The Weekly View (3/4/19)

Last Week’s Highlights:

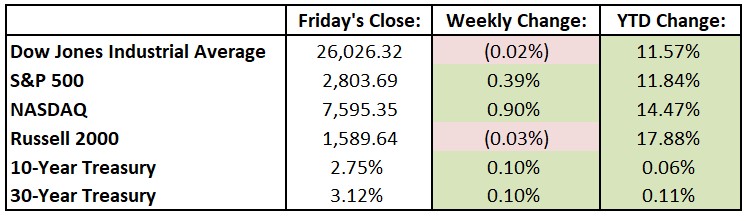

Despite a bumpy week, U.S. equity markets are off to their best start to a year in three decades, closing out February with gains of roughly 3%. Gains year-to-date have lifted the Dow Jones Industrial Average (DJIA) and the S&P 500 to within 4.3% of their records (the indices are up 11.6% and 11.8%, respectively, for the year). For this past week, the DJIA slipped 5.49 points, or 0.02%, to 26,026.32, while the S&P 500 advanced 0.39% to 2803.69. The tech-heavy NASDAQ edged up 0.90% for the week to 7595.35. Federal Reserve Chairman Jerome Powell testified before Congress, reiterating that the Fed was close to reducing its balance sheet. Gross Domestic Product (GDP) came in at 2.6% for the fourth-quarter of 2018, slightly beating estimates, and full-year GDP was 2.9%. The White House announced that it would delay the March 1st trade deadline for additional tariffs on Chinese goods as negotiations progressed. Michael Cohen’s testimony and the U.S.-North Korea summit in Vietnam generated plenty of headlines but few market implications.

Looking Ahead:

Earnings season nears its end with reports from Salesforce.com (CRM) and Ctrip.com (CTRP) on Monday. The Census Bureau reports construction spending data for December – analysts forecast a 0.3% gain after a 0.8% rise in November. Tuesday is Mardi Gras – the party starts with financial reports from Ciena (CIEN), Ross Stores (ROST), Target (TGT) and Kohl’s (KSS). The Census Bureau is back with its new-home sales data for December – expectations are for a seasonally adjusted annual rate of 580,000 units, down from 657,000 in November. On Ash Wednesday, earnings reports will be released by Dollar Tree (DLTR), Brown-Forman (BF) and Guidewire Software (GWRE). Estee Lauder (EL) and Exxon Mobil (XOM) host investor days in New York. Wednesday is also National Oreo Day for the sweet tooths out there. On Thursday, Costco Wholesale (COST), Kroger (KR) and H&R Block (HRB) report their earnings for the past quarter. The European Central Bank announces its monetary-policy decision – the bank is widely expected to keep its key interest rate at negative 0.4% due to falling growth projections for the euro zone. The business week ends with Vail Resorts (MTN) releasing its financial results.

The Tufton Capital Team hopes that you have a wonderful week!