The Weekly View (3/28/16 – 4/1/16)

What’s On Our Minds:

It’s being called the “Invisible IPO Market”. This year’s first quarter Initial Public Offering (or IPO) market was the slowest of any quarter since the financial crisis of 2009. Nervousness about the financial markets and the related volatility, combined with continued uncertainty in the energy industry, was the main reason for this slowdown in capital raising. Eight deals, raising just $700 million, were launched in this year’s first quarter, compared with 34 IPOs, raising $38 billion, in last year’s same period. All eight IPOs this year were by early-stage healthcare (namely biotech) companies, led by substantial buying of company shares by existing shareholders.

The pipeline of companies looking to raise capital is strong, but most companies looking to raise initial public capital are awaiting better (i.e. less volatile) market conditions. Companies such as Univision, Albertsons, Elevate Credit and Neiman Marcus have planned their IPOs and may perhaps launch them later this year. There are over 120 companies that have already filed an S-1, the initial registration form required by the Securities and Exchange Commission for a future IPO.

Market-watchers look to the level of IPO activity as a barometer of the market’s health: a super-active IPO market often means the market is getting “too hot.” But as we can see in our inflation, interest, and employment numbers, that doesn’t appear to be the case at this time. In the past, a large swing downward in IPO activity has accompanied a major economic slowdown (see chart, below). It is possible that IPOs will rebound or at least slowly recover from this point, but caution is warranted. In finance, we say that at the top of the market, the fool says “this time is different.” At the same time, we have to recognize that the IPO slowdown came at the same time as a market correction- maybe this time was just less bad.

Last Week’s Highlights:

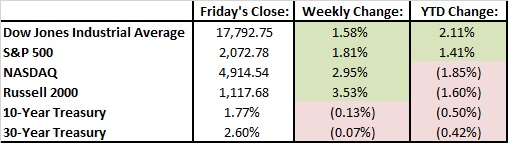

Strength continued in the equity markets, as stocks posted solid gains to close out the year’s first quarter. The Dow Jones (DJIA) rose 1.6% for the week, while the S&P 500 increased 37 points, or 1.8%. Bond prices were higher last week, pushing the U.S. 10-Year Treasury bond yield down slightly to 1.77%.

Comments by Federal Reserve Chair Janet Yellen on Tuesday helped the markets, as she indicated that the Fed should proceed cautiously with respect to future hikes in interest rates. Many investors welcomed these dovish comments, feeling that we may be in a “Goldilocks” economy: one that is not “too hot” and needing a cool-down in the form of a rate raise, but also not “too cold,” or growing too slowly.

March Madness lived up to its name, as the S&P rose 6.6% last month and approached new market highs. Stocks ended the first quarter slightly higher, following a very volatile period of double-digit losses followed by double digit gains.

Looking Ahead:

First quarter “earnings season,” when public companies report their financial results for the first three months of the year, takes off in a few weeks. As only a few companies will release their financial reports this week, investors’ focus will remain on any macroeconomic developments. Specifically, what is the Federal Reserve thinking, and how long can it continue saying the “right things” to help the stock market’s continued move up?

Minutes from the March meeting of the Federal Open Market Committee meeting will be released on Wednesday and closely examined by investors. Additionally, factory and durable goods orders, to be released Monday, will help determine if U.S. manufacturing growth, which has picked up, is sustainable.