make $2.4 trillion available to low-and middle-income families, mortgages were made available to more people. According to US Census data, the median price of a home doubled between 1992 and 2006 from $121,500 to $246,500.

The accessibility of student loans through the Federal Direct Student Loan Program (FDSLP), passed in 2010, mirrors the proliferation of mortgages in the early 2000s. This program provided aid to many students who otherwise may not have had access to student loans.

Per the Government Accountability Office, state funding for public colleges decreased by 12 percent from 2003 to 2012. Over this same timeframe, tuition increased by about 55 percent across all public colleges. It is worth noting that a significant portion of these shifts took place from 2010 to 2012, which is the timeframe directly following the passing of the FDSLP.

States have largely decreased funding to public universities and the onus has been shifted to families — either pay for education out-of-pocket, with federal loans, or some combination of the two. Though the decline of state funding and the increase in federal funding may not have a direct causation link stemming from the FDSLP, there is an observable correlation on a similar timeline.

The differences between the two

Though both mortgages and student loans represent a huge portion of our national debt, the total amount of debt varies widely between the two. In the midst of the housing market collapse, mortgages comprised nearly 75 percent—or about $9.25 trillion—of all debt in the United States. Around that time, the delinquency rate on mortgages peaked at about 11.5 percent. Comparatively, student loans represented about 10 percent—or $1.3 trillion—of debt in the United States in 2016. Currently, the delinquency rate on student loans is about 11.4 percent. In terms of direct economic impact, student loans represent a far smaller portion of the total debt in America than mortgages did nearly a decade ago. Though the delinquency rates are similar, the total monetary value of debt for student loans is far lower than either mortgages today or at the height of the housing bubble.

The effect of high student loan defaulting could, however, create a ripple of economic and financial events. Much like how mortgage defaulting significantly affected many more aspects of the economy than just the housing market, student loan defaulting could create unforeseen issues in the economy. Though the circumstances surrounding the housing market collapse and the student loan crisis may not be the exact same, there are definite similarities between the two.

The ubiquity of individuals obtaining student loans, as well as the life-changing impact they have on the life of an average American, evokes flashbacks to what preceded the Great Recession. It seems unlikely, however, that a similar default rate on student loans would have a comparable impact on the economy. Only time will tell how the student loan crisis is handled. In the meantime, the rate at which Americans are going into debt with student loans appears to exhibit no signs of slowing.

Last Week’s Highlights:

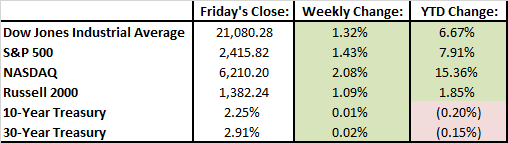

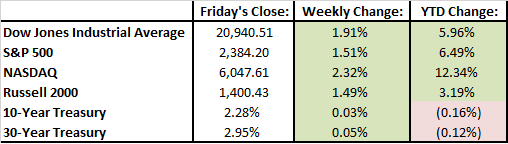

It was a strong five days for U.S. equity markets. U.S. large cap stocks experienced significant gains upwards of 1.5% last week following the previous week’s apprehension regarding President Trump’s relationship with Russia and the firing of James Comey. From where we sit now, the S&P 500 is up nearly 8% for the year, thanks to a sense of faith in the Trump administration’s policies on infrastructure spending and tax reform.

Investors were happy to hear that U.S. GDP was revised up from 0.7% to 1.2% for the first quarter thanks to strong consumer spending.

On the international side, markets have been improving rapidly. Developed-market equities (EAFE) have seen gains above 12% this year. Emerging-market stocks have increased 18% since the beginning of the year.

Looking Ahead:

U.S. markets were closed on Monday in observance of Memorial Day. Even though it’s an abbreviated week, there is plenty of economic data coming across the wire this week. On Tuesday, we will hear results from the Conference Board’s Consumer Confidence Survey. On Wednesday, investors will be examining pending home sales data. Vehicle sales and construction spending data will be released on Thursday. To wrap up the week, on Friday, we will get May’s jobs report. Investors are expecting 175,000 job gains and wage growth of 2.7% year-over-year in May.

What’s On Our Minds:

Last week, volatility returned to the markets so this week we will forgo our usual “Last Week” section and focus on last week’s news and the market’s emotional response.

