The Weekly View (5/23/16 – 5/27/16)

What’s On Our Minds:

Following the 2008 market collapse, hedge fund managers were sometimes viewed as the bad guys who profited from others’ misfortune or perhaps the good guys who were smart enough to realize something wasn’t right in the financial system. Since then, the media and television shows (i.e. Billions) have glamorized the hedge fund industry. Stories about the few managers who predicted the housing market collapse and went on to produce high enough returns for them to retire ten times over have become nothing short of legendary.

Often considered the “smart money” in the world of Wall Street, hedge funds, have struggled in recent years and some investors have been pulling their money noting they are too complicated and too expensive. You may remember in September of 2014 when the California Public Employees Retirement System (Calpers) announced it would liquidate $4 billion it had invested with 24 different hedge funds. Considering Calpers is the nation’s largest pension fund, managing roughly $300 billion, this announcement was particularly newsworthy.

You see, good old traditional investing has outperformed a good portion of hedge funds since 2008. While the S&P 500 is up roughly 11% in the past 5 years, the HFRX global hedge fund composite is down about 1%. The struggle to produce alpha in clients’ portfolios and the traditional hedge fund fee model of 2% on assets and 20% on profits has put a strain on the fund industry. In the 4th quarter of 2015, investors pulled $26.77 billion out of hedge funds and then $14.35 billion during the first quarter of this year. These flows of assets show how critical investors have become of performance and fees.

Last Week’s Highlights:

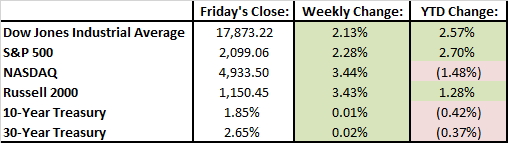

The market had a very strong week with the Dow and S&P both up over 2%. The NASDAQ went on a tear and was up 3.44% but the index is still down about 1.5% YTD. Based on these moves, it’s clear the market is no longer worried about the the Federal Reserve potentially increasing interest rates in June. Higher crude oil prices also helped the market rally with crude topping out around $50 per barrel. (A tough break for folks looking to make trips back and forth to the beach this summer in gas guzzling SUVs.) In company news, Hewlett Packard Enterprise announcing that it is planning on spinning off its services business. CEO Meg Whitman said of the deal, “It is always better to be on the front end of consolidation.”

Looking Ahead:

Markets were closed on Monday for Memorial Day in honor of those Americans who have paid the ultimate sacrifice. During the abbreviated week of trading, some important data will come across the wire. The European Central Bank is meeting on Thursday to discuss target inflation levels which could go on to influence interest rate and stimulus decisions. OPEC is meeting in Vienna on Thursday. Friday, U.S. nonfarm payrolls are reported. A good number could seal the deal on a June interest rate hike.