The Weekly View (4/25/16 – 4/29/16)

What’s On Our Minds:

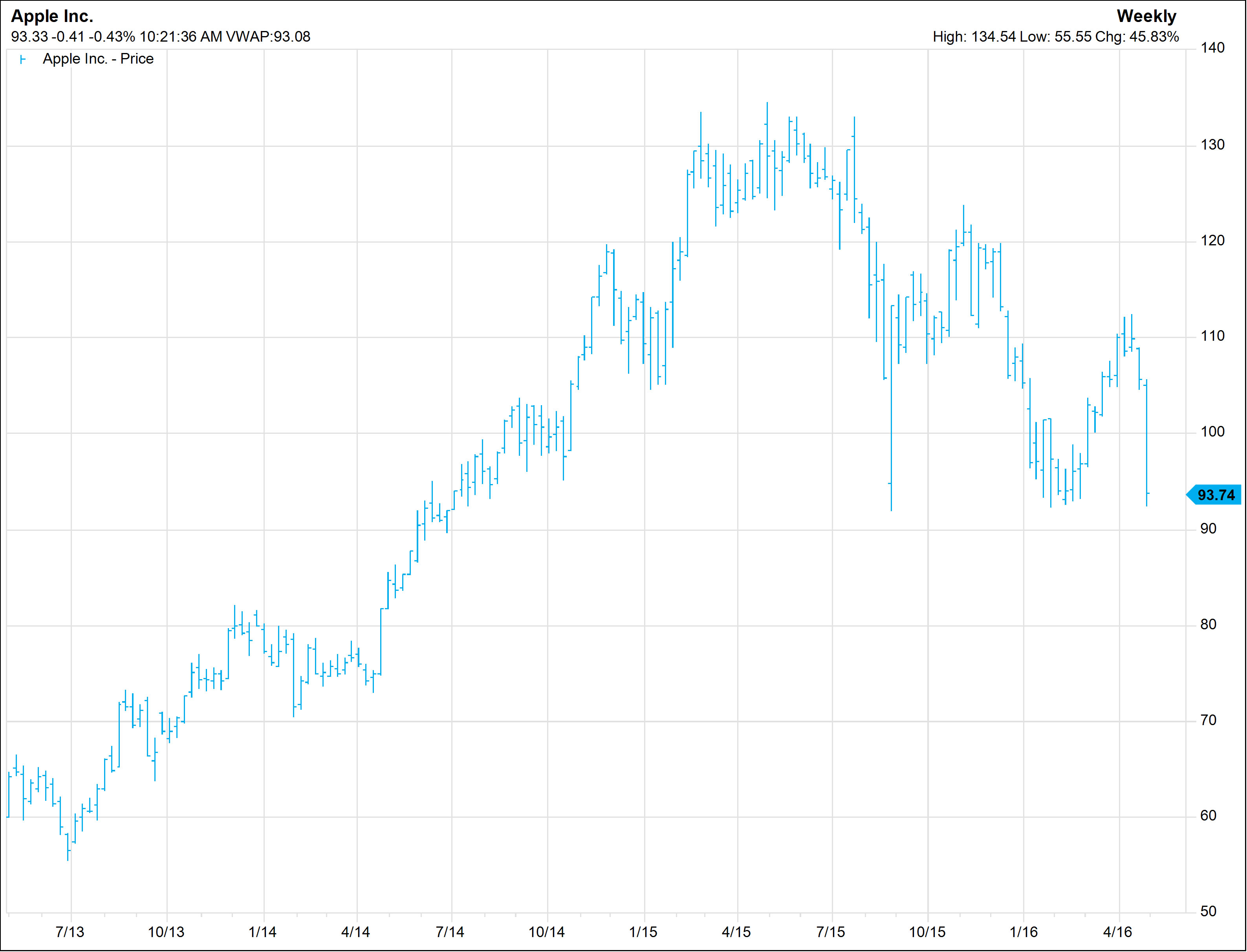

Apple, the world’s largest company by market value, reported disappointing earnings last Tuesday which caused it to fall 11% over the week to $93.74 per share. The company’s quarterly revenue dropped 13% year-over-year to $50.6 billion. This decline goes to show that not everyone can overcome strict government regulations in China. (The Chinese government banned Apple’s iBooks and iTunes Movies sales last month.) Along with the earnings miss, activist investor, Carl Icahn, announced that he had sold his position in the company. The billionaire specified that he had grown concerned with Apple’s growth prospects in China. Last year, when he owned 53 million shares, Icahn was a huge proponent of owning the stock and even went as far as calling his position a “no-brainer”. Icahn estimates that his hedge fund made a $2 billion profit on the stock and he probably wanted to cash in on those big gains.

Last Week’s Highlights:

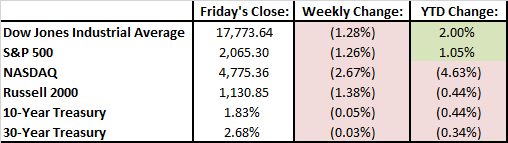

It was a tough week on Wall Street as the Dow Jones and S&P 500 both slipped 1.2%. The Federal Reserve met last week and announced that it had decided to hold off on raising interest rates, but did not give a clear answer as to whether or not they would make a move at their next meeting in June. The Bank of Japan decided that it would not pursue further stimulus. There were three big pharma deals announced last week. Abbot is planning a $30 billion takeover of St. Jude Medical, Sanodi’s plans on purchasing Medivation for $9.3 billion, and AbbVie is making a deal to acquire Stemcentrx for $5.8 billion.

Looking Ahead:

Economic data is heavy this week with manufacturing PMI coming out on Monday, Service Sector PMIs on Wednesday, Eurozone retail sales on Wednesday, and US employment numbers on Friday. The street is expecting that our economy gained 200,000 jobs in April which would be on track to continue the healthy additions we have seen over the last few months.