The Weekly View (8/26/19)

Last Week’s Highlights:

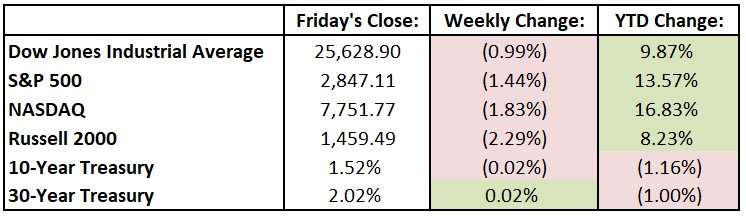

Stocks continued their wild swings as the U.S.-China trade war and comments from Fed Chairman Jerome Powell dominated business headlines. Equities were on track to finish higher for the week until China announced a new round of retaliatory tariffs on Friday morning, unveiling new tariffs on $75 billion of U.S. goods and a resumption of penalties on U.S. cars. While markets took this news in stride, stocks sold off sharply once President Trump responded. “My only question is, who is our bigger enemy, Jay Powell of Chairman Xi,” the president tweeted. From there, he turned his attention to China and “ordered” U.S. companies to “immediately start looking for an alternative to China.” Equities didn’t respond well to the news, as the Dow Jones Industrial Average (DJIA) sold off 623.34 points on Friday, ruining what had been a strong week. For the week, the DJIA fell 257.11 points, or 1.0%, to 25,628.90, while the S&P 500 declined 1.4% to 2847.11. The tech-heavy NASDAQ dropped 1.8%, closing at 7751.77. After Friday’s drop, the S&P 500 sits 5.9% below its all-time high, well above the 10% threshold for a market correction. Stock market futures rallied ahead of Monday’s open on positive comments from the White House regarding trade optimism. U.S. markets are on track to open higher Monday morning.

Looking Ahead:

With second-quarter earnings season largely in the books, the focus for the stock and bond markets will be on economic reports and continued U.S.-China trade talks this week. On Monday, the Census Bureau releases the Durable Goods report for July – consensus estimates call for a 1.1% gain in new orders for manufactured durable goods, down from June’s 1.9% rise. Autodesk (ADSK), Hewlett Packard Enterprises (HPE) and J.M. Smucker (SJM) report financial results on Tuesday. The Conference Board releases the results of its Consumer Confidence Survey for August – expectations are for a 130 reading, down from July’s 135.7 report. Look for earnings reports from Brown-Forman (BF), H&R Block (HRB) and Tiffany (TIF) on Wednesday. Thursday brings financial results from Best Buy (BBY), Burlington Stores (BURL), Dell Technologies (DELL) and Dollar General (DG). The National Association of Realtors reports its Pending Home Sales Index for July – estimates call for a 0.8% gain after a 2.8% rise in June. On Friday, the Bureau of Economic Analysis releases the Federal Reserve’s favored inflation gauge, the PCE price index, for July – consensus estimates are for a 1.4% year-over-year rise, even with June’s print.

The Tufton Capital Team hopes that you have a wonderful week!