Everyone Loves a Trophy

By: Alex Olshanskiy

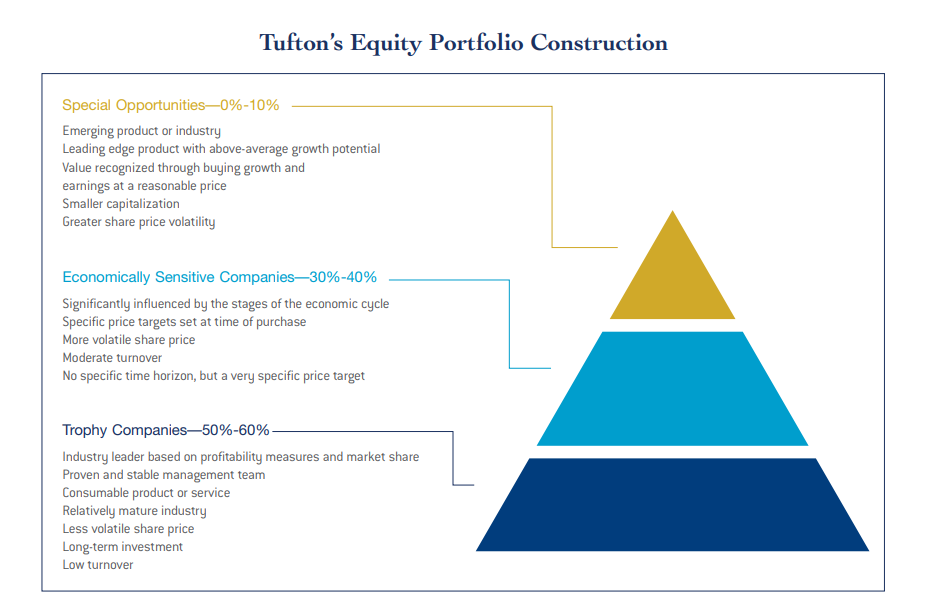

Automatic Data Processing, J.P. Morgan and Microsoft share a common trait. All three are trophy companies. In the intricate art of constructing an equity portfolio, Tufton Capital categorizes companies into three distinct groups: trophy, economically sensitive and special opportunities. Among these, trophy companies occupy a special pedestal, serving as the bedrock of stability and long-term growth potential. With its established market dominance, proven profitability and enduring management excellence, trophy companies stand as the cornerstone of strategic investment portfolios. An exploration of the essence of a trophy company provides our clients with an insight into the advantages of these companies in a diversified portfolio. These investments offer the potential for capital appreciation while reducing downside risk.

Growth in earnings: Warren Buffett’s timeless wisdom, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price,” reinforces our emphasis on owning companies that exhibit growth in earnings. A company’s ability to generate profits consistently and increase earnings often translates into higher shareholder value. As earnings grow, companies may distribute dividends to shareholders or reinvest profits into further growth initiatives, both of which can enhance shareholder returns.

Quality Management: A proven and stable management team is indicative of a company’s ability to navigate challenges and to capitalize on opportunities for growth. In our analysis, we look for companies with visionary leaders who prioritize long-term value creation over short-term gains. This emphasis on quality management is reflected in our commitment to identifying trophy companies that demonstrate leadership continuity and a track record of strategic decision-making. We seek out companies that consistently demonstrate a high return on capital employed (ROCE). This metric serves as a gauge of how effectively a company generates profit from its operational investments, reflecting its efficiency and profitability. Measuring a management team quantitatively is more useful than measuring it qualitatively. No management team will openly admit that they don’t care for the customer, that they have stopped innovating or that they hire unqualified individuals. Have you ever heard a company leader criticize their products or services, admit their competition is doing a better job or that they are tired of company politics? On a qualitative basis, most management teams are very persuasive. The president of Enron, Jeffrey Skilling, and his senior management team during the launch of Enron Broadband in 2000 were poised, confident and you could even say competent. However, less than two years later, Enron filed for bankruptcy, and in 2006, Skilling was sent to prison. We find that a quantitative measurement of ROCE provides a good yardstick to measure management’s success. Think of the top running back, or fastest marathoner, greatest baseball hitter or fastest swimmer. We don’t rate their abilities based on their interviews or their confidence, we rate them based on their results. Similarly, we value management’s efforts to reduce debt, allocate capital wisely, properly manage the buyback of shares and encourage ownership of company stock by the management team. However, no matter how brilliant management might be, it is not the sole criterion.

Balance Sheet Quality: The goal of all beings is to survive for as long as possible. They can make errors that fall into two broad categories: they do things that they are not supposed to (type 1, error of commission) and/or they don’t do things they are supposed to (type 2, error of omission). At Tufton, we try our best to avoid big risks and to refrain from investments in which the probability of losing money is higher than the probability of making money. We tend to think about risk first, and then return. One of the ways that we can reduce a type 1 error is by being great rejectors. We want the companies we invest in to survive since they are long-term investments. We certainly don’t want the company to go bankrupt. Bad things happen to businesses at remarkably regular intervals, and therefore, we try to pick trophy companies with manageable levels of debt. A higher credit rating also gives us comfort. A company that strives to minimize debt to maximize the safety of capital lets us know that this company aspires to trophy company status. Warren Buffett famously remarked, “You only find out who is swimming naked when the tide goes out,” highlighting the perils of excessive leverage. Therefore, a strong balance sheet with moderate debt levels provides a buffer against unforeseen challenges and enhances the resilience of the business.

High Margins: A trophy company is also one that demonstrates a consistent track record of profitability and efficiency. One way to measure this is by assessing a company’s gross profit margin, which measures the percentage of revenue that remains after subtracting the cost of goods sold. An ability to maintain high margins can translate into a sustainable competitive advantage (also known as a moat). Ultimately, high margins provide a window into a company’s financial health, including its profitability, competitive edge, resilience to market fluctuations and its ability to invest in growth opportunities.

Market Leaders: A market leader is a company that has a large market share resulting from a combination of metrics. The business also sells a product or service that is needed or desired. Moreover, indicators such as distinctive product offerings, robust brand loyalty, streamlined operations and proprietary technology can also signal market leadership. A company that continues to increase its market share might be building a moat—a defensible competitive advantage that is very valuable. Just like a medieval castle, the moat serves to protect those inside the fortress and their riches from outsiders.

Trophy companies form the foundation of portfolio construction at Tufton. By emphasizing growth in earnings, quality management, balance sheet strength, high margins and market leadership, we can clearly identify and incorporate trophy companies into a diversified portfolio.