Company Spotlight: Philip Morris International (Ticker: PM)

By Rick Rubin

Philip Morris International (Ticker: PM) is a global leader in the manufacturing and sale of cigarettes and other nicotine-containing products. It has an attractive portfolio of iconic brands including Marlboro, Parliament, and L&M, which it markets internationally. All of its sales are outside of the U.S., and it has an impressive share of 28% of the international cigarette and heated tobacco market. Furthermore, it is in the process of commercializing IQOS, a “heat-not-burn” device, in nearly forty markets. In March of 2008, PM was spun off from Altria Group, formerly Philip Morris Companies. Altria is a holding company and the leading cigarette producer in the U.S., where it has the right to sell the same brands to domestic consumers through its subsidiary, Philip Morris USA. This corporate action allowed PM more freedom to operate independently in less regulated international markets, such as Europe and Asia.

Though tobacco use has largely fallen out of favor here at home, it has taken much longer for the other regions that PM serves to kick the habit. In Europe in particular, smoking is almost twice as prevalent among adults. Since the population growth rate is much higher in the rest of the world, PM will have access to more smokers in years to come.

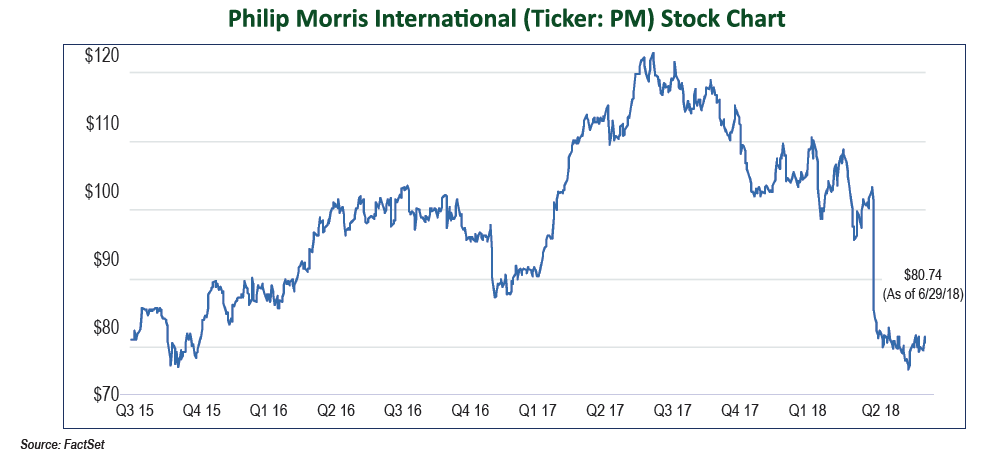

PM’s stock has been hit hard this year due to declining volumes in its cigarette business, market share losses to lower-tier brands, and an unexpected setback of IQOS in Japan, which has been a growth driver for the company. The IQOS took Japan by storm when it was first released, eventually capturing 16% of the overall tobacco market in two years. However, once this rapid growth slowed, the stock cooled, culminating in a 20% one-week loss when the company reported lower than expected sales for the device. Furthermore, investors have been dumping shares of consumer staples companies due to the growth of e-commerce, greater competition from smaller niche brands, and rising commodity and transportation costs. We believe these concerns are fully priced into PM shares at its current levels.

Despite a few hiccups, the company still has strong growth potential, and we are continuing to purchase shares for our clients where appropriate. Our positive recommendation is based on our belief that the company will improve fundamentals in its legacy cigarette business with plans to stabilize its leading market share and raise prices to cover large excise tax increases. Furthermore, the company has long-term upside potential from continued growth of IQOS in Japan, Korea, and other untapped markets.

In our view, PM shares are an attractive prospect at current price-to-earnings multiples, where they trade at a modest discount to the S&P 500. We believe this takes into account the near-term challenges such as overall cigarette volume weakness. Recently, management decided to raise the dividend by 6.5%, giving the stock a very generous 5.6% yield. Potential risk factors impacting PM include increased regulatory action such as smoking bans, higher taxation, and a stronger U.S. dollar. All things considered, we think the chances of this stock going up in smoke are slim.