The Weekly View (7/29/19)

Last Week’s Highlights:

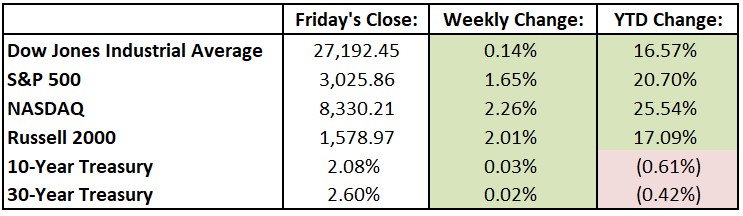

Last week brought record levels for two of the three major U.S. equity indexes. The S&P 500 and NASDAQ hit new highs as technology stocks roared after Google parent Alphabet (GOOGL) and Twitter (TWTR) handily beat earnings estimates. Alphabet’s announced $25 billion stock buyback was especially well received by investors. The Dow Jones Industrial Average (DJIA) was held back by component Boeing (BA), which slumped 8.6% after the grounding of the 737 MAX hit the company’s earnings. The Dow is a price-weighted index (as opposed to the S&P, which is market capitalization-weighted), so higher priced stocks such as Boeing have especially large impacts on the index’s performance. For the week, the DJIA advanced just 38.25 points, or 0.1%, to 27,192.45, while the S&P 500 rose 1.7% to 3025.86. The tech-heavy NASDAQ gained 2.3%, closing at 8330.21. Second-quarter gross domestic product (GDP) numbers, released Friday, showed that the U.S. economy grew at an annualized pace of 2.1%, a slowdown from the first-quarter’s 3.1% but slightly above economists’ forecasts of 2.0%. On the M&A front, the long-predicted Justice Department approval of the $26 billion T-Mobile (TMUS)/US-Sprint (S) merger finally took place. The U.K.’s Conservative Party elected Boris Johnson, the former London mayor and foreign minister, as party leader and prime minister. Johnson has been adamantly pro-Brexit, arguing that he will take the U.K. out of the European Union “do or die” by October 31st, without a deal if necessary.

Looking Ahead:

This is the busiest week of earnings season, with 156 S&P 500 constituents reporting their second-quarter financial results. On Monday, Affiliated Managers Group (AMG), Illumina (ILMN), SBA Communications (SBAC) and Vornado Realty Trust (VNO) release earnings. Tuesday brings financial results from Advanced Micro Devices (AMD), Procter & Gamble (PG) and Apple (AAPL). The Bank of Japan announces its monetary policy decision – the central bank is widely expected to keep its key interest rate at negative 0.1%. The week’s main event will be Wednesday’s Federal Open Market Committee’s July meeting. Wall Street has already priced in a 25-basis-point cut to the federal-funds rate, to 2% to 2.25%. The committee’s statement will be release at 2PM, followed by a news conference with Fed Chairman Jerome Powell. Automatic Data Processing (ADP), Dominion Energy (D) and Qualcomm (QCOM) announce their financial results. Look for earnings releases on Thursday from Corteva (CTVA), General Motors (GM), Verizon Communications (VZ) and Yum! Brands (YUM). The Institute for Supply Management announces its Manufacturing Index for July – consensus estimates call for a 52 reading, up from June’s 51.7 print. Chevron (CVX), Exxon Mobil (XOM) and Sempra Energy (SRE) announce their financial results on Friday. The Bureau of Labor Statistics releases the jobs report for July – economists forecast a 160,000 gain in nonfarm payroll employment after a 224,000 jump in June.

The Tufton Capital Team hopes that you have a wonderful week!