First Quarter 2024: Head Fake

By: Eric Schopf

Strong fourth quarter momentum carried through to the first quarter resulting in robust gains for the stock market. The Standard & Poor’s 500 delivered a total return of 10.56%, and unlike last year, price appreciation was more widespread. Five of the eleven index sectors outperformed the broad index and only one sector, real estate, posted a negative total return. The stock market stood in sharp contrast to the bond market. Interest rates moved higher across the yield curve and bond prices fell. The S&P U.S. Aggregate Bond index, an index that measures the investment grade U.S. fixed income market including U.S. treasuries, quasi-governments, corporates, covered bonds and residential mortgage pass-throughs, posted a total return of -0.56%. The benchmark 10-year U.S. Treasury yield climbed from 3.9% to 4.3%.

The poor bond market performance comes as no surprise. The gap between market expectations and Federal Reserve projections communicated through their dot plot chart grew too wide. At year end, the Fed was signaling for three interest rate cuts in 2024 while investors through the futures markets were pricing in six interest rate cuts. Economic data released during the quarter bolstered the Fed’s decision to defer the initial interest rate cut and added credibility to their three-cut forecast. The timing of the three cuts is also a moving target. The consumer price index (CPI) and personal consumption expenditure (PCE) paint similar pictures of choppy progress. Although inflation continued to moderate, it is proving more difficult to reach the desired 2% Fed-imposed target. Logistics disruptions in the Red Sea and the dislocations that will result from the collapse of the Francis Scott Key Bridge will result in additional cost pressures. Although there is still room for improvement on the inflation front, the wide gap between current inflation levels and the Fed funds interest rate gives the Fed plenty of room to cut rates. Three cuts of a combined 75 basis points (three quarters of one percent) would still be considered somewhat constrictive based on historic spreads between inflation and the interest rate. Lower rates will serve as a catalyst to unleash further growth, and lower financing costs alone would benefit the automobile and housing industries.

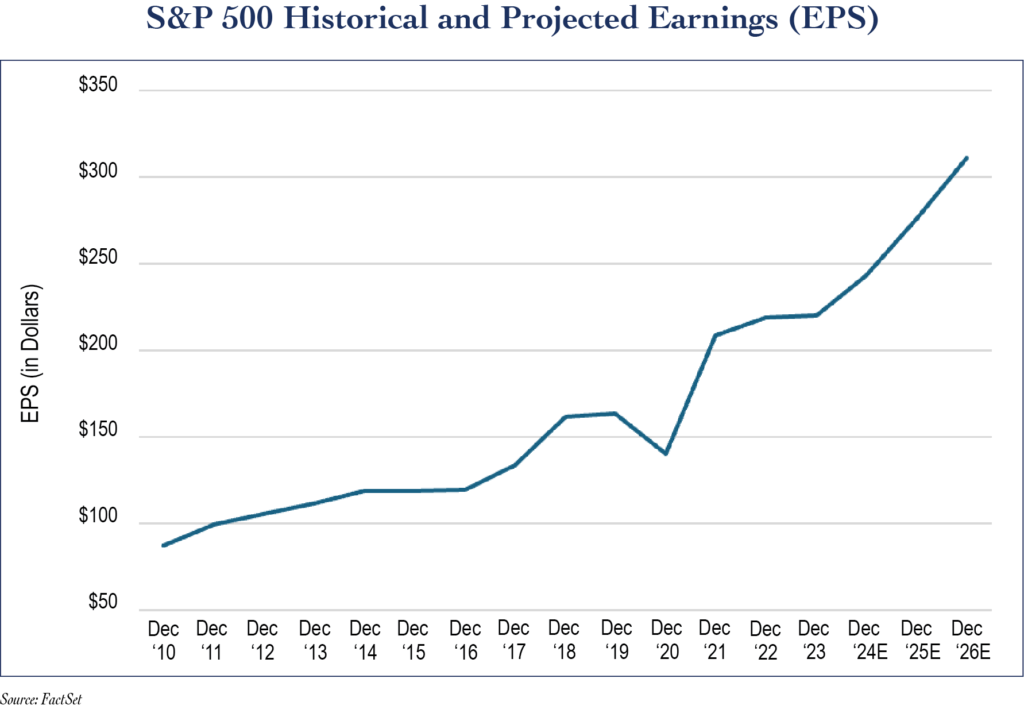

The anticipation of lower interest rates has helped propel the stock market higher. The S&P 500 set twenty-two record highs during the quarter. The performance was even more impressive since the expectations for lower interest rates did not materialize. The stock market, however, has been more than a one-trick pony. Corporate earnings are poised to rebound from their slow growth of 2023. Consensus growth estimates for 2024 are now at 10.5% and estimates for 2025 and 2026 are even more impressive at 13.3% and 12.8%, respectively. Underpinning the earnings growth estimates is a resilient economy which describes an economy that has withstood a 5.25% increase in interest rates without sliding into recession. Real fourth quarter gross domestic product (GDP) growth was 3.4%, exceeding the advanced estimates of 3.2%. The “real” figure considers inflation, which makes the number even more impressive. The quarter decelerated from 4.9% growth in the third quarter but contributed to a growth rate of 2.5% for the year. The employment situation reflects the economy. The unemployment rate stands at 3.9%, with March marking the twenty-fifth consecutive month with an unemployment rate being below 4%. The economic landscape remains favorable. Fiscal policies, including reshoring initiatives to relocate manufacturing and production operations, should continue to create jobs.

