The Weekly View (10/24/16 – 10/28/16)

What’s On Our Minds:

Over the past few weeks, the news headlines have been filled with many merger and acquisition deals and this morning continued the trend as the oil and gas service company Baker Hughes agreed to combine with General Electric’s oil and gas business. In terms of market value of the deals, October represented the second largest month ever for US listed companies. Other deals included communication company CenturyLink’s acquisition of Level3 Communications for $34 billion, AT&T’s acquisition of Time Warner for $108 billion, chipmaker Qualcomm’s acquisition of European based NXP Semiconductors for $47 billion, and British American Tobacco’s agreed buyout of the rest its stake in cigarette maker Reynolds America for $58 billion.

This past quarter represents the sixth straight quarter of earnings declines for S&P 500 companies. Facing diminishing earnings, corporate executives are looking for new ways to grow their businesses (and bonuses). Many executive bonuses are partly dependent on year over year growth in their company’s earnings per share (EPS). When growth declines or disappears, executives look to other sources of generating revenue, such as acquiring other companies.

Seeing that the M&A business has heated up this year, we would be willing to bet that a good bit of investment bankers will be very happy with their year-end bonus checks in December!

Last Week’s Highlights:

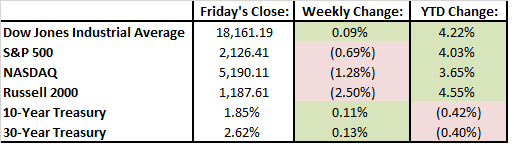

Stock market indexes were mixed last week. The Dow increased just a bit, and the S&P 500 lost some value. For the most part, third quarter earnings announcements drove results last week.

It was announced that U.S. GDP increased at an annual rate of 2.9% in the third quarter. This was up from just 1.4% in the second quarter. The accelerated GDP number reflects an upturn in private inventory investment, increased exports, less decreases in local government spending, and an upturn in federal government spending.

Twitter’s stock has been beaten up this year, and the company announced it is planning on laying off 9% of their employees to focus on profits. Meanwhile, Snap (the parent company of social app Snapchat) is planning on raising up to $4 billion in an IPO deal. Based on these metrics, Snapchat is being valued anywhere between $25 and $40 billion. Clearly, Twitter has lost some of its birdsong while Snapchat is snapping along nicely.

Finally, on Friday afternoon the presidential race heated back up when the FBI announced it would re-open investigations into Hilary Clinton’s emails after discovering related emails on Anthony Weiner’s laptop during an unrelated investigation. Markets decreased on the news, which shows investors were probably expecting (and perhaps even hoping for) a Clinton victory next week. What we know for sure is that any bit of uncertainty introduces pessimism to the markets.

Looking Ahead:

The presidential election is just over a week away, which should dominate headlines this week, but we are still in the thick of third quarter earnings season. Home improvement giant Lowes reports earnings on Monday. Occidental Petroleum reports on Tuesday. On Wednesday, we will get results from Qualcomm. The Fed will announce its interest rate policy moving forward on Wednesday but it’s unlikely that they will raise rates right before the election. They should give some signals as to whether they will raise rates in December. CBS and Starbucks report earnings on Thursday. On Friday, the October jobs report is released.