After months of remarkably low stock market volatility, we got our fair share last week. Markets took their biggest hit of the year on Wednesday when investors turned bearish as President Trump fired FBI Director James Comey and it was reported that Trump had asked him to drop an investigation into former National Security Advisor Michael Flynn’s dealings with Russian officials. Traders got anxious on the news, seeing it as a threat to Trump’s policy initiatives. After hovering around its lowest level for weeks, the CBOE Volatility Index (VIX) surged 46% on Wednesday.

While the 24-hour news cycle may have suggested that the sky was falling on Wednesday, investors refocused on the stock market’s improving fundamentals Thursday and Friday. By the end of the week, it was clear that the emotional reaction to Wednesday’s market drop was more severe than the actual potential economic damage that the revelations may cause.

Recent political events (Brexit, China devaluing their currency, the night of the US election, and North Korea concerns) have not been able to interrupt the 8-year-old bull market. In times like these where political events can cause media hysteria and drive the market one way or the other, it’s important to remember that the market reflects the future expected earnings of companies. Seeing that S&P 500 companies posted 14% earnings growth during the first quarter of 2017, the labor market is strong, the housing market is close to cycle highs, and industrial production has picked up recently, it’s not surprising to see resilience in the current market. Too put it another way, it’s not all about President Trump.

Furthermore, given the flat market we have been experiencing lately, last week’s volatility may have seemed like a big deal, but it shouldn’t surprise investors as this type of move is really not unusual. As JPMorgan pointed out last week, stocks have averaged a drop of 14.1% at some point in each calendar year since 1980 and have finished in the green 28 of those 37 years.

Moral of the story last week? Don’t get caught up in the hype and stay focused on the long term.

Looking Ahead:

This week, as earnings season is coming to an end, investors will shift their focus from individual companies’ first quarter results to macroeconomic data coming across the wire. Preliminary Manufacturing PMI numbers will be released on Tuesday. Investors will be looking for continued improvement in this number. Investors will also look to the Federal Reserve’s May meeting minutes which are being reported on Wednesday. On Friday, consumer sentiment data will be reported along with the durable goods number.

What’s On Our Minds:

Have you ever asked yourself, “Will I have enough saved up to fulfill my retirement dreams? Will Social Security be enough to sustain me?”

Unfortunately, the answer to the latter question is “probably not.” Government assistance is not designed to sustain you through retirement, so you must be proactive in saving for your future. The good news for you is that with smart investing, you will be better equipped to plan for a successful retirement.

Investing for a Sound Future

Retirement is expensive, there is no doubt about that. Many experts estimate that you will need 70 percent of your pre-retirement income (90 percent or more for lower earners) to maintain your standard of living when you stop working. It’s time to take charge of your financial future today. Below are some tips on how to maximize your retirement savings:

- Invest in your employer’s pre-tax savings plans, such as a 401(k). Contribute as much as you are financially able to responsibly, and use the automatic deduction feature to place money into your retirement account at every pay period. Over time, compound interest and tax deferrals will make a big difference in the amount you will accumulate.

- Place your money into an Individual Retirement Account (IRA). When you open an IRA, you have two basic options—a traditional IRA or a Roth IRA. In general, traditional IRA contributions are not taxed until the time of withdrawal, whereas Roth IRA contributions are taxed immediately but not taxed at withdrawal. Keep in mind, the after-tax value of your withdrawal will depend on inflation, your tax bracket and the type of IRA that you choose.

- Avoid dipping into your retirement savings, as you will lose principal and interest, and may lose tax benefits. If you change jobs, consider rolling over your savings directly into an IRA or to your new employer’s pre-tax retirement plan.

- Start saving early—the sooner you are able to start saving, the more time your money has to grow. Devise a savings plan, stick to it and set goals for the future.

- Take advantage of employer matching funds if you are able. Most employer-sponsored plans require the employer to match a certain percentage of your income. This may be the closest thing to free money, so take advantage!

- Study your investment choices carefully. The more you know about investing, the more likely you will choose wisely.

- Learn as much as you can about your plan’s administrative fees, investment fees and services fees to avoid reducing the amount of your retirement benefits unnecessarily.

Investing a predetermined amount on a regular basis through your company 401(k), a Roth IRA, etc. makes solid retirement sense. For more information, contact us to learn more about how our solutions can help you prepare for your future.