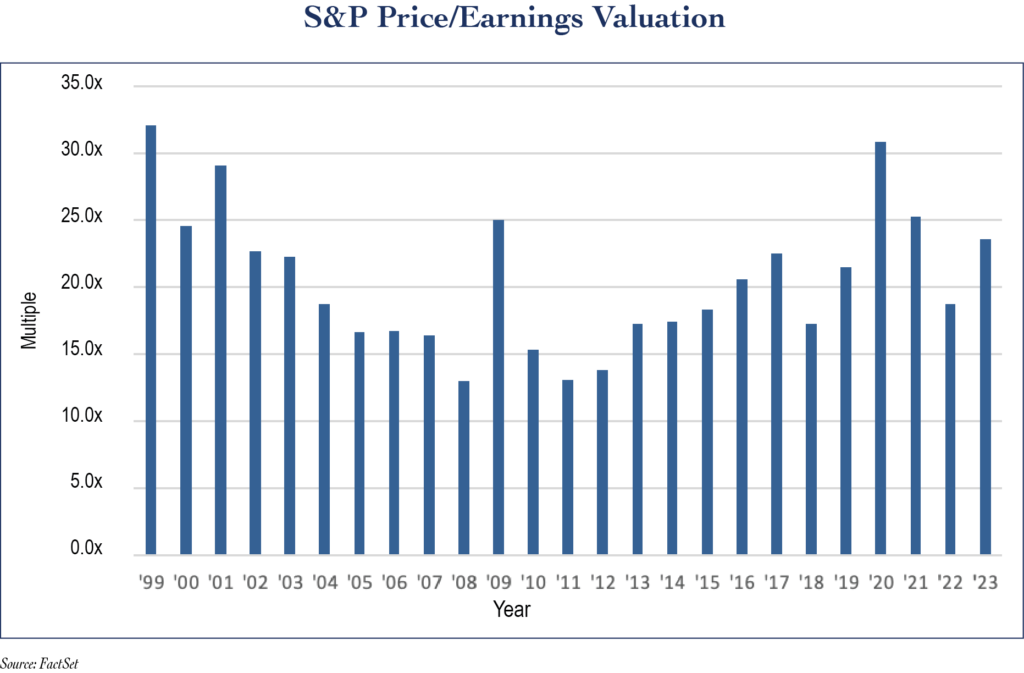

Although the outlook leaves us sanguine, we are mindful of potential bumps in the road. Stock valuations are one area of concern. Projected earnings growth for the year has already been met by stock market returns. Further price gains will require even higher earnings, lower interest rates or an expansion of valuation multiples. We use various valuation metrics when valuing stocks. A widely used measure is the price/earnings ratio, which reflects how much we need to pay for $1 of earnings. The higher the figure, the more expensive the asset. The market is at the high end of historic valuation multiples, so multiple expansion may be difficult to achieve. Lower interest rates are almost certain given the Fed’s rhetoric. Fewer than three rate cuts given the current level of inflation would be a head fake worthy of college basketball’s March Madness. Corporate earnings could exceed expectations due to continued economic strength, while lower interest rates could spur economic activity, resulting in even greater earnings growth.

Another concern is the U.S. consumer. Of the four components (consumption, business investment, government spending and net exports) that constitute gross domestic product (GDP), consumer consumption was the clear star with a growth rate of 2.8%. Low unemployment rates provide the capacity for spending, and total personal debt levels are low in some part due to student loan forgiveness. More and more of consumer spending, however, is being covered by credit cards. Total household credit card loan growth was 15.2% in the fourth quarter, on top of the 14.5% growth in the third quarter. Delinquency rates hit 8.5%, which is 1.6% higher than pre-pandemic levels. High variable rates make credit card debt particularly onerous, and many consumers are beginning to buckle under the strain. Auto loan performance is showing a similar trend. Consumption typically makes up almost 70% of our economy, so any slowdown will have negative effects.

A third cause for unease is the debt level of the U.S. government. Policies passed during President Biden’s term include the American Rescue Act, the Infrastructure Investment and Jobs Act, the CHIPS and Science Act and the Inflation Reduction Act. The various plans include investments geared toward improving and strengthening our economy. Like any investment, we expect a payoff. The outcomes will be years away, and we are unsure of their successes. In the short term, we know what the cost is as measured by the interest expense associated with financing the projects. Like consumers, the federal government is being squeezed by higher interest rates. Lower interest rates will help, but more important are the rates of return on the spending. GDP growth that is lower than the cost of capital will impact future budgets as greater outlays will be required for interest coverage. With $34 trillion of debt outstanding collateralized by a $27.4 trillion dollar economy, it is important that we see a good payoff.

Our team at Tufton Capital Management devotes its time and resources to monitoring and deciphering the economy and financial markets. Although circumstance change, our goal remains unchanged in delivering a good payoff for an acceptable level of risk.