The Weekly View (5/9/16 – 5/13/16)

What’s On Our Minds:

Last week, investors received two very different perspectives on retail sales. The government report released on Friday stated that retail sales grew 1.3% in the month of April, which was the largest growth rate the US economy has seen in over a year. On the other hand, the large department stores reported first quarter earnings and offered lower than expected guidance for sales in the second quarter. Beaten up retailers such as JC Penney and Sears have struggled for years, but now their hardship seems to be spreading. For the week, Macy and Nordstrom were both down 17% and 18.5% respectively on the surprising sales guidance.

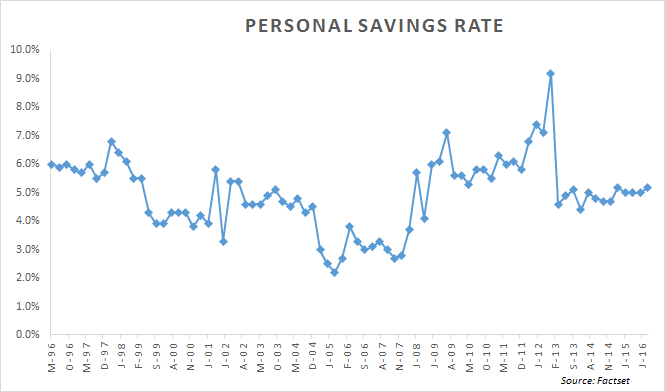

The retail sales report showed that “nonstore retailers” (i.e. online shopping) rose 10.2% on a seasonally adjusted basis from $41.1 billion in April of 2015 to $45.2 billion last month. Some analysts speculate that the day of reckoning is here for the brick and mortar department stores and that online shopping and Amazon are here to stay. Other analysts believe that the consumer is still not spending as the personal savings rate sits at 5.2% of disposable income, above the 20-year average of 4.9%. Perhaps the retail story is a mixture of both.

Nevertheless, the department stores have begun to pivot. Without a doubt, the US department store leader in the online space is Nordstrom. In 2011, the company acquired HauteLook which offers “flash-sales” and limited-time discounts from well-known brands. Last year, they launched Rack.com in order to sell apparel online from their Nordstrom Rack business. They also acquired clothing service company Trunk Club that provides customers with their own personal stylist and ships them handpicked clothing free of charge.

Internationally, department stores have made more radical moves to the ever-changing landscape. Selfridges in London realizes that in order to drive foot traffic, their stores need to become more of a destination. Recently, their London store provided Jedi training sessions that corresponded with the debut of the new Star Wars movie. In Japan, the Isetan Mitsukoshi Group is planning on opening stores in the center of large cities, as well as airports, residential areas and train stations.

Whatever the correct answer may be, we certainly think we’ve seen “The Brighter Side of Sears.”

Last Week’s Highlights:

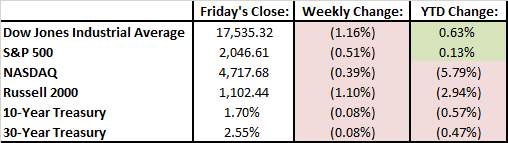

Stocks struggled last week as the Dow Jones Industrial Average fell 1.2% and the S&P 500 slipped 0.5%. In addition to the retail struggles, investors received weak credit data out of China and feared a stronger dollar. Another merger deal collapsed as the Federal Trade Commission blocked the combination office suppliers Staples and Office Depot. As a result, Staples was off 19% for the week while Office Depot was down an astonishing 40%! West Texas Intermediate Crude Oil rose 3.5% despite reports that Saudi Arabia, the world’s largest producer, was attempting to increase market share. The oil market appeared to be more focused on the supply disruptions in Canada and Nigeria.

Looking Ahead:

This week will bring additional news from the retailers with T.J. Maxx and Home Depot reporting first quarter earnings on Tuesday. Target and Home Depot’s rival Lowe’s will release their results on Wednesday and Walmart will polish off the retail news before the opening bell on Thursday. On the macro front, investors will be watching inflation with the release of the April Consumer Price Index reading at 8:30 on Tuesday morning. Analysts are expecting year over year growth of 0.4%. Janet Yellen and the Federal Reserve will certainly continue to watch this number closely as they decide on whether or not to raise interest rates at their meeting in June. Lastly, investors will also get a gauge of the housing sector with the release of April Housing Starting and April Existing Home Sales on Tuesday and Friday, respectively.