The Weekly View (4/1/19)

Last Week’s Highlights:

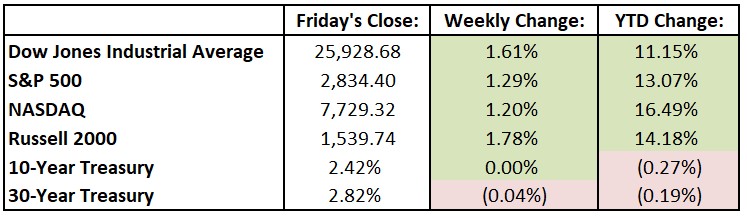

U.S. equities ended the week and the quarter on a high note. For the first quarter, the S&P 500 recorded its strongest quarterly performance in a decade, rising 13% and leaving the index just 3% from its all-time high. Much of this year’s market rally has been fueled by investor relief that central banks may be willing to back off of their interest rate-increase campaigns given slower global growth. Markets now see a rate cut as a possibility in 2019, a different view from when the year started with market expectations for at least one rate hike. For the past week, the Dow Jones Industrial Average (DJIA) rose 426.36 points, or 1.6%, to 25,928.68, while the S&P 500 advanced 1.3% to 2834.40. The tech-heavy NASDAQ was up 1.2%, closing at 7729.32. The yield curve continued to be on investors’ minds last week as it tried to straighten itself out – the 10-year Treasury closed Friday at 2.41% while three-month bills were 2.40%. The yield curve briefly inverted several weeks ago for the first time since 2007, raising investors’ concerns about the state of the economy. As a reminder, an inverted yield curve means that long-term Treasury yields (the 10-year note in this case) are lower than both the three-month and one-year yields. Such an inversion has been a reliable indicator of a looming recession. Last week also saw the IPO of Lyft (LYFT) – the new shares took off, resulting in a $22 billion market cap for the ride-hailing company.

Looking Ahead:

Monday is the first day of April (Rabbit, Rabbit!) and the first day of the second business quarter. It’s also April Fools’ Day, so please look out. The week starts with the release of retail sales data for February by the Census Bureau – economists forecast a 0.3% rise after a 0.2% bump in January. Excluding autos, retail sales are seen gaining 0.3% after rising 0.9% in January. On Tuesday, earnings results will be released by GameStop (GME), Walgreens Boots Alliance (WBA) and Lamb Weston Holdings (LW). Dow begins regular trading on the New York Stock Exchange under the ticker symbol DOW after a split from DowDuPont. The Census Bureau releases its Durable Goods report for February – economists forecast a 0.5% decline, down from January’s gain of 0.3%. Tuesday is World Autism Awareness Day. On Wednesday, ADP releases its National Employment Report for March – consensus estimates call for a gain of 170,000 in private-sector employment after an increase of 183,000 in February. Earnings will be out from Acuity Brands (AYI) and Signet Jewelers (SIG). Constellation Brands (STZ) hosts a conference call to discuss financial results on Thursday. On Friday, the Bureau of Labor Statistics releases its Employment Report for March – consensus estimates are for a 175,000 increase in nonfarm payrolls after a small gain of 20,000 in February. The unemployment rate is expected to remain stable at 3.8%.

The Tufton Capital Team hopes that you have a wonderful week!