The Weekly View (5/16/16 – 5/20/16)

What’s On Our Minds:

This week, we take a step back from the financial workings of the economy and instead look at a macro trend that’s been getting a lot of attention but whose market implications haven’t been discussed as much: the phenomenon of self-driving cars. Sure, there has been plenty of attention given to the long term effects on markets like truck driving and shipping (they will be completely overhauled), but how do we get from here to there?

“Truck driver” is the #1 job in a majority of states. When all those jobs go away, it will mean big changes. It will dramatically drive down the cost of shipping, but it will also result in some 3.5 million truck drivers finding themselves out of a job. There will still be plenty of folks working in shipping, but no one will be driving. A ~3% increase in the unemployment rate is no small matter. It will put stress on politicians to do something to help those who are out of work, compounded with economic stresses from the changing US economy.

The question is, when? The technology is mostly here now, but it needs to be implemented, which is no small task. We expect, though, for large shippers to push hard to get regulations streamlined and trucks on the road because of the massive savings. Business Insider projects a major driver shortfall in the coming years (below) as the Millennial generation turns away from truck driving as a profession.

In the coming few years, we expect to see major changes from automation. Many industries and businesses are not prepared. We constantly scan our portfolios for these potential weaknesses – or strengths. Those who have major investments in artificial intelligence, like Google, stand to profit. The loser? Working-class Americans who cannot or will not re-train for a new career.

Last Week’s Highlights:

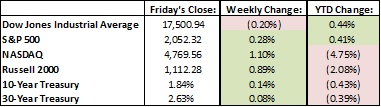

Stocks were mixed and mostly flat, as the Dow Jones Industrial Average fell .2% and the S&P 500 rose 0.3%. This marked the fourth consecutive week that the Dow has been in the red. On Monday, Warren Buffet disclosed that he had taken a one Billion dollar position in Apple which helped its stock after it has struggled lately. Later in the week, all eyes were on the Federal Open Markets Committee (FOMC) meeting on Wednesday. The federal reserve surprised the market and came out with a hawkish stance on further rate increases in June which caused stocks to fall, treasury yields to increase, and the dollar to gain strength.

Looking Ahead:

With last week’s wake up call from the Fed, investors will continue to weigh the changes that a June interest rate increase could bring to the market. Last time the fed raised rates by 25 basis points in December, the market sold but then recovered. It will be interesting to see how to market reacts to another increase or if the Fed continues to “kick the can down the road”. Internationally, the Eurozone and Japanese economy will be in focus this week as German GDP is released and Japan is hosting the G7 summit.