The Weekly View (2/4/19)

Last Week’s Highlights:

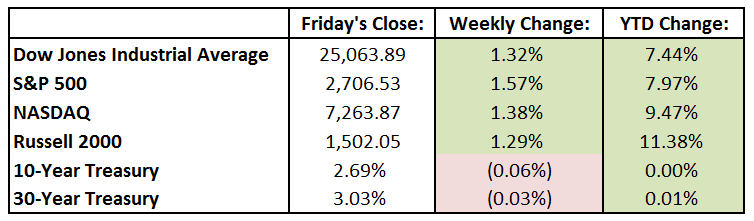

Corporate earnings and the Federal Reserve dominated business headlines last week, leading to continued strength for U.S. equities. The Dow Jones Industrial Average (DJIA) rose 326.69 points, or 1.3%, to 25,063.89, while the S&P 500 advanced 1.6% to 2706.53. The tech-heavy NASDAQ gained 1.4% for the week to 7263.87. The Dow was up 7.2% last month, its best January since 1989. Last week saw a large batch of earnings results, providing a continued tailwind to U.S. equities. Nearly half of the companies in the S&P 500 have posted results so far, with 70% surpassing analyst expectations. Companies in the index are on track to post year-over-year earnings growth of 12%, marking the fifth straight quarter of double-digit earnings increases. On Wednesday, Fed Chairman Jerome Powell indicated that the case for raising interest rates “has weakened somewhat”, easing concerns about tighter monetary policy in the U.S. Results from the Labor Department on Friday exceeded expectations as U.S. nonfarm payrolls rose a strong 304,000 in January, further evidence of a strong economy. The New England Patriots defeated the L.A. Rams 13-3 in the lowest-scoring game in Super Bowl history, leading the Pats to yet another Lombardi Trophy.

Looking Ahead:

Fourth-quarter earnings season remains in full swing, with 90 S&P 500 components reporting financial results this week. Monday brings earnings reports from Google-parent Alphabet (GOOG), Gilead Sciences (GILD) and Clorox (CLX). The Census Bureau releases its final Durable Goods report for November, with economists forecasting a 1.5% rise after falling 4.3% in October. Monday is also World Cancer Day. Tuesday begins the Chinese New Year, with many stock markets closing across Asia in observance of the start of the Year of the Pig. We’ll see earnings from Chubb (CB), Walt Disney (DIS), Viacom (VIA) and Becton Dickinson (BDX). The State of the Union will take place Tuesday night. Wednesday includes financial results from Boston Scientific (BSX), General Motors (GM), MetLife (MET) and Eli Lilly (LLY). The Census Bureau releases its Trade Balance in Goods and Services for November – the estimate is for a deficit of $54 billion. The Bank of England announces its monetary policy decision on Thursday, with the central bank expected to keep its benchmark interest rate at 0.75%. Earnings releases are expected from Kellogg (K), Twitter (TWTR), Yum! Brands (YUM) and Fiserv (FISV). The busy week ends with financial results from Exelon (EXC), Hasbro (HAS) and Phillips 66 (PSX).

The Tufton Capital Team hopes that you have a wonderful week!