What’s On Our Minds:

While much of the media’s attention lately has been focused on the possibility of a looming trade war, recent movements in the media space have set the stage for a battle royale in the industry. Headlines have been coming fast and furious these past few weeks, with the regulatory approval of AT&T’s acquisition of Time Warner and the escalating bidding war between Disney and Comcast to decide the fate of Twenty-First Century Fox’s entertainment assets. These deals have the potential to be the first dominoes to fall in an industry-wide restructuring of how content is created, distributed, and consumed. We think now is as good a time as any to break down what this means for the consumer, the companies involved, and the changing media landscape as a whole.

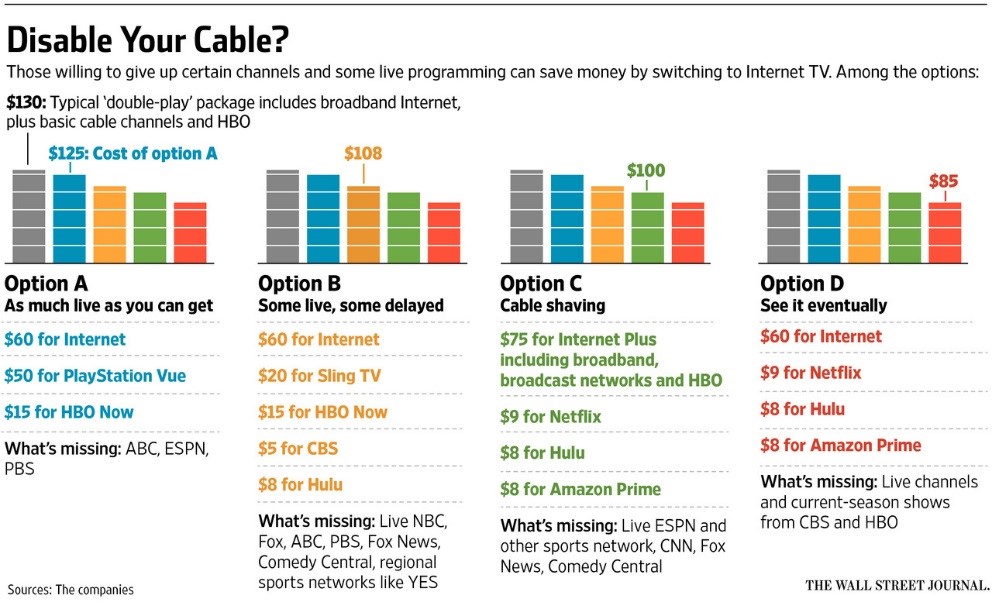

As you may know, cable and satellite television companies have seen a decline in pay-for-TV subscriptions in recent years. This is a result of what is known as the “cord-cutting” phenomenon. Much of this cord-cutting has been done in concert with the rise of Netflix and other direct-to-consumer over-the-top streaming services, which distribute streaming media through the internet. These platforms give viewers more choice in deciding what content they want to pay for and how, when, and where they consume it. However, much of Netflix’s incredible growth, to the point of being included in the prestigious FAANG (Facebook, Apple, Amazon, Netflix, and Google) group of tech stocks, has come at the expense of the very companies it now threatens to overthrow in the media landscape.

For years, Netflix relied on licensing content from media heavyweights, such as Disney, Fox, Comcast, and Time Warner, to build up its library and develop a viewer base. At the time, these industry titans were happy to sit back and take in the extra revenues provided to them by Netflix at little to no cost. Only recently have they realized that in doing so, they created their worst nightmare. However, traditional media companies are starting to strike back, with a vengeance.

The recent transactions involving Disney, Fox, AT&T, and Time Warner offer a glimpse into the future with regards to how these companies plan to compete with the 800-pound streaming gorilla of Netflix, as well as the direction media may go over the next few years. The main reasoning for these acquisitions was content; to attract viewers, you’ve got to have something worth watching. As Disney and AT&T bolster their creative ammunition with new studios and intellectual property, both companies also plan on pulling their content licenses from Netflix by the end of 2018 in hopes of weakening the behemoth by limiting its content selection to mostly original productions. This combined strategy will, ideally, drive consumers to their own over-the-top streaming services.

