The Weekly View (3/7/16 – 3/11/16)

What’s On Our Minds:

Our Investment Committee has been especially focused on recent employee figures and what they “really” mean. One of our crack analysts (who also writes for the Weekly View) prepared the below chart for the committee. It shows the timeline of a very familiar data point (in blue): Initial Claims. This figure is the number of people filing for unemployment benefits for the first time, and is widely considered to be an important leading (forward-looking) indicator of the stock market. The initial claims number shows that the number of people filing for first-time benefits is as low as it was in the late 90s.

The conclusion is not, however, “Sell everything.” We can see that between about 2005 and 2008, we were also at levels suggesting full employment. We certainly would not have wanted to be out of the market for that entire three year period

Last Week’s Highlights:

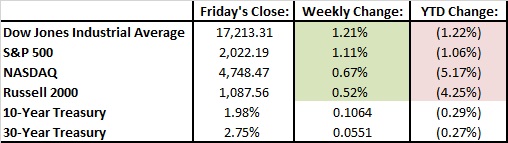

The S&P 500 was up 1.2% on better economic data and a rally in oil prices. The market has bounced off of February lows and is now down 1.2% Year to Date.

Last week we marked the seven year anniversary of the current bull market. Although it feels like investors have been beaten up over the past nine months, the bull market that began on March 6, 2009 continues: we have not seen a drop of more than 20% in the market in over seven years. We have seen two 10% corrections since last summer, but the market recovered on both occasions and the volatility presented tremendous buying opportunities. The average bull market since World War II has lasted 56 months and posted a 144% gain. In comparison, the current 84 month bull has posted a 193% gain in the S&P 500. Clearly, this bull has come a long way!

Looking Ahead:

After unexpectedly resorting to negative interest rate policy in January, the Bank of Japan will announce its updated interest rate policy on Tuesday. So far, the bank’s radical move has failed to assuage the country’s deflation and stagnation woes.

At home, investors will be watching the Federal Reserve this week as they hold their two-day policy meeting on Tuesday and Wednesday. We expect the Fed to keep another interest rate increase on hold this time around, but Janet Yellen could give an indication of future moves during her press conference on Tuesday at 2:30 PM.

On Tuesday we will get one step closer to electing our new president as Florida, Illinois, Missouri, North Carolina, and Ohio voters head to the polls in their respective primary elections.