What’s On Our Minds:

One may associate the summer months with longer days, beach vacations, leisurely weekends, and a general slowdown in the business world. But instead of getting lulled into the “Summertime Blues”, at Tufton Capital, we are cranking up our research efforts with a full crew of summer interns.

At Tufton, our Investment Committee stays busy throughout the year as our five portfolio managers and two research associates conduct all the firm’s equity research in house. To stay ahead with our research efforts during the summer months, it has long been a tradition for the firm to hire highly qualified summer interns to run valuations, write reports, and present their findings to our Investment Committee. It is important work that we believe benefits both the firm and our interns as they look to get into the investment business after college. Many of the alumni from our internship program have gone on to land great jobs on Wall Street after college.

This year we are happy to have a crew of four interns joining us for the summer.

Chris Guidry is joining us from Hood College where he is majoring in Economics with a concentration in Finance. Chris is the Chief Investment Officer of the Hood College Student Investment Fund. Prior to attending Hood, Chris was a Sergeant in the United States Marine Corps.

Nick Kuchar interned with the firm in 2015 while he was at Gilman and is joining us again this summer from the University of Michigan. Nick is a member of the Michigan Interactive Investment Club where he and other students manage a $20,000 fund. Nick is also a recruiting analyst for the school’s football team.

George Sarkes is joining us for his second summer at Tufton. George recently graduated from Washington and Lee University where he majored in Accounting and Business Administration and was a member of the Beta Alpha Psi honor society.

Haley Greenspan is joining us from the University of Maryland where she is attending the Robert H. Smith School of Business and is majoring in Finance and Computer Science.

We are very pleased with our intern team’s progress thus far this summer and appreciate the hustle and bustle they bring to our office.

Last Week’s Highlights:

Markets were quiet last week as there were not any market moving catalysts. Senate released the long awaited healthcare bill after closed door negotiations. Details are still being figured out. Oil once again dipped in bear market territory; it lost 4.4% on the week and ended at $43.01. Banks passed the Fed’s stress tests that require them to have adequate capital levels to lend during a recession. Uber CEO, Travis Kalanick, resigned under pressure from investors amid ongoing negative PR and controversy.

In global news, tensions spiked in Syria as an American jet shot down a Syrian government jet. International stability is topic of concern for investors, and developments overseas continue to affect the markets.

Looking Ahead:

All eyes will be on Washington D.C. for the upcoming vote on Senate Republican’s alternative to Obamacare, the BCRA. The Congressional Budget Office (CBO) will issue a report on the BCRA Monday, estimating the bill’s cost/savings, along with how many individuals will be left uninsured. Five Republican Senators ranging from hard-line conservative Ted Cruz (R-TX) to moderate Dean Heller (R-NV), have openly opposed the bill in its current form. Mitch McConnell can only afford two GOP defections to pass the bill, and he plans to vote on the bill on either late Thursday or Friday, before the July 4th recess. One sixth of the US economy could be affected by the changes in the healthcare law.

On Wednesday, the Federal Reserve will publish its results on if big banks passed their stress tests. The stress tests, which were started because of the Dodd-Frank financial overhaul, are expected to be less strenuous because the Trump administration removed the qualitative part of the test that led to embarrassing failures for banks, such as Citigroup, Deutsche Bank, and Banco Santando.

Lastly, Blue Apron, the meal-kit company, is set to IPO Wednesday. They are expecting to raise $586 million from the IPO and are given a $3 billion valuation, making it one of the bigger IPOs of 2017.

What’s On Our Minds:

On Friday, it was announced that Amazon will make its largest acquisition to date by acquiring Whole Foods for $13.7 billion. By acquiring the 460-store grocery network, Jeff Bezos, CEO of Amazon, is planning on Amazon becoming a top five grocery retailer by 2025. Traditional grocers, like Krogers, Costco, and Walmart, saw their shares sink on Friday at the prospects of a pricing war and disruption in the industry.

This purchase should be a game changer for the grocery business. Like any merger or acquisition, there will be some winners and some losers. As Amazon continues to transform the way consumers shop, they should benefit from more grocery options and a more efficient shopping experience which should save them time and money. The deal could end up being an unfortunate scenario for Whole Foods cashiers and other minimum wage employees, as Amazon will be looking to cut costs and optimize efficiency in brick and mortar stores.

Amazon is known for waging fierce price wars and upending traditional logistics methods to cut costs. Market commentators have speculated that Amazon will look to cut costs at the pricey chain by eliminating cashiers, changing inventory, and updating the stores’ approach. As one might expect from Amazon, technology could play a large role.

Last year, Amazon released a concept called “Amazon Go” where shoppers walk into an Amazon grocery store, check in with an app on their phone, pick out what they want to take home, and then simply walk out. Amazon Go stores can track which products you take off their shelves and automatically charge your account. Amazon calls it “just walk out” technology. While it’s unclear if Amazon will apply the concept in Whole Foods stores, it’s likely we will be seeing some changes in our neighborhood Whole Foods stores.