Last week, Disney successfully fended off Comcast’s best effort to buy Twenty-First Century Fox. The Fox acquisition allows them to combine their already-prolific library with box office heavyweights, such as Avatar and X-Men. After rolling out its first over-the-top platform in early 2018 with ESPN+, Disney plans to unveil another streaming service in early 2019 to directly compete with Netflix. Disney is counting on Fox’s assets strengthening its content offerings to the point of making its service indispensable. Furthermore, the 30% stake in Hulu Disney receives from Fox gives it a 60% controlling interest in the platform, affording them control over another established streaming service. With Hulu and its own proprietary over-the-top services in its back pocket, Disney can attack Netflix from multiple angles.

AT&T, on the other hand, has even grander plans for dominating the market. The company’s recent acquisition of Time Warner, combined with its prior acquisition of DirecTV, has effectively given the company a completely vertical supply chain in the industry. It can now produce its own content through Time Warner, distribute the content via DirecTV and its streaming service DirecTV Now, and provide high-speed internet service for its consumers to access the content. Arguably more important, however, is the fact that as the third largest internet provider in the country, AT&T will be getting its slice of the pie even if consumers choose not to use its distribution services. With regards to over-the-top services, a rising tide lifts all of AT&T’s boats, as its competitors in the streaming market are dependent on high-speed internet to provide their customers with a high-quality experience.

Despite Netflix’s rapid ascent in the industry, these recent transactions indicate that legacy media companies are not going anywhere anytime soon. In this sense, necessity is the mother of innovation, as traditional industry bulwarks have shown the ability to evolve in response to trends in technology. The only options to respond to a disruption on this scale are adapt or die, and Disney and AT&T have loudly declared they aren’t going anywhere any time soon. But, don’t expect Netflix to stop fighting back now as the company is putting on a full court press in the content game with recently-announced plans to invest $8 billion this year in original programming. However it shakes out in the end, the way we consume media is primed to undergo remarkable changes in the coming years. One thing’s for sure: this industry will be one to watch moving forward.

Last Week’s Highlights:

OPEC ministers met last Friday and agreed to raise oil output by an effective 600,000 barrels per day in an effort to curb rising oil prices. A Supreme Court ruling gave states the authority to require e-commerce companies to collect sales taxes on online purchases, marking a major victory for brick-and-mortar stores and states themselves. This reversed a 1992 ruling that required retailers to collect the tax only if they had a physical presence in the state. The nation’s biggest banks passed the first of the Fed’s annual stress tests, indicating that the banks have enough capital to survive a severe downturn in the economy, including recession, cratering housing prices, and double-digit unemployment.

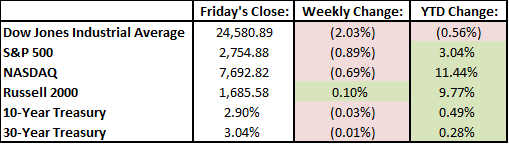

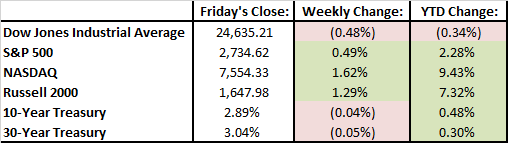

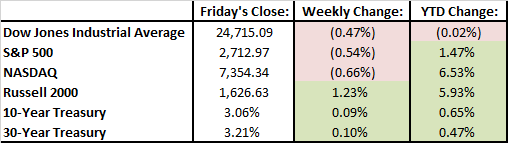

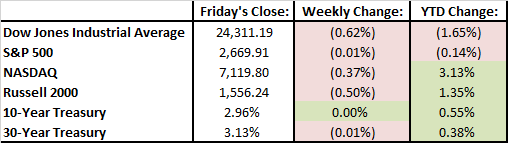

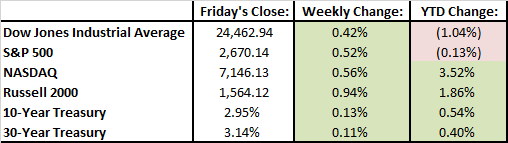

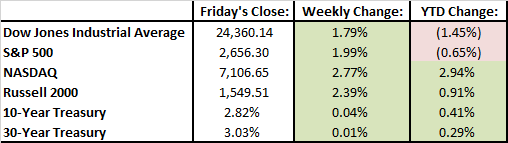

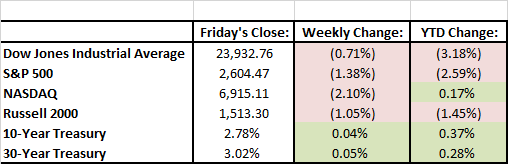

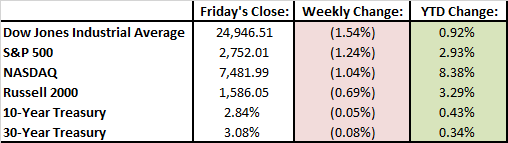

Most indices finished slightly down for the week, with the Dow taking the biggest hit. The Industrial Average index had a rough week, announcing it was dropping GE and adding Walgreens, and has now moved into negative territory for the year. Government bonds stayed relatively stable, hovering around 3%.

