The Weekly View (6/5/17)

What’s On Our Minds:

At Tufton, we often bring in new accounts holding numerous mutual funds. It’s likely that the client’s previous advisor was ‘filling the buckets” by picking what they believed were the best funds for each category. It’s a common strategy that is not necessarily a bad one, but we believe investors with sizable assets deserve a higher level of service: a customized portfolio constructed with individual securities.

It’s commonly said that “diversification is the only free lunch in investing.” In its most basic sense, diversification involves the accumulation of assets with negative or low correlations to reduce risk and increase potential return. At Tufton, we believe in diversification, but we’re not for over-diversification, or what famous fund manager Peter Lynch coined as “diworsification:”

The process of adding investments to one’s portfolio in such a way that the risk/return trade-off is worsened. Diworsification is investing in too many assets with similar correlations that will result in an averaging effect. It occurs where risk is at its lowest level and additional assets reduce potential portfolio gains, as well as the chances of outperforming a benchmark.

Consider that the average mutual fund owns about 100 different stocks. If you own 5 to 10 different mutual funds, do you know exactly what you own? An account invested in 10 different mutual funds may own over 1,000 different securities, and you may even hold the same stocks in different funds. Moreover, the fund likely charges a management fee on top of the fee paid to the financial advisor playing “quarterback” and picking the funds. If an investor wants this type of broad diversification, why not just purchase an index fund? It would be much cheaper!

At Tufton, we believe that an equity portfolio made up of 30 to 50 stocks is a sweet spot where portfolio managers can limit volatility stemming from each security (company-specific risk) and still produce alpha in an account.

Last Week’s Highlights:

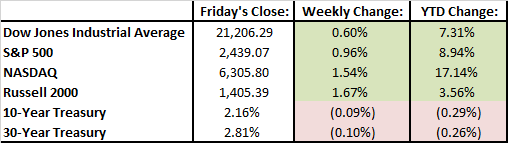

Stocks had a strong week as investors remain optimistic that improving economic statistics and corporate earnings will continue to gain positive momentum. Even though it was a strong week overall, individual sectors of the market did not all move higher. Energy and financial stocks declined last week, while telecom shares led the market higher.

On Friday, the May jobs report showed that the U.S. added only 138,000 jobs in May. The disappointing number did little to upset investors though, and stocks reached all-time highs on Friday. Some investors believe that the disappointing number will persuade the Federal Reserve to hold off on increasing interest rates later this month. Thus, the anemic number may actually have been a positive for equities. Since 2010, the U.S. economy has added 16 million jobs and the unemployment rate currently sits at 4.3%.

Looking Ahead:

There are numerous important events that will test the stock market this week.

The following economic data will be released this week:

- Monday: non-farm productivity, unit labor costs, ISM non-manufacturing data, factory orders and durable goods.

- Tuesday: labor turnover survey results and job openings

- Wednesday: consumer credit figures

- Thursday: results from the quarterly services survey.

- Friday: wholesale inventory numbers.

On Tuesday, the Business Roundtable (an association of chief executive officers from America’s leading companies) will release its 2017 CEO Economic Outlook Survey. The survey should indicate what companies are expecting in regards to sales, hiring, and capital spending.

On Thursday, the European Central bank will issue its latest statements on monetary policy. On top of that announcement, Britain will be holding elections. An upset of conservative Prime Minister Teresa May would certainly upset Brexit plans.

It will also be a busy week in Washington. Congress is expected to vote on the Financial Choice Act, which is a plan to roll back banking industry reforms that were made after the Great Recession. On Thursday, former FBI director James Comey will testify on allegations that President Trump’s campaign had improper contact with Russian officials.