Click here to see a video on the “Amazon Go” concept

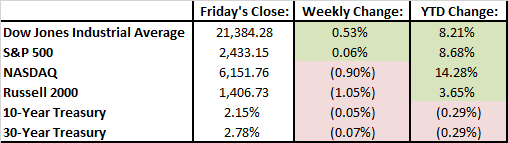

Last Week’s Highlights:

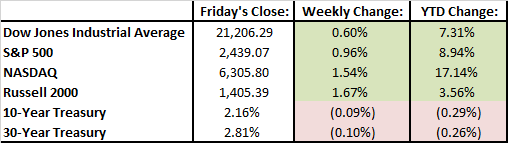

The S&P 500 finished up 0.06% last week. Technology stocks continued their slide, down 1.37% as fears continue to mount about the sector being overvalued at 2000-esque levels. Industrials (+1.13%), Real Estate (+.81%), and Utilities (+.82%) were the winners of the week with Tech (-1.37%), Consumer Staples (-1.27%), and Materials (-1.12%) being the losers.

The Federal Reserve raised its benchmark interest rate to between 1% and 1.25%. This is the second increase this year, and Fed Chair Janet Yellen suggested that it will stick to plans to raise rates three times in 2017. Yellen also laid out a plan to gradually ‘normalize’ the Fed’s $4.5 trillion balance sheet by not reinvesting the principle when the 10-year Treasury notes and Mortgage Backed Securities come due.

Travis Kalanick, the embattled CEO of Uber, announced an indefinite leave of absence as the firm agreed to recommendations to conduct an independent review into its abrasive corporate culture that has led to a series of PR disasters, mostly related to corporate sexism. With half its C-Suite empty and operating at a $607 million loss, Uber is certainly going through growing pains.

Oil prices plunged to their lowest levels in seven months after data from the International Energy Agency indicated that stockpiles of crude in America are falling by much less than had been expected, and they do not expect the global supply glut in oil to ease this year.

Looking Ahead:

Brexit talks begin today, and investors will be hungry for any information related to the extent and timing of the UK’s exit from the European Union. Many economists are hoping the new agreement will at least partly maintain the UK’s participation in the European free trading area.

The White House will be holding a tech summit this week, and the Paris Air Show will be taking place all week. The Paris Air Show is a perfect platform for Aerospace/Defense to showcase new technology, so look for market-making news to come from this event. The tech summit should give insight to the lengths the Trump administration will go to modernize the nation and partner with tech companies.

U.S. housing market data and crude oil inventory numbers will be released on Wednesday, Initial Jobless Claims report and EU consumer confidence on Thursday, and the EU leader’s summit will take place Thursday-Friday.

What’s On Our Minds:

Forget about FANG; there’s an updated group of market moving mega-cap tech stocks in 2017. The “Fabulous Five” includes Facebook, Amazon, Apple, Microsoft, and Google. The street is calling the high-flying group “FAAMG”. Combined, the FAAMG stocks have added $660 billion in market value this year and even though these companies are only 1% of the number of companies in the S&P 500, these top 5 tech stocks account for 13% of the market value weighting in the index.

Last Friday, Goldman Sachs’ research department took a shot at the FAAMG high-fliers noting that the overall return of the Nasdaq and S&P 500 is getting increasingly dependent on the FAAMG group. The report even went as far to compare the run up in these stocks to the euphoria in tech stocks before the burst of the Dot-Com bubble nearly 20 years ago. Goldman analyst Robert Bourojerdi wrote, “This out performance, driven by secular growth and the death of the reflation narrative, has created positions extremes, factor crowding and difficult-to-decipher risk narratives (e.g. FAAMG’s realized volatility is now below that of Staples and Utilities).” For investors, Friday’s report from one of Wall Street’s top firms, was hard pill to swallow and the exuberance built in these companies’ share prices was interrupted. Facebook was down 2.27%, Amazon was down 2.95%, Apple was down 3.52%, Microsoft was down 2.39% and Alphabet was fell 2.3%.

Clearly, Goldman’s research department is a bit worried the investors are getting caught up in the game of chasing growth in this small group of names.

Even though these types of moves are exciting to follow, we urge our readers to avoid getting caught up in the day to day media hype, and remain focused on the long-term prospects of their investment portfolio. The Tufton investment team continues to diligently monitor developments throughout the market and clients’ individual portfolios.

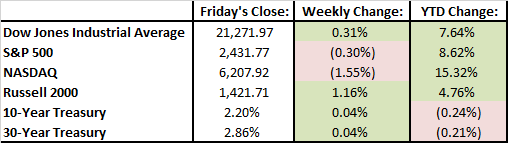

Last Week’s Highlights:

While financials had a great week due to a Dodd Frank repeal moving through the House of Representatives, a move Friday by technology stocks drove the S&P and NASDAQ into the red. NASDAQ was pushed lower by note by Goldman Sachs that suggested investors are overestimating the stability and strength of many recent outperformers in the Tech space. This led to a quick selloff and profit taking across the board in tech, and ended with the Technology Select Sector SPDR ETF (XLF) slumping -2.47%. Energy stocks had a volatile week, dropping in value midweek, but recovered on Friday. The price of WTI oil moved to its lowest level since November, on higher than expected inventory levels, as supply and demand forces continue to duel it out causing uncertainty in the energy sector.

