The Weekly View (4/11/16 – 4/15/16)

What’s On Our Minds:

Over the weekend, some of the world’s largest oil producers met at the center of the Middle East in Doha, Qatar to discuss a potential production “freeze” from each participant. Going into the weekend, signs of the freeze deal collapsing began as the oil representative from Iran decided not to attend. Late Sunday afternoon, it was announced that the freeze deal had in fact collapsed as the Saudi Arabian oil ministers got up from the table apparently stating that they would not freeze unless their political rival Iran agreed to take the same actions.

The oil price crash began in mid-2014 when Saudi Arabia refused to cut production as oil prices declined. This coincided with US Shale Oil production rising to a record 9.6 million barrels of production per day. Many speculated that the oil kingdom’s refusal to cut was to regain market share and put the growing US shale companies out of business. Others speculated that the Saudis took action to prevent rival Iran from funding their own operations and nuclear ambitions. Like Saudi Arabia, much of Iran’s income is derived from oil sales.

Now, the ladder theory appears to be evident. Since the lifting of federal and international sanctions last year, Iran has ramped oil production by 600,000 barrels per day and continues to develop for further production. A future production freeze or even cut among large producers is still not entirely out of the question. However, without Iran’s cooperation, expect the soap opera to continue…

Last Week’s Highlights:

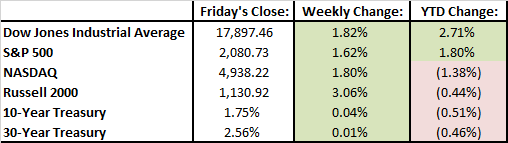

Last week, the S&P 500 rose 1.62% while the Dow rose 1.82%. Financial stocks helped drive the major averages higher as the big banks reported better than expected earnings. JPMorgan Chase, the largest US Bank in terms of assets, has stated that even if the Federal Reserve does not increase interest rate, they can still expect to grow their net interest income by $2 billion – an impressive feat for any financial institution in a low interest rate environment.

Investors also received some good news out of China. The world’s second largest economy reportedly grew 6.7% in the first quarter. This was slightly down from the 6.8% increase in the fourth quarter, but still a welcoming relief to investors as growth in China has recently been a concern.

Looking Ahead:

Looking forward to this week, more first quarter earnings reports will be on the docket. After the bell on Monday, technology companies Netflix and IBM will report. Subsequently to being a “high flyer” in 2015, Netflix is down 4.3% this year – under performing the market by 6.5%. On Tuesday morning, investors will hear about earnings and future plans from internet company Yahoo!. The company is shopping it’s core search business to potential bidders as a breakup of the company appears to be imminent. The week will finish off with results from industrial bellwethers Caterpillar and General Electric. As Jim Hardesty would say, “Pushing dirt is good business.” Let’s hope we hear the same from Caterpillar.