The Weekly View (2/18/19)

Last Week’s Highlights:

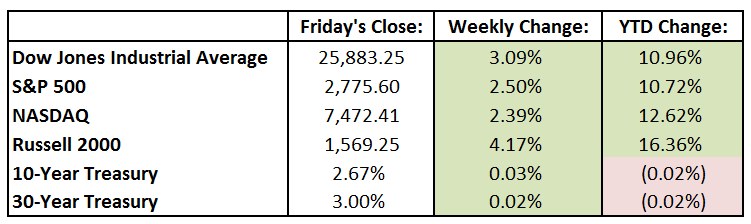

U.S. equity markets continued moving higher, as the Dow Jones Industrial Average (DJIA) completed its eighth-straight winning week. Rising optimism about talks with China, combined with a newly accommodative Federal Reserve, have helped push domestic stock markets higher by over 10% since the year began. For this past week, the DJIA rose 776.92 points, or 3.1%, to 25,883.25, while the S&P 500 advanced 2.5% to 2775.60. The tech-heavy NASDAQ gained 2.4% for the week to 7472.41. The House and Senate agreed to a compromise on border security, hoping to avoid another government shutdown. Although President Trump signed the funding bills on Friday, he also declared a “national emergency” and seeks to find funds elsewhere for his wall. Earnings season continued last week, and two-thirds of S&P 500 companies have reported their fourth-quarter results so far. Earnings are on track to have grown 13% from a year ago, marking the fifth straight quarter of double-digit earnings growth. Amazon.com (AMZN) pulled out of its HQ2 New York plan after being hit by opposition from local groups and politicians.

Looking Ahead:

U.S and Canadian financial markets are closed on Monday in observance of Presidents Day and Family Day, respectively. On Tuesday, earnings season powers on with 46 S&P 500 components releasing financials this week. Tuesday’s earnings include results from Walmart (WMT), Noble Energy (NBL) and Medtronic (MDT). The National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for February – economists expect a 60 reading, up from January’s 58. On Wednesday, we’ll see more fourth-quarter numbers from GoDaddy (GDDY), Analog Devices (ADI), CVS Health (CVS) and Entergy (ETR). Thursday brings the Census Bureau release of its Advance Report on Durable Goods. Expectations call for December durable-goods orders to be up 1.7% after rising 0.7% in November. Domino’s Pizza (DPZ), Zillow Group (Z) and Hormel Foods (HRL) report earnings. On Friday, the University of Chicago hosts its annual U.S. Monetary Policy Forum. AutoNation (AN), Wayfair (W) and Cabot Oil & Gas (COG) are among the companies reporting financials Friday. Warren Buffett’s eagerly awaited annual shareholder letter will be released by Berkshire Hathaway on Saturday.

The Tufton Capital Team hopes that you have a wonderful week!