The Weekly View (10/17/16 – 10/21/16)

What’s On Our Minds:

In just two weeks, Americans will head to the polls to determine our next president. A lot of folks seem a bit nervous regarding their investment portfolios heading into this year’s election. Anxiety ahead of any presidential election is hardly unusual as elections bring change into the picture and for investors. Furthermore, this year’s election has brought a sense of dread into the 24-hour news cycle which doesn’t help investor angst. While campaign related news can quickly move the stock market one way or the other, it’s important to remember that these types of events rarely have a long-term impact on the markets.

Sometimes it’s hard to keep emotions out of financial decision making. More often than not, your investment portfolio’s highs, lows, twists, turns and plummets are actually courtesy of your own psychology. Emotions substantially affect rational thinking; when you let certain emotions fuel your investment decisions, your portfolio could be in trouble. So over the short term, it’s important to try to keep your emotions in check and divorce politics from your investment portfolio.

While the past doesn’t predict the future, one could note that the S&P 500 has been positive in 76% of presidential election years. Even though historical figures might not reflect what will happen the rest of this year, we suggest that investors stick to their long term plan rather than let their emotions surrounding the election drive their investment decisions. For folks looking to make trades around what they think we happen in the coming election, we would remind you that trying to time the market almost never works out over the long run.

Last Week’s Highlights:

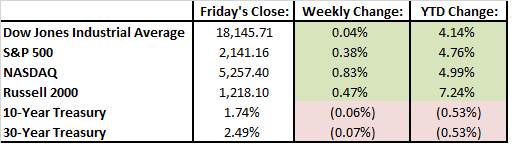

Markets were up modestly last week but it was a bit of a bumpy ride getting there. The S&P 500 and Nasdaq rose by 0.38% and 0.83% respectively. The Dow finished the week almost exactly where it started.

U.S. crude oil prices hit a 15 month high of $51.60 a barrel, after data showed stockpiles had fallen. Saudi Arabia also said that many OPEC members are planning on participating in a production cut. Doubts persist over the production cut deal between OPEC nations though.

On Saturday night, the largest take over deal of the year was announced. AT&T has agreed to buy Time Warner for about $107.50 a share in cash and stock. Both presidential candidates have scrutinized the deal and competitor Walt Disney Co. stated, “a transaction of this magnitude obviously warrants very close regulatory scrutiny.”

Looking Ahead:

Third quarter profit reports are coming through day by day, and the presidential election is right around the corner. We will be in the thick of 3rd quarter earnings season again this week. Visa will kick off the week, releasing earnings on Monday. Tuesday, we will hear from Apple, Fiat Chrysler, and Chipotle. Wednesday, we will get numbers from Southwest Airlines, Boeing, and Coca-Cola. On Thursday, Apple is revealing its new Mac computer and Google, Samsung, and ConocoPhillips will release their earnings. On Friday, we will finish the week with earnings reports from Legg Mason, MasterCard, Anheuser-Busch, and U.S. GDP figures for the 3rd quarter will be released.