The Weekly View (6/20/16 – 6/24/16)

What’s On Our Minds:

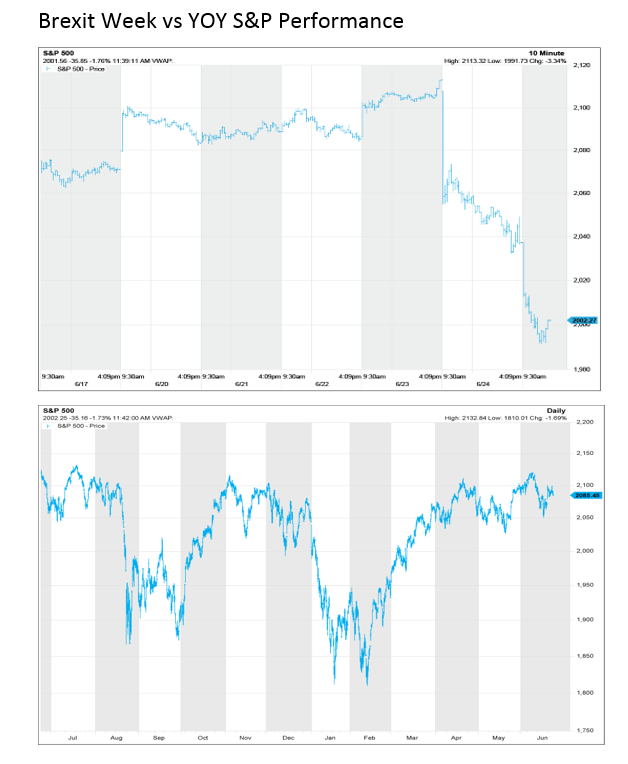

In late June, tennis at Wimbledon is usually the big news coming out of Britain, but not this year! British citizens have spoken; they want to leave the European Union and the referendum results last Thursday sent shocks through global equity markets on Friday. Stocks sank, currency values were volatile, and gold values increased. It was the eighth-largest drop in the Dow Jones index on a point basis but on a percentage basis (3.6%) it ranked below the correction the S&P 500 experience in August of 2015. Furthermore, the market had rallied to near all-time highs leading up to the vote as many predicted Britain would vote to stay in the EU. The decision to “stay” was priced into the market leading up to the vote, and the uncertainty brought on by a “leave” vote sent markets south.

It’s important to note that unlike the financial event that led to collapse of Lehman Brothers in 2008, the Brexit is a political event. It’s clear that Britain has become increasingly polarized; Prime Minister David Cameron made a campaign promise to hold a referendum as a concession to a growing faction in his conservative party that wanted to exit the EU. These “Brexiteers” want to have more control over their borders and believe their EU membership costs could be redirected to benefit the nation domestically. They will get their wish if Britain can successfully complete the 2 year process of negotiating its way out of the EU.

In our opinion, we continue to take a long term view on the equity markets as investors throughout the world continue to digest the unexpected Brexit. That being said, we believe our portfolio of companies has the financial strength to ride this storm out and continue paying dividends.

Last Week’s Highlights:

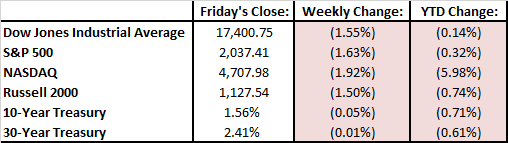

Without a doubt, it was a tough week on Wall Street. Markets had rallied big early in the week only to tank on Friday’s Brexit news. On Friday, the S&P 500 fell 3.6%. The Dow fell 3.4%. This puts the indexes in the red for the year. The NASDAQ is now down almost 6% year to date. The nation’s biggest banks passed their stress test. The Fed considered the 33 of them to be in good health and can withstand a recession based on higher capital, better loans, and lower costs. In company news, Tesla made an offer to purchase SolarCity for $2.8 billion. Boeing announced it had signed jetliner deal with Iran worth roughly $27 billion. Volkswagen announced it will pay $10 billion to either buy back or fix cars it sold with emissions cheating software.

Looking Ahead:

On Monday, Janet Yellen and ECB President Mario Draghi will be speaking at a European forum on central banking on the impact of the Brexit. On Tuesday, the final estimate for Q1 GDP is reported along with June consumer confidence numbers. On Wednesday, May spending and personal income numbers will be reported. Thursday we will hear about the U.S. economy and monetary policy from the St. Louis Fed President, James Bullard. We will also get quarterly results from Hunt Valley based, McCormick.