The Weekly View (4/4/16 – 4/8/16)

What’s On Our Minds:

Last Wednesday the United States Department of Labor unveiled its fiduciary rule in its final form. You would think it would be obvious, but the new rule requires retirement plan advisors to put their clients’ interests ahead of their own. The rule includes both investment products and fees.

Up until now, brokers (or “financial advisors”) and insurance salesmen who provided advice to retirement accounts and 401K plans were only required to follow a “suitability” standard, which allowed them to receive undue trail fees and commissions from mutual funds and insurance products. As one can imagine, these lucrative fees and commissions can influence a broker’s decision making process: they may make their suggestions based on what gets them a higher payout. The new rule forces brokers to follow a fiduciary standard, mandating that they suggest products that are truly in the client’s best interest.

Although the new rule has been met with opposition from the industry, it will inevitably benefit the average person who puts money away in a retirement account because over time, compounding costs will mathematically exceed compounding interest. As a registered investment advisor (RIA), our firm follows a fee-based business model and we have always acted as a fiduciary for our clients since our founding. Because this new rule forces others in the industry to put clients’ interests ahead of their own, we view this rule change as a positive development for Americans saving for retirement.

Last Week’s Highlights:

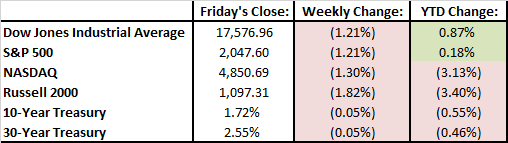

Both the S&P 500 and Dow Jones were down 1.2% last week. Oil prices surged 8% to $39.72 per barrel, which propelled energy stocks upwards. Investors worried about an increase in the value of the Japanese Yen while Japan’s central bank has been failing to drive its exchange rate lower with their negative interest rate policy.

In merger and acquisition news, Alaska Airlines agreed to purchase Virgin America for $57 per share. The $160 billion merger between Allergen and Pfizer collapsed. The deal had received criticism from President Obama because it would have allowed Pfizer to move offshore to Ireland and cut its corporate tax bill.

The Baltimore Orioles started the season off on Monday at Camden Yards. The team remained undefeated (5-0) in their first week of play. In golf, Englishman Danny Willett took home the coveted green jacket following Jordan Spieth’s meltdown on the the 12th hole at Augusta National.

Looking Ahead:

It is going to be a busy week on Wall Street as first quarter earnings season kicks off on Monday afternoon with aluminum producer Alcoa. Analyst are expecting a third consecutive quarter of negative earnings growth primarily attributed to lower oil prices and the strong dollar. We will get a glimpse of how this year’s persistently low interest rates, reduced trading revenue, and the IPO decline has effected big financial firms when JPMorgan reports earnings on Wednesday followed by Bank of America on Thursday. We will also see key economic data this week with Retail Sales on Wednesday and Consumer Price Index on Thursday. New York will hold its primaries on Tuesday, where Trump and Clinton have long been favored.