The Weekly View (2/11/19)

Last Week’s Highlights:

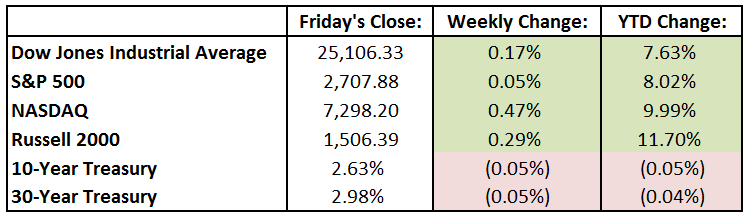

Strong quarterly earnings results, led largely by several technology companies, fueled an early-week rally in U.S stock markets. The fun was short-lived, however, as trade and global economic worries weighed on equities later in the week. Despite this volatility, the main U.S. indices were essentially flat for the week, as the Dow Jones Industrial Average rose 0.17% and the S&P 500 was up just 0.05%. The technology-heavy NASDAQ ended 0.47% higher, led largely by solid weekly performances from Microsoft (MSFT) and Apple (AAPL). Investors remained focused on U.S. trade negotiations with China as well as reports of soft economic data coming out of Europe. Regional banks BB&T (BBT) and SunTrust (STI) announced their merger in a $28 billion all-stock deal, the largest since 2009. Earnings season continued, highlighted by Google-parent Alphabet (GOOG) reporting its fourth quarter results. While GOOG reported sales and earnings that exceeded expectations, the stock slipped as investors worried about higher costs and lower margins. Walt Disney (DIS) also beat analysts’ forecasts, as the company launched the Disney+ streaming service and completed the acquisition of 21st Century Fox.

Looking Ahead:

The week begins with earnings results from Loews Corp. (L), Brighthouse Financial (BHF) and Restaurant Brands (QSR) on Monday. Japan’s financial markets are closed for National Foundation Day. The Bureau of Labor Statistics reports the Job Openings and Labor Turnover Summary (JOLTS) for December on Tuesday. Economists forecast a seven million reading, up from November’s 6.9 million. Earnings will be released by Under Armour (UA), Martin Marietta Material (MLM) and Activision Blizzard (ATVI). On Wednesday, the BLS reports the consumer price index for January – consensus estimates call for a year-over-year rise of 1.5%, down from December’s 1.9%. Reporting season continues, with results coming from Cisco Systems (CSCO), American International Group (AIG) and Hilton Worldwide Holdings (HLT). The Census Bureau reports data on business inventories for November on Thursday. Earning will be released by Applied Materials (AMAT), CBS (CBS), Waste Management (WM) and Zoetis (ZTS). The week ends with financial results from Deere (DE) and Newell Brands (NWL). The BLS reports its export and import data for January – prices are expected to decline by 0.2% for both exports and imports.

The Tufton Capital Team hopes that you have a wonderful week!