The Weekly View (6/6/16 – 6/10/16)

What’s On Our Minds:

Continuing with the employment theme, the economic team at Tufton presented research to the investment committee about the unemployment rate and how it relates to historical levels.

We are cautious when comparing to past numbers both the current U-6 unemployment rate (see definitions below) as well as the labor force participation rate. We believe that these two figures could reflect a structural change in the nature of employment as low-paying jobs become scarcer as automation increases. We believe that the U-3 rate, which is the “headline” figure, will be affected by these trends less than the U-6 rate.

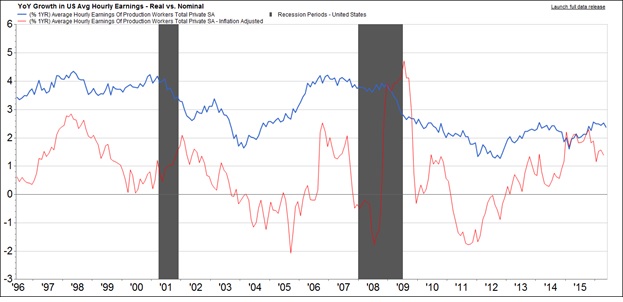

Tufton is also watching trends in hourly earnings. Economic theory states that when unemployment reaches or goes below its natural (equilibrium) level, wages begin to pick up as employers seek to attract employees. We see in the chart below that inflation-adjusted wages (in red) have been picking up for about the last two years, a sign that the economy is strong and employers are having to pay more for qualified candidates.

U-3: total unemployed, as a percent of the civilian labor force (this is the definition used for the official unemployment rate).

U-6: total unemployed, plus all marginally attached workers, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all marginally attached workers.

Civilian Labor Force: The subset of Americans who have jobs or are seeking a job, are at least 16 years old, are not serving in the military and are not institutionalized.

Last Week’s Highlights:

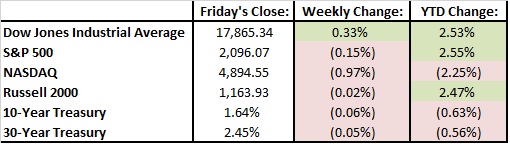

Last week, the major markets again ended mixed. The Dow was up 0.33%, the S&P 500 was mostly unchanged a -.15%, and the Nasdaq was down 0.97%, with some weakness in a few big tech names.

Many commentators poked fun at the Fed last week, noting that for all of Janet Yellen’s talking points and data, no real commitments or information were given.

Looking Ahead:

This week, we’ll be looking at China’s industrial and retail numbers on Monday. The Chinese growth story continues to affect worldwide markets, and numbers coming out of the country, while valuable, have been met with some skepticism in the past.For a checkup on the consumer, we’ll get US retail sales numbers on Tuesday. Another increase would mean consumers are less and less scared of spending their hard-earned cash. And, importantly, we will hear from Janet Yellen at the conclusion of the Fed meeting on Wednesday. We expect no real changes.