The Weekly View (1/28/19)

Last Week’s Highlights:

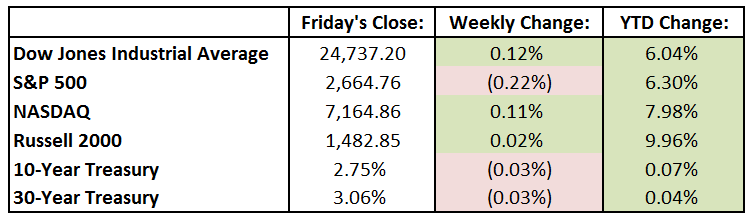

Earnings season is well underway as the market continues to digest companies’ 4th quarter results. Last week, the main US indices were essentially flat with the Dow Jones Industrial Average up just 0.12%. The S&P 500 was down 0.22% and tech-heavy NASDAQ was up 0.11%. The week brought news from many large well-known companies. Johnson & Johnson (JNJ) beat on sales and estimates, but the stock fell due to a softer 2019 outlook. Procter & Gamble (PG) also beat on sales and estimates. The stock rallied higher as the company raised their full-year guidance. On the economic front, Existing Home Sales have fell short of Wall Street estimates coming in at 4.9 million. The FHFA Home Price Index was flat month-over-month as the home prices barely budged. In addition, investors were also focused on trade tensions between the US and China as well as commentary coming out of the global economic forum in Davos, Switzerland. Finally, the government shutdown ended over the weekend.

This week, earnings will continue to be in focus as Microsoft (MSFT), Amazon (AMZN), Apple (AAPL) and Facebook (FB) all report their 4th quarter results. We will also gain some insight from the energy patch when Exxon (XOM) and Chevron (CVX) report on Friday. The behemoths of the former Telecommunications sector will also release their numbers with Verizon (VZ) and AT&T (T) reporting on Tuesday and Wednesday, respectively. In economic news, Consumer Confidence will be reported on Tuesday. Wall Street is estimating a reading of 125 versus 128.1 in December. Investors will also get a preliminary reading on 4th quarter economic growth when Gross Domestic Product is disclosed on Wednesday. Lastly, the Federal Open Market Committee (FOMC) will meet this week and are expected to leave the Federal Funds Rate unchanged at 2.25% to 2.5%.

The Tufton Capital Team hopes that you have a wonderful week!