The Weekly View (4/8/19)

Last Week’s Highlights:

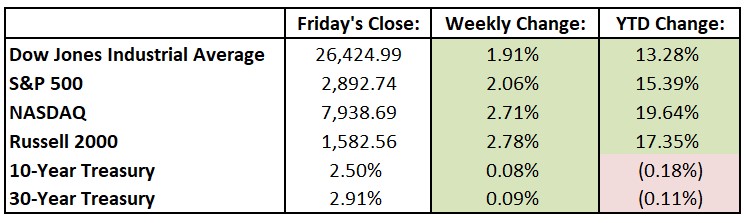

Global equities were strong last week, with the S&P 500 finishing higher each day (capping off seven straight trading sessions in the green for the index). International stocks, especially those in emerging markets, had a solid five days, and cyclical sectors outperformed the defensive ones. Positive economic results from China, the world’s second-largest economy, was the main catalyst for the global rally. The China March Purchasing Managers’ Index (PMI) showed a return to expansion after over six months of mild contraction, signaling that the tax cuts and other policies may be producing faster growth than previously expected. Domestically, the March jobs report (196,000 new jobs) showed that hiring rebounded last month following a soft reading in February. For the past week, the Dow Jones Industrial Average (DJIA) rose 496.31 points, or 1.91%, to 26,424.99, while the S&P 500 advanced 2.06% to 2892.74. The tech-heavy NASDAQ was up 2.71%, closing at 7938.69. Chinese officials came to Washington last week for the sixth round of trade talks. President Trump indicated that discussions are going well and that both sides are aiming for a deal next month. Across the pond, despite a hard Brexit looming for England on April 12th, the House of Commons continued to vote down plans presented by Prime Minister Theresa May.

Looking Ahead:

The business week begins with Synopsys (SNPS) holding its annual meeting of stockholders in Sunnyvale, California. The Final Four hoops championship game is Monday night, with Virginia playing Texas Tech for the NCAA tournament title. On Tuesday, The Bureau of Labor Statistics releases its Job Openings and Labor Turnover Survey for February – the consensus estimate is for 7.54 million job openings, in line with January’s print. Bank of New York Mellon (BK) hosts its annual shareholders meeting. On Wednesday, Delta Air Lines (DAL) and Bed Bath & Beyond (BBBY) discuss their quarterly earnings results. The Treasury Department releases the U.S. budget statement for March – economists forecast a $179 billion deficit after a $234 billion shortfall in February. Wednesday is National Siblings Day. Walt Disney (DIS) webcasts its investor day on Thursday. The BLS releases its producer price index for March – consensus estimates call for a 1.8% year-on-year rise after a 1.9% gain in February. The Masters golf tournament tees off in Augusta, Georgia. First Republic Bank (FRC) and PNC Financial Services Group (PNC) report earnings on Friday. Bristol-Myers Squibb (BMY) holds a special shareholder meeting to vote on merging with Celgene (CELG). The deal is expected to win approval after two leading proxy advisory firms backed the combination.

The Tufton Capital Team hopes that you have a wonderful week!