The Weekly View (4/18/16 – 4/22/16)

What’s On Our Minds:

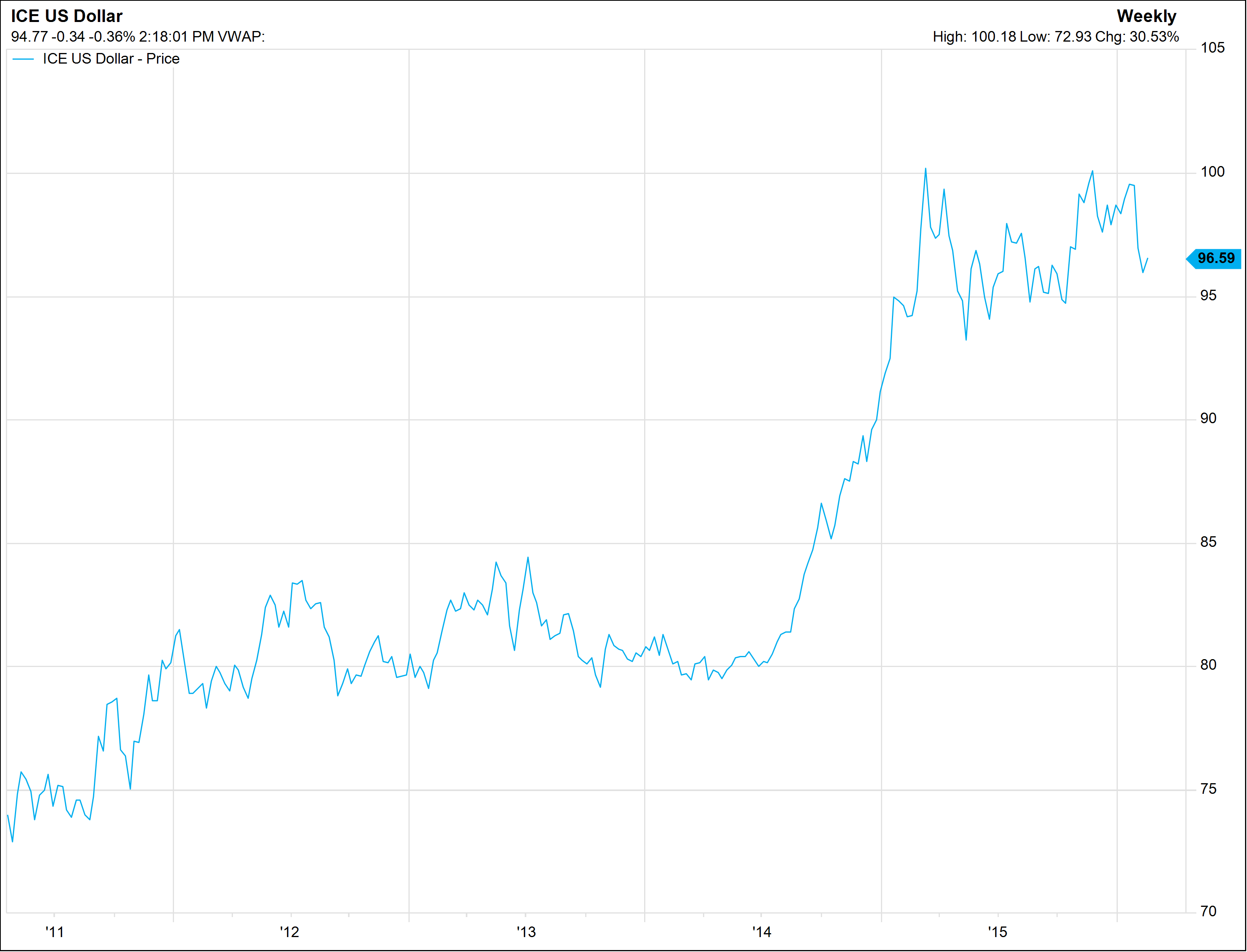

Is a strong dollar a good thing? It’s a bit of a mixed bag. The dollar’s strength in recent years has been good for the American consumer, but it’s a double edged sword in that it is a disadvantage for American companies who export products, services or equipment abroad.

The strength of the US dollar can be attributed to the strength of our economy. The most obvious benefit of a strong dollar is that your dollars go further abroad or when purchasing imported goods. In theory, a trip to Europe or a car imported from abroad should be more affordable for US consumers in the current environment. Furthermore, because imported goods are cheaper in the US, domestic products will have to come down in price to remain competitive. Thus, the consumer’s dollars go further. But producers and manufacturers suffer the opposite effect.

US companies operating abroad are paid in foreign currency. When they convert this revenue back into dollars, their profits are worth less at home. Also, exported US products are more expensive for foreign consumers, which can curb demand for US exports. Manufacturing companies’ revenues and profitability are hit especially hard from a strong greenback. On the other hand, companies that import equipment or goods from abroad and do business at home stand to benefit from a strong dollar.

All in all, strength in the US dollar is great for U.S. shoppers and travelers, but it hurts big U.S. companies operating abroad. If these companies’ profits remain low for long, they will be forced to lay off employees, and then it isn’t good for the consumer, either.

Last Week’s Highlights:

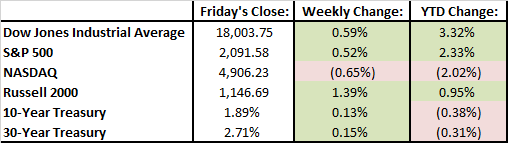

The week started off strong on Monday as the Dow rose above 18,000 for the first time since last July. Markets witnessed a pullback as the week progressed while a heap of earnings announcements were released. In tech, Alphabet (Google), Netflix, and Microsoft reported earnings that disappointed investors. Caterpillar, which is often viewed as bellwether of global manufacturing, reported disappointing earnings that were weaker than analysts’ forecasts. Baltimore based Under Armour beat earnings expectations as the company’s footwear revenue jumped 64%. McDonald’s gamble to serve breakfast all day has paid off as same store sales increased 5.4% in the first quarter.

Looking Ahead:

Earnings season is in full swing again this week with notable releases from Proctor and Gamble, Capital One, and Apple on Tuesday and Chevron and Exxon on Friday. Federal Reserve policymakers are meeting on Tuesday and Wednesday where they will announce interest rate policy moving forward. The market is currently pricing in a 0% chance of a rate hike at this meeting. Weakness in retail sales, concern about China’s economy and weak international trade are factors the will likely keep the Fed on the fence. The Fed will release first quarter GDP numbers on Thursday following their meeting. Locally, Democrat and Republican primaries are held in Maryland on Tuesday. Baltimore City’s Democratic primary race for mayor will be particularly interesting.