Looking Ahead:

The consumer confidence report for June is set to be released next week, measuring the degree of optimism consumers have in the economy through their saving and spending activities. A looming trade war has the potential to escalate due to the President’s threats to increase tariffs to $200 billion of Chinese products. The second quarter of the 2018 calendar year ends next week, setting the stage for earnings reports in the coming weeks.

What’s On Our Minds:

The weather has been getting nicer and the days have been getting longer, but here at Tufton we have been ramping up our research initiatives with the help of our new summer interns. While many college students are spending their summers at the beach or enjoying vacations, our group has been hard at work supporting the research associates and portfolio managers with the information and analysis they need to stay ahead of the markets.

At Tufton, we are proud to conduct all equity research in-house. To help with this sizeable task, each summer, we hire talented college students with a focus and interest in finance to give us some extra horsepower. These interns run valuations, research industry trends, write reports, and bring fresh ideas to our Investment Committee. We believe our internship program to be mutually beneficial for both the firm and the students, and have a strong track record of helping our interns gain the experience they need to go on to get competitive jobs in the financial services industry all over the country.

This year we are excited to introduce our two interns joining us for the summer:.

Jackson Gibb is joining us from Stevenson University where he is majoring in Business Administration with a concentration in Finance. Jackson is the Treasurer of the Financial Management Association and a project manager for the school’s Enactus chapter.

Rick Roebuck is joining us from University of Richmond where he attends the E. Claiborne Robins School of Business and is majoring in Business Administration with concentrations in Finance and Accounting. Rick serves a member of the University of Richmond FinTech Club and the Entrepreneurial Club.

Last Week’s Highlights:

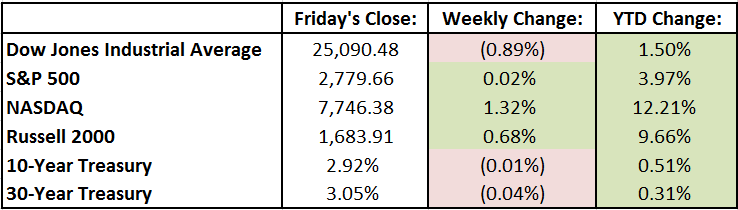

Once again, markets shrugged off trade war noise after an initial dip in response to news of tariffs being placed on Chinese imports. China’s response brought markets even lower, but stocks rallied on Friday afternoon to bring the major indices into positive territory for the week. Courts rebuffed the Department of Justice, definitively approving the AT&T-Time Warner merger. This has set the stage for a bidding war between Comcast and Disney for Fox’s entertainment assets in the rapidly-changing media space.

Looking Ahead:

The World Cup draws global attention to Russia, as underdogs like Mexico and Iceland look to make spirited runs on the largest stage in soccer. The United States Men’s National Team failed to make the tournament this year, but there is no shortage of excitement in the tournament so far. Later in the week, the U.S. is set to meet with OPEC to discuss oil production in the Middle East. The outcome of this meeting will have lasting implications for the price of oil through the rest of the summer.

What’s On Our Minds:

With the summer months kicking off, you may be itching to jump back into the real estate game by buying a second home or wishing your family had a beach or lake house. While interest rates are still low, it might make sense to buy a house to use as a vacation home, a rental property, or a home for retirement in a state with lower tax rates. The process of buying a second home is similar to the process you already undertook when you bought your first home, but the mortgage and tax implications will be different. Below we will discuss some of these differences.

Financing the House

At this point in your life, you may have more cash to put toward a down payment or may even be able to buy a second home outright. However, while rates are still historically low, it may make sense to finance a portion of the home. That being said, mortgages for second homes are often more difficult to qualify for and require stricter terms:

- Interest rates:Expect your interest rate to be half a point to one point higher than it would be if you were buying a principle residence.

- Down payment:For a principle residence, most mortgage lenders prefer 20 percent down, but don’t require it. For a second home, plan to put 20 to 25 percent down in order to qualify for financing.