Last Week’s Highlights:

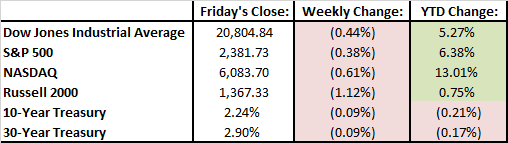

Economic data, drama in Washington D.C. and corporate earnings had the market moving up and down last week. By Friday afternoon, the S&P 500 was off 0.35% and the Dow Jones was down 0.53%.

Stateside, the consumer price index and retail sales figures disappointed investors last week while President Trump fired embattled FBI Director James Comey. Abroad, investors are betting big on Europe: according to Bank of America, a record $6.1 billion was added to funds focused on European stocks last week. Finally, we note a development that affects the whole world: computer hacking. On Friday, a global cyberattack hit dozens of countries. The “ransomware” locks up a Windows computer, and demands a $300 ransom to free it.

There were some big deals announced last week. Verizon agreed to buy Straight Path Communications for $3.1 billion, Sinclair Broadcast Group agreed to buy Tribune Media for $3.9 billion and Coach said it would acquire Kate Spade for $2.4 billion.

Over the weekend, Russia and Saudia Arabia agreed to jointly extend oil production cuts until March 2018. Oil prices posted strong gains Monday morning.

Looking Ahead:

Earnings season is slowing down but a few important companies report this week. Retail behemoth Wal-Mart will report its first quarter results on Thursday, and on Friday Deere & Co. will report their results.

The IPO market will be busy this week. On Monday, compact loader manufacturer ASV Holdings will go public. 3.8 million shares are being offered at $7 each. On Wednesday, cancer treatment biotech company G1 Therapeutics goes public with 6.25 million shares being offered at $16 each.

What’s On Our Minds:

Over the weekend crowds of investors flocked to Omaha, Nebraska for Berkshire Hathaway’s annual shareholder meeting where Warren Buffet, a.k.a. the “Oracle of Omaha,” and his longtime business partner Charlie Munger spent hours talking shop with 35,000 of their faithful shareholders. Berkshire is currently America’s sixth largest company by market capitalization, behind Apple, Alphabet (Google), Facebook, Amazon, and Microsoft. The company currently has $86 billion of cash on hand which constantly has investors asking, “What will they buy next?”

Buffet and Munger spent their Saturday discussing a changing investment landscape that has made them buyers of airline stocks and Apple, and a seller of IBM. They also discussed the recent fake-account scandal at Well Fargo, which happens to be one of their largest holdings. Buffet blamed executive level management for the scandal, as he believes they didn’t react to whistleblowers. Buffet was also critical of the bank’s incentive system that, in his words, “incentivized the wrong kind of behavior”.

The pair also fielded questions on technology and autonomous driving. Buffet had mixed opinions on the idea of self-driving vehicles and said, “Autonomous vehicles widespread would hurt us. My personal view is that it will come but I think it will be a long way off. If they make the world safer it is going to be a very good thing, but it won’t be good for our auto insurers.” Buffet and Munger also talked about how they missed the opportunity to invest in Google back when it was a fledgling new company.

Towards the end of the meeting, Buffet underscored the importance of finding a capable successor to take over the day-to-day management of Berkshire. Seeing that Warren (86) and Charlie (93) are both getting up there in age, this continues to be the looming “elephant in the room” for the company.

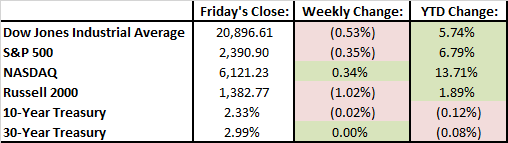

Last Week’s Highlights:

The market was up slightly last week, but has been unusually flat over the last eight trading days. Major indexes haven’t moved by more than 0.4% during that period. Major indexes are currently siting near all-time highs, thanks to a mix of strong corporate earnings and economic data that has shown a healthy domestic job market.

Last Wednesday, the Federal Reserve announced it would hold interest rates steady at 0.75%-1.00%. The House of Representatives narrowly passed a new healthcare bill that seeks to replace Obamacare.

Over the weekend, news broke that Hunt Valley-based Sinclair Broadcast Group is close to buying Tribune Media for $3.9 billion. This comes just weeks after the Federal Communications Commission voted to ease the limit on TV-station ownership in the U.S.

