The Weekly View (8/19/19)

Last Week’s Highlights:

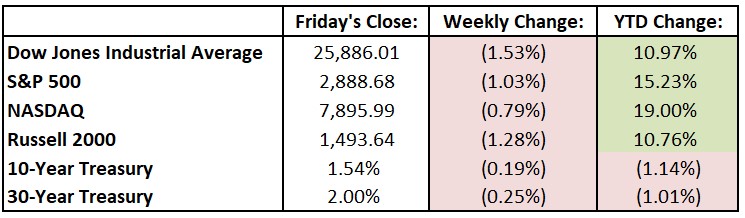

Stocks swung wildly as the yield curve inverted last week. The Dow Jones Industrial Average (DJIA) bounced back from Wednesday’s 800-point selloff with two consecutive sessions of solid gains and a modest loss for the week. Investors’ biggest worry concerned tumbling bond yields, as the 10-year Treasury yield traded as low as 1.47% on Thursday, its lowest since 2016. The 30-year yield dropped below 2% for the first time ever. With this activity, the 10-year briefly fell below that of the two-year (the yield curve inversion that has dominated headlines), a move that has historically foreshadowed a recession. For the week, the DJIA fell 401.43 points, or 1.5%, to 25,886.01, while the S&P 500 declined 1.0% to 2888.68. The tech-heavy NASDAQ dropped 0.8%, closing at 7895.99. All three indexes fell for the third consecutive week. While the yield curve was on the top of traders’ minds, President Trump was also moving markets as the U.S.-China trade war continued. Stocks rallied earlier in the week after Trump said that the U.S. would delay tariffs on some $156 billion in Chinese goods – mostly consumer items, including smartphones, laptops and toys. “We’re doing this for the Christmas season, just in case some of the tariffs would have an impact on U.S. consumers,” the president told reporters. Stock market futures rallied Sunday night on positive comments from the White House regarding the economy, and U.S. markets are on track to open higher Monday morning.

Looking Ahead:

With second-quarter earnings season largely in the books, the focus for the stock and bond markets will be on the Federal Reserve this week. Chairman Jerome Powell is scheduled to speak at the central bank’s annual retreat in Jackson Hole, Wyoming. On Monday, Baidu (BIDU), BHP Group (BHP) and Estee Lauder (EL) report their financial results. Home Depot (HD), Toll Brothers (TOL) and TJX Companies (TJX) announce earnings on Tuesday. Microchip Technology (MCHP) holds its annual shareholder meeting in Chandler, Arizona. Look for financial reports from Analog Devices (ADI), Nordstrom (JWN) and Target (TGT) on Wednesday. The Federal Open Market Committee releases minutes from its monetary policy meeting at the end of July. The National Association of Realtors releases home sales data for July – economists forecast a 2.5% rise in existing home sales, compared with a 1.7% decline in June. On Thursday, Hormel Foods (HRL), Salesforce.com (CRM) and Gap (GPS) report earnings. The Conference Board releases its Leading Economic Index for July – the consensus estimate calls for a 0.3% gain after declining 0.3% in June. Foot Locker (FL) releases second quarter fiscal 2020 earnings on Friday. Chairman Powell’s speech in Jackson Hole also takes place that day. The three-day G-7 Summit convenes on Saturday in Biarritz, France. The agenda is geared toward tacking issues of inequality.

The Tufton Capital Team hopes that you have a wonderful week!