- Credit score:Typically, you must have a credit score of at least 730 or 740 to get the best loan terms. Some lenders will require an even higher score for second home mortgage applicants.

- Debt ratio:The debt ratio (the ratio of your debt payments to your monthly income) that your second mortgage lender requires will probably be the same as for your first mortgage—typically no higher than 36 percent. However, when calculating the ratio for your second mortgage, you’ll have to include house payments, property taxes and insurance for two houses instead of just one.

Tax Implications

Your second home expenses will include additional property taxes. If you’re renting it out, you also need to pay income tax on your rent earnings, but you could be eligible to deduct operating costs. The sale of a second home is also subject to different capital gains tax rules than a primary residence.

- Property taxes: The taxes you pay on either of your houses will depend on where they’re located, how much land you own, and how many improvements the house has had. If you buy a run-down house with plans to make improvements, expect your property tax bill to increase. Similarly, if you buy a house that has seen major improvements since the last tax assessment, be prepared for it to increase after you buy it. You can write off your property taxes as a tax deduction, just as you can with a first home.

- Income taxes: If you rent your house out for more than 14 days and use it for personal reasons for less than 14 days of the year, you must pay income tax on your rent earnings. However, when you claim rental income on your taxes, you can also deduct rental expenses you incur from maintaining the property, finding tenants, etc.

- Interest deduction: You can also deduct your mortgage interest payments on your second house if you itemize your tax return. If the total value of both mortgages is below $1 million, you can deduct your interest in full.

- Capital gains taxes: When you sell your primary residence, you won’t be taxed on capital gains up to $500,000 (if you’re married) or $250,000 (if you’re single). With a second home, those limits don’t apply. Instead, you’ll be taxed on the entirety of your capital gains. To avoid paying high capital gains taxes, you must have lived in your home for at least two years before selling. If you’re selling a house that you used as a rental property or vacation home, consider making it your primary residence for two years before selling to reap the tax benefits.

While owning a second home comes with added expenses, the tax benefits provided by taking on a mortgage and potential appreciation of the home’s value can make it a sound investment strategy.

Last Week’s Highlights:

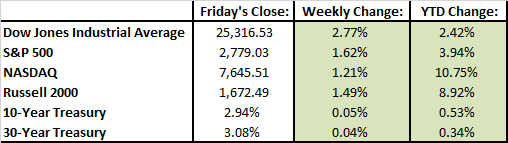

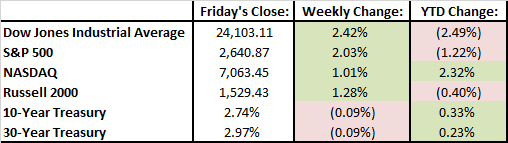

After months of escalation, it seems the markets have become desensitized to headline volatility with regards to tariffs and trade wars. Although the G7 Summit ended on shaky ground with threats flying back and forth between world leaders, markets finished the week in the green. Every major index posted strong gains, with the beleaguered Consumer Staples sector leading the way. The Dow Jones was up nearly 3% last week! From unemployment data released last week we learned that, for the first time in 20 years, there are more jobs available than people looking for work in the United States, giving investors plenty of reasons to be optimistic about the economy.

Looking Ahead:

All eyes are on North Korea, as President Trump is scheduled to meet with Kim Jong-Un to discuss denuclearization in Singapore. The Fed is set to raise interest rates on Wednesday, which will increase the cost of borrowing across the board for consumers, banks, and businesses. The E3 Expo, the premier videogame conference in Los Angeles, begins on Tuesday with implications for technology, consumer electronics, and media sectors. The Bureau of Labor Statistics will release their report on the CPI Tuesday morning, with the Retail sales report following on Thursday to give us a good picture of consumer sentiment.

What’s On Our Minds:

While Tufton Capital is focused on asset management and not legal or tax advice, we would like to take this opportunity to touch on some of the benefits of using a Donor-Advised Fund (DAF) to fulfill your philanthropic goals. The way we see it, if you are going donate to charities, why not make your good will as tax efficient as possible? In that light, donor advised funds have become increasingly popular under this year’s the new tax code.

Long before the contents of the 2017 tax overhaul were finalized, and in the context of a booming stock market, most tax advisors understood that DAFs would likely continue to grow significantly moving forward.

