Investors Beware: The Pitfalls of Mutual Funds

By: Rick Rubin, CFA

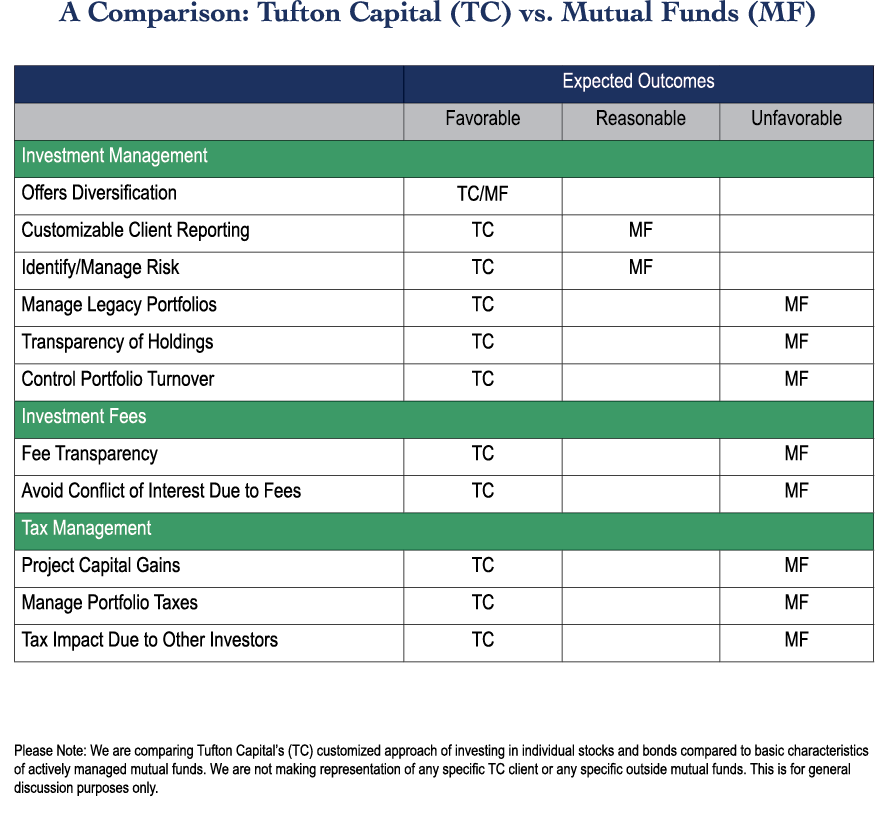

For their affluent clients, many financial advisors build a book of business using mutual funds. Is it because funds have favorable characteristics and offer stronger investment returns? Absolutely not. Mutual funds have many drawbacks!! First, they limit an advisor’s ability to customize a portfolio and effectively manage risk. Second, they add an additional layer of fees, which reduces an investor’s returns. Third, they are inefficient for investors who want to manage their tax bill. Small retail investors have few options and mutual funds may make sense for them. Fortunately, our clients enjoy a customized approach to managing their money. We invest in a diversified portfolio of individual stocks and bonds to meet our clients’ goals.

Often, advisors put clients into mutual funds because of the lack of robust in-house research or to free up the advisors’ time to attract new business. While funds offer investors instant diversification, it’s a one-size-fits-all approach. A fund manager’s objective may be quite different from that of the investor. For example, a manager’s compensation may be linked to outperforming a benchmark with no consideration for the level of risk taken, the amount of taxes passed on to investors, earned income or growth of income. Also, a fund’s objective can change over time, as can the manager, which leads to greater portfolio turnover. This cycle can be unsatisfactory for the client’s bottom line.

We believe limited transparency of mutual funds is problematic. Most investors don’t know what stocks they are holding in the fund, and many funds only disclose their holdings quarterly. A mutual fund may consist of fifty or more stocks. Imagine tracking a portfolio made up of ten or more mutual funds. An investor’s portfolio may be holding 500 or more stocks! Diversification is a good thing, but over-diversification not so much.

At Tufton Capital, risk management is one of the keys to our process. Our clients can see what they are holding at any time, and we can readily identify a portfolio’s risks and sector positioning. While we are not traders, our disciplined approach allows us to take advantage of intraday volatility in stocks that we want to purchase on weakness or to sell into strength. Also, we can quickly reduce portfolio risk and raise cash on short notice. This may not appear to be a big advantage, but mutual fund investors can only execute transactions at the fund’s closing price at the end of the trading day. An investor is beholden to the fund manager and may miss an opportunity to profit from large intraday price spikes (e.g., selling a stock into strength on buyout chatter). Often a rumor is just that, and the mutual fund investor can miss the profit potential.

We have a flexible approach which helps us meet our clients’ needs. For example, a client may need to withdraw $50,000 of cash in six months but wants to keep the portfolio fully invested until then. We can simply handle the client’s request by buying a bond that matures in six months. Meanwhile, an advisor that uses bond mutual funds to raise cash will expose an investor to the risk of rising rates. Alternatively, an advisor may be forced to sell an equity fund during a period of declining prices. Neither of these alternatives is ideal.

Over the long term, a majority of actively managed funds fail to match the returns of passive benchmarks. Many funds charge an annual fee of 1% or more. It’s hard for investors to know how much they pay since the fees are embedded within the funds. On top of that, financial advisors often charge at least 1% for their services, so the all-in cost can exceed 2% each year. High fees can significantly impact results, particularly over long time periods.

Mutual funds don’t help investors who want to manage their capital gains taxes. A fund is required to distribute capital gains annually. An investor may get stuck with large capital gain distributions even though he or she didn’t sell the fund. Why? One reason may be that another investor decided to redeem the fund, and an existing holder got stuck with the tax liability. It’s a structural flaw of mutual funds, which is exacerbated during times of market stress such as the 2008 financial crisis and the coronavirus pandemic.

If you are concerned about your outside mutual funds or accounts, we are happy to perform a complimentary portfolio review. Our firm’s careful and disciplined approach can help you meet your financial goals.