Looking Ahead:

Earnings season begins to slow down this week. On Monday, Sturm Ruger reports their earnings followed by Disney and News Corp. on Tuesday, Snapchat and Wendy’s on Wednesday, Kohl’s and Macy’s on Thursday, and JCPenney on on Friday.

On the economic front, it will be a light week with retail sales and inflation data being released on Friday.

What’s On Our Minds:

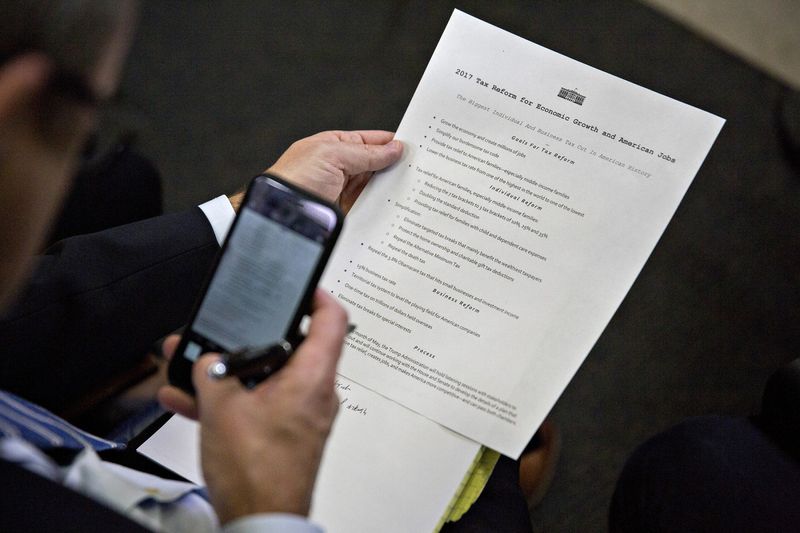

President Trump’s administration unveiled a proposal last Wednesday that was purported to be the “biggest tax cut” in U.S. history. After months of anticipation, the White House released a one-page list of bullet points that amounted to less than 250 words. The tax plan was really more of an outline that painted with very broad strokes, heavy on ambition but light on details. The major takeaway from the proposal was fewer tax brackets and fewer deductions.

If passed, the plan would cut the number of income brackets from seven to three. The plan proposes marginal tax rates of 10%, 25%, and a top line rate of 35%. The plan would also cut the corporate tax rate from 35% to 15%. To the chopping block go the alternative minimum tax and the “death tax” for wealthy individuals. Trump’s proposal to cut corporate taxes should benefit US corporations’ bottom lines significantly. We would expect reduced corporate taxes to then spur economic growth, but increased use of “pass-through” businesses could also leave plenty of room for abuse. On the individual taxpayer side, under Trump’s plan taxpayers will no longer be allowed to deduct state and local taxes from their federally taxed income. This will hurt folks in blue states like Maryland, where they pay high state and local taxes. Deductions for mortgage interest and charitable contributions are protected under Trump’s plan.

Of course, there are some big questions surrounding Trump’s tax proposal. Most importantly, “Will it make it through Congress intact?” We will have to wait and see.

The tax plan handed out before the start of a White House press briefing. Photographer: Andrew Harrer/Bloomberg

Last Week’s Highlights:

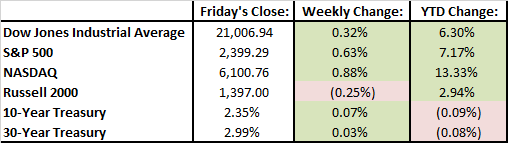

Major indexes were up more than 1.5% last week on strong corporate earnings. On Thursday, Google’s parent company Alphabet posted earnings that beat analyst expectations, helping to lift its share price by 6% for the week. Healthcare and technology stocks led last week’s rally, while telecom and utility stocks declined. Congress avoided a government shutdown by extending the funding deadline for a week.

Looking Ahead:

Earnings season continues this week with Apple reporting on Tuesday, and Facebook and Tesla both reporting on Wednesday. On Wednesday, investors are expecting the Federal Reserve to hold interest rates at current levels. On Friday, we get a highly anticipated April jobs report. Since Trump took office, unemployment has fallen from 4.8% in February to 4.5% in March. Investors will see if that trend continued with Friday’s report. Berkshire Hathaway’s annual shareholder meeting will be held Saturday. Warren Buffet will answer shareholders’ questions for six hours.