The Weekly View (2/25/19)

Last Week’s Highlights:

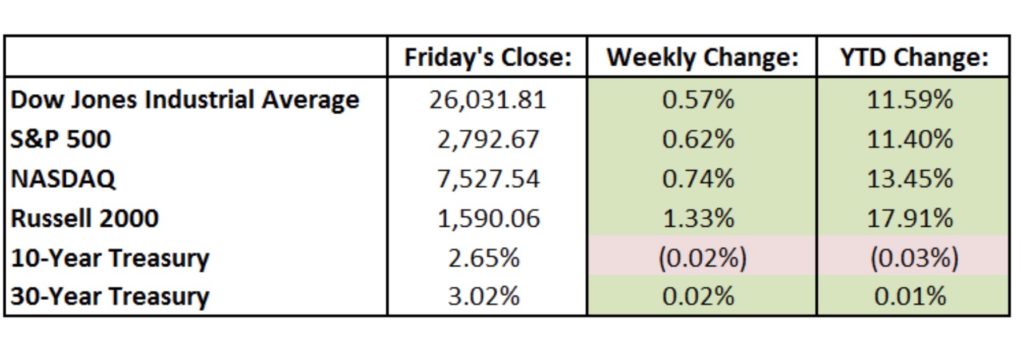

U.S. equity markets extended their winning streak to nine consecutive weeks and are on track for their largest early-year advance in three decades. A more flexible approach to monetary policy from the Federal Reserve, a stronger-than-expected corporate earnings season and easing U.S.-China trade tensions have helped fuel investor enthusiasm. For this past week, the Dow Jones Industrial Average (DJIA) rose 148.62 points, or 0.57%, to 26,031.81, while the S&P 500 advanced 0.61% to 2792.67. The tech-heavy NASDAQ gained 0.74% for the week to 7527.54. The DJIA and S&P 500 indexes are now sitting at 3% and 4.7%, respectively, below last year’s all-time highs. Sixteen states joined to file a suit opposing President Trump’s declaration of a national emergency over the Southern border. These states argue that the move violates the constitutional provision that Congress appropriates funds. House Democrats also prepared to vote on a resolution opposing the step. Trouble continued in Venezuela, as Trump threatened the country’s military that it would “lose everything” if it remained loyal to President Maduro. Talks of a busy year for IPOs continued, as ride-hailing company Lyft and on-line image-search operator Pinterest filed to possibly go public in the coming months. The much anticipated (at least in Tufton’s offices) annual letter from Warren Buffett came out Saturday morning. Topics ranged from Berkshire Hathaway’s frustration with finding good “elephant-sized acquisitions” to new accounting rules. Importantly, Buffett remains sanguine about the health of the U.S. economy.  Looking Ahead:

Looking Ahead:

Etsy (ETSY), Mosaic (MOS) and Shake Shack (SHAK) report quarterly results on Monday. The Federal Reserve Bank of Dallas releases its Texas Manufacturing Outlook Survey for February – forecasters call for a 4.5 reading, well above January’s 1.0 print. Earnings continue on Tuesday, as we’ll see numbers from Home Depot (HD), Mylan (MYL), Macy’s (M) and Discovery (DFS). Fed Chairman Jerome Powell is scheduled to deliver the central bank’s semi-annual Monetary Policy Report and provide testimony before the Senate Banking Committee. The Conference Board releases its Consumer Confidence Index for February – consensus estimates are for a 125 reading, slightly higher than January’s. JP Morgan Chase (JPM) and T. Rowe Price Group (TROW) host their 2019 investor days. On Wednesday, earnings reports are due from American Tower (AMT), Best Buy (BBY), Campbell Soup (CPB) and Lowe’s (LOW). Chairman Powell is back in action, as he’ll appear before the House Financial Services Committee. Edison International (EIX), Nordstrom (JWN) and Gap (GPS) report financials on Thursday. The day also brings preliminary fourth quarter U.S. GDP data from the Bureau of Economic Analysis – consensus estimates are for 2.5% growth, down from the third quarter’s 3.4%. Friday is the first day of March and brings the end of the 90-day negotiating period agreed upon by Trump and Chinese President Xi Jinping. Trump has hinted that the deadline could be extended. The day also brings earnings results from Marriott International (MAR), Foot Locker (FL) and Dentsply Sirona (XRAY).

The Tufton Capital Team hopes that you have a wonderful week!