The Weekly View (5/2/16 – 5/6/16)

What’s On Our Minds:

Whether the going is tough or the market is hitting all-time highs, it’s important for investors to get back down to basics and remember their long term strategy. As a value focused investment firm, Tufton follows an investment strategy pioneered by Benjamin Graham during the 1930s, 40s, and 50s. During his time, he revolutionized the investment business by harping on the important difference between “investing” versus “speculating”. Rather than purchasing trendy companies and betting on the success of their emerging products, he focused on companies with good book values, which temporarily traded below their intrinsic value. In his books, Security Analysis (1932) and The Intelligent Investor (1949), he shares his insights on stock evaluation and the mindset needed for value investing. Even though it’s tough to purchase a stock that the rest of the market seems to hate, Graham explains how it’s essential to go against the grain when using his strategy. While markets have become much more efficient since Graham’s era, and it is not as easy to uncover mispriced securities, his strategies are still useful today. Just ask Warren Buffet.

Last Week’s Highlights:

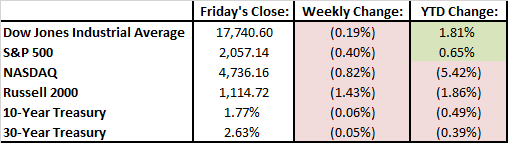

The stock market struggled last week for the second week in a row. It wasn’t horrible though with the the S&P 500 selling off by 0.4%, finding support at its 50-day moving average on Friday. In company news, oil field service companies, Baker Hughes and Halliburton, cancelled their merger plans. The US Dept. of Justice had filed an anti-trust law suit against the merger last month. Economically, the big news was a miss on the US jobs number. Our economy added only 160,000 jobs in April which was the smallest gain we have seen since last September. With unemployment stuck at 5%, it is likely that the Fed will hold off on raising rates in June. In politics, Donald Trump became the presumptive Republican nominee after a win in Indiana. On the Democratic side of the isle, Hilary Clinton lost to Bernie Sanders in Indiana, but she is close to locking up all the delegates she needs for the Democratic bid. On Saturday, the Kentucky Derby favorite, Nyquist, took home $1.24 million. The horse will be arriving in Baltimore on Monday as our town prepares to host the Preakness on May 21st.

Looking Ahead:

We will be a watching a few more reports coming across the wire. Israeli based generic drug producer, Teva Pharmaceuticals, reports earnings on Monday. Disney, which many consider a bellwether for the cable television business, reports earnings on Tuesday. On Wednesday, Macy’s and Wendy’s will report. With analyst expecting a 1% increase, retail sales numbers will be released on Friday. With earnings wrapping up, analysts are likely to shift their focus on the Fed’s Open Market Committee meeting on June 15th.