The Weekly View (3/14/16 – 3/18/16)

What’s On Our Minds:

Last week, the 50% plunge in the stock price of Canadian drug maker Valeant displayed the importance of diversification in an investor’s portfolio. In the past two years, Valeant was considered a hedge fund darling due to its unconventional business model that has produced significant growth in earnings and cash flow. Instead of spending money on research and development to develop new drugs, Valeant has acquired smaller pharmaceutical companies with mature specialty drugs. Following the closing of the acquisition, Valeant would restructure the former company’s costs and assets, raise their drug prices and by being based in Canada, utilize a lower corporate tax rate. Many investors fell in love with this business model and held positions in Valeant that amounted to over 15% of their total portfolio.

For some time, these investors looked like geniuses as the stock climbed from $50 in 2012 to $263 in July of last year. Then, in the Fall of 2015, accusations arose regarding the company inflating sales and price gouging – the stock tumbled. Next came legal investigations from customers and the regulators – the stock tumbled more. Last week, the company provided weak guidance and stated that they lacked cash to make further acquisitions, planned on spending more on compliance and reporting, and that first quarter earnings would be cut in half. As a result, the company’s stock lost $12 billion dollars – or 50% – in value.

One of the largest holders in Valeant is activist investor Bill Ackman, who runs hedge fund Pershing Square Capital Management. Prior to the company’s decline, Valeant was the largest of the fund’s nine holdings. According to the Financial Times, Ackman has now lost more than half of his client’s money since the stock peaked last July.

It pays to be diversified.

Valeant Pharmaceuticals (VRX)

Last Week’s Highlights:

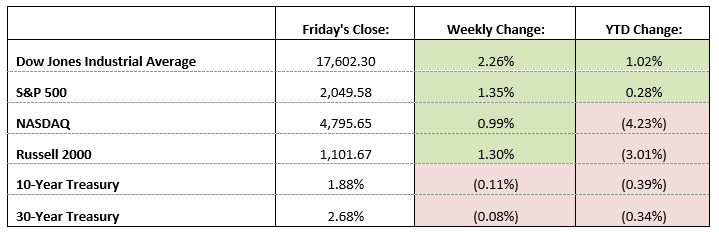

The S&P 500 rose 1.35% and the Dow Jones rose 2.26% on the week. The Federal Reserve held their March Federal Open Market Committee (FOMC) meeting and left interest rates unchanged and implied two possible rate-hikes during 2016. The markets cheered the lower-for-longer near zero interest rate policies. Increases in oil and other commodity prices also improved market sentiment.

Looking Ahead:

The week is somewhat light on economic data. The condition of US oil and gas companies will be in focus at the annual Howard Weil Energy Conference in New Orleans. On Thursday, investors will get a gauge of the industrial sector when the Flash Manufacturing PMI for March is released at 9:45 AM. Any reading above 50 implies that there was growth in the period – Wall Street is estimating a reading 50.3. The markets will be closed on Friday in observance of Good Friday as traders prepare for Easter.

Remember – don’t put all your eggs in one basket.