Investing Through Volatility

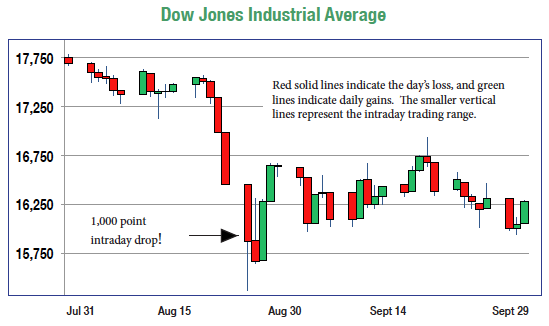

The month of August showed the return of volatility in the financial markets. The S&P 500 dropped 11% in the span of seven days and the VIX, widely known as “the Fear Index,” hit an intraday high of 53 – a level not seen since the financial crisis. In one day of trading, the Dow Jones Industrial Average opened down more than 1,000 points within the first hour, causing a “Flash Crash” as many ETF investors attempted to run for the exits. All of this chaos resulted in the >10% correction we had been long awaiting.

The month of August showed the return of volatility in the financial markets. The S&P 500 dropped 11% in the span of seven days and the VIX, widely known as “the Fear Index,” hit an intraday high of 53 – a level not seen since the financial crisis. In one day of trading, the Dow Jones Industrial Average opened down more than 1,000 points within the first hour, causing a “Flash Crash” as many ETF investors attempted to run for the exits. All of this chaos resulted in the >10% correction we had been long awaiting.

Throughout this volatile time, I received texts and calls from relatives asking if they should sell or trim their portfolios. My response often was “What? Why would you? I’m buying!” As we have mentioned in previous articles, >10% corrections are common and have occurred about every two years since 1957. Selling or trimming your portfolio during these corrections is one of the worst investment decisions you can make. Rather than running for the sidelines, history has shown that these are the moments to find a second wind and stay in the game, either by adding to your positions or making new investments.

Buying when the crowd is selling is often difficult when CNBC is airing “Markets in Turmoil” specials and Bloomberg Businessweek is putting 37 bears on its cover, implying a market decline of 20% or more. However, going against the crowd has allowed us to make great investments in terrific companies, time and time again. In his book The Crowd: Study of the Popular Mind, Gustave Le Bon observes that “in a crowd every sentiment and act is contagious, and contagious to such a degree that an individual sacrifices his personal interest to the collective interest.” CNBC’s sparks of fear, bear-market magazine covers, and a 1,000-point decline in the Dow at the open are examples of Le Bon’s point and the movements of crowds. The difference is that, while each of these crowd-related events occurred in the month of August, Le Bon made this observation when he published his book – in 1895! Fortunately, our investment strategy promotes buying on this weakness, as stocks we have had our eye on have fallen down to our buy prices.

Investors have and will likely continue to make the same mistakes, and I will likely continue to respond to my relatives – suggesting that they buy rather than joining the crowd that is planning to sell. If you have an established discipline and are patient, you can avoid the chaos of the crowd and use volatility to your advantage. After all, who wants to wait in line?