The Weekly View (5/8/17)

What’s On Our Minds:

Over the weekend crowds of investors flocked to Omaha, Nebraska for Berkshire Hathaway’s annual shareholder meeting where Warren Buffet, a.k.a. the “Oracle of Omaha,” and his longtime business partner Charlie Munger spent hours talking shop with 35,000 of their faithful shareholders. Berkshire is currently America’s sixth largest company by market capitalization, behind Apple, Alphabet (Google), Facebook, Amazon, and Microsoft. The company currently has $86 billion of cash on hand which constantly has investors asking, “What will they buy next?”

Buffet and Munger spent their Saturday discussing a changing investment landscape that has made them buyers of airline stocks and Apple, and a seller of IBM. They also discussed the recent fake-account scandal at Well Fargo, which happens to be one of their largest holdings. Buffet blamed executive level management for the scandal, as he believes they didn’t react to whistleblowers. Buffet was also critical of the bank’s incentive system that, in his words, “incentivized the wrong kind of behavior”.

The pair also fielded questions on technology and autonomous driving. Buffet had mixed opinions on the idea of self-driving vehicles and said, “Autonomous vehicles widespread would hurt us. My personal view is that it will come but I think it will be a long way off. If they make the world safer it is going to be a very good thing, but it won’t be good for our auto insurers.” Buffet and Munger also talked about how they missed the opportunity to invest in Google back when it was a fledgling new company.

Towards the end of the meeting, Buffet underscored the importance of finding a capable successor to take over the day-to-day management of Berkshire. Seeing that Warren (86) and Charlie (93) are both getting up there in age, this continues to be the looming “elephant in the room” for the company.

Last Week’s Highlights:

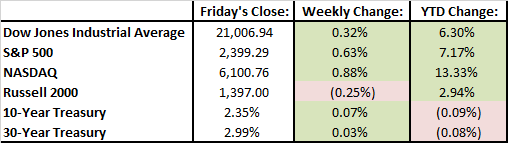

The market was up slightly last week, but has been unusually flat over the last eight trading days. Major indexes haven’t moved by more than 0.4% during that period. Major indexes are currently siting near all-time highs, thanks to a mix of strong corporate earnings and economic data that has shown a healthy domestic job market.

Last Wednesday, the Federal Reserve announced it would hold interest rates steady at 0.75%-1.00%. The House of Representatives narrowly passed a new healthcare bill that seeks to replace Obamacare.

Over the weekend, news broke that Hunt Valley-based Sinclair Broadcast Group is close to buying Tribune Media for $3.9 billion. This comes just weeks after the Federal Communications Commission voted to ease the limit on TV-station ownership in the U.S.

Looking Ahead:

Earnings season begins to slow down this week. On Monday, Sturm Ruger reports their earnings followed by Disney and News Corp. on Tuesday, Snapchat and Wendy’s on Wednesday, Kohl’s and Macy’s on Thursday, and JCPenney on on Friday.

On the economic front, it will be a light week with retail sales and inflation data being released on Friday.