The Weekly View (10/31/16 – 11/4/16)

What’s On Our Minds:

Can’t we just get this election over with already? Unfortunately not, but we are almost there. While technically not an event from last week, we would be remiss in not pointing out the big market move this morning after Hillary Clinton was cleared by the FBI regarding the newly-discovered emails. It has become fairly evident that the markets are hoping for a Democratic victory.

The division in American politics is real and often frightening. The FBI’s involvement in politics has many people even more concerned about the direction of our political system and the way we conduct elections. However, we hope and believe that calm heads can prevail. Further, we know that whatever the outcome of the election, there will be plenty of work to do in evaluating the economic effects of the new president-elect’s plans. If your favored candidate doesn’t win, it might seem like the end of the world, but financial markets will keep on trading, and investing wisely will still be important to secure your future.

Last Week’s Highlights:

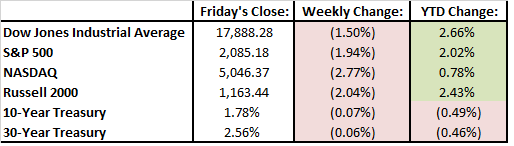

The markets took it on the chin last week. By Friday, markets had declined for 9 straight days, the longest losing streak since 1980. Trump’s momentum and a general feeling of uncertainty surrounding the election weighed on global markets with the S&P 500 giving up nearly 2%.

It wasn’t all bad though. The U.S. jobs report was good on Friday and third quarter GDP grew more than expected. The country saw strong wage growth in October with the Fed reporting that non farm payrolls increased by 161,000. The unemployment rate is now down to 4.9%. The Fed didn’t raise interest rates going into the election but gave some hints that they will likely increase rates soon. Investors are expecting a bump in rates in December.

It was a crazy week in the energy business with crude oil prices ticking down 9.5% to $44.07 on news that crude stock piles grew much more than expected. Ironically, gasoline prices rose 15% because a pipeline in Alabama ruptured.

In company news, GE struck a deal to combine its oil and gas business with Baker Hughes. Generic drug manufacturers are being investigated by the federal government for alleged price collusion. These companies include Teva, Mylan and Endo.

Looking Ahead:

With all the election hype it’s easy to forget that we are still in the thick of third quarter earnings season. Chemours and Sysco report earnings on Monday. CVS, Johnson Controls, and News Corp report their results on Tuesday. Mylan and Wendy’s will share their quarterly results on Wednesday. Thursday we will get reports from Disney, Kohl’s and Macy’s. Finally, on Friday, Armstrong Flooring and J.C. Penney post their third quarter numbers.

On Tuesday Americans head to the polls. Markets will probably experience some short term volatility around the election as investors figure out who will be leading our country for the next four years. Election jitters will be in full force.

The bond market will be closed on Friday for Veteran’s Day. Tufton would like to thank all Veterans for their service to our great country.