Political forces continued to drive the narrative and influence the markets, but last week, economic forces took the wheel in moving the needle. The Comey testimony before Congress did not reveal anything particularly material or surprising, and markets reacted positively. In other news, Nordstrom is seeking to take itself private, GM sided with management against activist investor David Einhorn’s proposals, and Alibaba surged on raised guidance.

Looking Ahead:

All eyes will be on the Federal Reserve this week when they decide Wednesday whether to raise short term interest rates. The Street is expecting the Fed to increase rates by 25 basis points. Janet Yellen will also hold a press conference afterwards, which will be closely followed, because it could shed light on the state of the US economy, future Fed rate hikes, and if they will start to unwind the Fed’s $4.5 trillion balance sheet.

The Producers Price Index (PPI) and the consumers price index (CPI) will be reported Tuesday and Wednesday respectively. Both are measures of inflation and it is estimated that each increased between 0.2% and 0.5% this past month.

To wrap up the week on Friday, the stock market will likely see increased volume because it is a ‘triple-witching’ day. Triple witching days happen four times a year in March, June, September and December. It is a day when contracts for stock index options, stock index futures, and stock options all expire on the same day, and the stock market is flooded by arbitrage traders seeking to exploit price disparities.

What’s On Our Minds:

At Tufton, we often bring in new accounts holding numerous mutual funds. It’s likely that the client’s previous advisor was ‘filling the buckets” by picking what they believed were the best funds for each category. It’s a common strategy that is not necessarily a bad one, but we believe investors with sizable assets deserve a higher level of service: a customized portfolio constructed with individual securities.

It’s commonly said that “diversification is the only free lunch in investing.” In its most basic sense, diversification involves the accumulation of assets with negative or low correlations to reduce risk and increase potential return. At Tufton, we believe in diversification, but we’re not for over-diversification, or what famous fund manager Peter Lynch coined as “diworsification:”

The process of adding investments to one’s portfolio in such a way that the risk/return trade-off is worsened. Diworsification is investing in too many assets with similar correlations that will result in an averaging effect. It occurs where risk is at its lowest level and additional assets reduce potential portfolio gains, as well as the chances of outperforming a benchmark.

Consider that the average mutual fund owns about 100 different stocks. If you own 5 to 10 different mutual funds, do you know exactly what you own? An account invested in 10 different mutual funds may own over 1,000 different securities, and you may even hold the same stocks in different funds. Moreover, the fund likely charges a management fee on top of the fee paid to the financial advisor playing “quarterback” and picking the funds. If an investor wants this type of broad diversification, why not just purchase an index fund? It would be much cheaper!

At Tufton, we believe that an equity portfolio made up of 30 to 50 stocks is a sweet spot where portfolio managers can limit volatility stemming from each security (company-specific risk) and still produce alpha in an account.

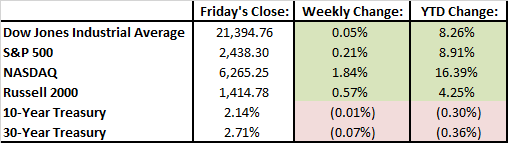

Last Week’s Highlights:

Stocks had a strong week as investors remain optimistic that improving economic statistics and corporate earnings will continue to gain positive momentum. Even though it was a strong week overall, individual sectors of the market did not all move higher. Energy and financial stocks declined last week, while telecom shares led the market higher.

On Friday, the May jobs report showed that the U.S. added only 138,000 jobs in May. The disappointing number did little to upset investors though, and stocks reached all-time highs on Friday. Some investors believe that the disappointing number will persuade the Federal Reserve to hold off on increasing interest rates later this month. Thus, the anemic number may actually have been a positive for equities. Since 2010, the U.S. economy has added 16 million jobs and the unemployment rate currently sits at 4.3%.

Looking Ahead:

There are numerous important events that will test the stock market this week.

The following economic data will be released this week:

- Monday: non-farm productivity, unit labor costs, ISM non-manufacturing data, factory orders and durable goods.

- Tuesday: labor turnover survey results and job openings

- Wednesday: consumer credit figures

- Thursday: results from the quarterly services survey.

- Friday: wholesale inventory numbers.

On Tuesday, the Business Roundtable (an association of chief executive officers from America’s leading companies) will release its 2017 CEO Economic Outlook Survey. The survey should indicate what companies are expecting in regards to sales, hiring, and capital spending.

On Thursday, the European Central bank will issue its latest statements on monetary policy. On top of that announcement, Britain will be holding elections. An upset of conservative Prime Minister Teresa May would certainly upset Brexit plans.

It will also be a busy week in Washington. Congress is expected to vote on the Financial Choice Act, which is a plan to roll back banking industry reforms that were made after the Great Recession. On Thursday, former FBI director James Comey will testify on allegations that President Trump’s campaign had improper contact with Russian officials.