The Weekly View (8/12/19)

Last Week’s Highlights:

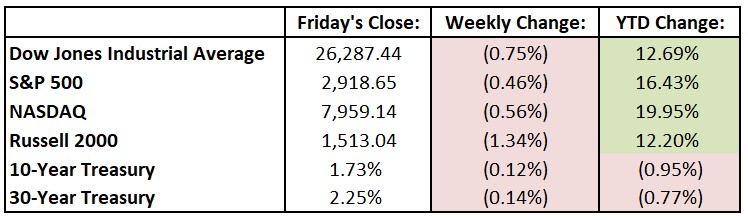

U.S. equity markets ended the week slightly below where they started. However, quite a bit happened between Monday and Friday as investors rotated between riskier and safer assets. The U.S.-China trade war continued to dominate headlines, and Beijing’s currency depreciation took center stage. The Dow Jones Industrial Average (DJIA) gave up 767.27 points on Monday after China let its currency weaken past 7 yuan to the dollar. Markets rallied on Tuesday, then tumbled Wednesday morning after India, Thailand and New Zealand announced unexpected interest rate cuts due to the global economic situation. Markets came back Wednesday afternoon and Thursday before faltering on Friday. For the week, the DJIA fell 197.57 points, or 0.8%, to 26,287.44, while the S&P 500 declined 0.5% to 2918.65. The tech-heavy NASDAQ dropped 0.6%, closing at 7959.14. Gold prices rallied to over $1,500 an ounce for the first time since 2013 and the 30-year U.S. Treasury briefly yielded 2.12% (its lowest since 2016), signaling investors’ appetites for safer assets in these volatile times.

Looking Ahead:

Second-quarter earnings season is in its final stretch, with Sysco (SYY) and Barrick Gold (GOLD) reporting financial results on Monday. The Treasury Department reports the nation’s budget statement for July – consensus estimates call for a $111 billion deficit, worse than July’s $77 billion shortfall. JD.com (JD), Tilray (TLRY) and Advance Auto Parts (AAP) announce earnings on Tuesday. The Bureau of Labor Statistics reports its consumer price index (CPI) for July – economists estimate a 1.8% year-over-year increase, up from June’s 1.6% print. The core CPI, which excludes volatile food and energy prices, is expected to be up 2.1%. Look for earnings reports Wednesday from Cisco Systems (CSCO), Agilent Technologies (A) and Macy’s (M). The BLS releases the Import and Export Indexes for July – import prices are expected to decline 0.2%, while export prices are seen falling 0.1%. On Thursday, Applied Materials (AMAT), Walmart (WMT) and Nvidia (NVDA) report their financial results for the past quarter. The Census Bureau releases retail sales data for July – analyst estimates forecast a 0.3% gain after the 0.4% rise in June. Deere (DE) reports earnings results on Friday. The BLS announces productivity and costs data for the second quarter – non-farm business sector productivity is expected to increase 0.9% after a 3.4% first-quarter rise.

The Tufton Capital Team hopes that you have a wonderful week!