Charitable “clumping” has become popular under the new code, which allows taxpayers to claim a “standard deduction” that discourages itemized deductions. Given the challenge of having enough itemized deductions to exceed the standard deduction, it has become beneficial to lump together numerous years of donations into one tax year in order to take one larger deduction upfront. Furthermore, donor-advised funds can be funded with appreciated securities, which allows folks to avoid paying capital gains tax upon liquidating shares, while securities used to fund the venture can remain invested. In short, by clumping the charitable contributions together, donations that otherwise would have been itemized deductions that fell below the threshold for the standard deduction are at least partially above the threshold, thus providing an immediate tax benefit that simply would not have been received at all if the contributions had been made annually.

Along with the tax benefits, donor-advised funds are simpler to use than a family foundation, and require much less paperwork and bureaucratic maintenance.

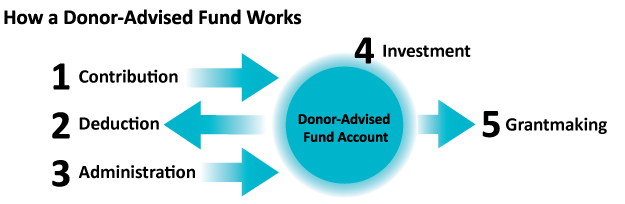

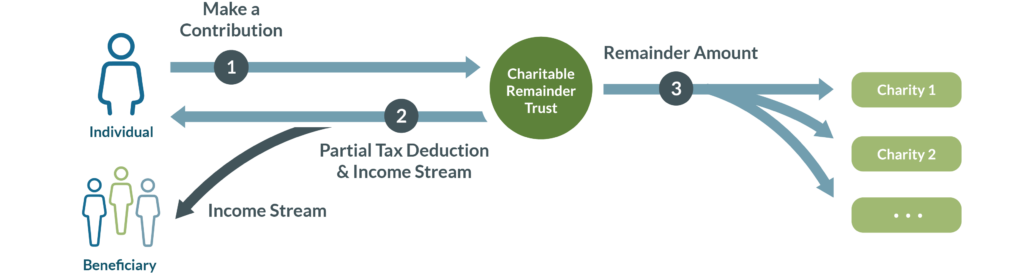

How a Donor-Advised Fund Works

1. You make an irrevocable contribution of personal assets.

2. You immediately receive the maximum tax deduction that the IRS allows.

3. You name your donor-advised fund account, advisors, and any successors or charitable beneficiaries.

4. Your contribution is placed into a donor-advised fund account where it can be invested and grow.

Last Week’s Highlights:

Political turmoil in Italy and continued uncertainty over trade tariffs made for a rocky week in the markets, but most indices finished strong. The May jobs report showed the lowest level of unemployment since 2000 at 3.8%. This beat most expectations, and paired with decent wage growth paint a strong picture of the overall economy. 10-Year Treasury prices were down slightly, as money began to flow back into equities due to increased confidence in the market.

Looking Ahead:

With fewer earnings reports to scrutinize, focus will turn to economic indicators and political events. Further labor data will be released throughout the week, and the consumer credit report is due to come out on Thursday. In the realm of politics, the G7 Summit begins on Friday where trade deals will be a hot topic.

What’s On Our Minds:

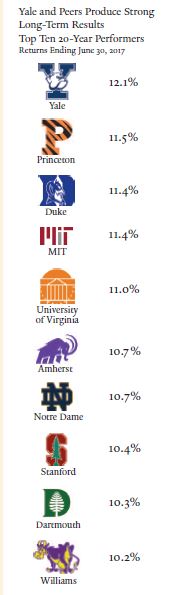

On Memorial Day, Yale University’s Men’s Lacrosse team took down Duke for the program’s first ever National Championship. While Yale may now be known for its strong lacrosse program, the school’s endowment fund has long been heralded as an investment powerhouse under the leadership of David Swensen, who has been the endowment fund manager at the school since 1985. While he underperformed the S&P 500 during their 2017 fiscal year, his long-term results remain in the top-tier of institutional investors. Over the past 20 years, Yale’s endowment has recorded annualized returns of 12.1%, and during that period the endowment fund grew from $5.8 billion to $27.2 billion. For the sake of comparison, the S&P 500 returned just 7.15% over that same period.

Swensen’s strategy has been so successful that numerous other endowment funds have followed suit and adopted his model. At Yale, Swensen plays “quarterback” where he allocates funds to various outside money managers that he believes can outperform. During his tenure, he has continuously increased Yale’s allocation towards alternative investments and hedge funds, or what he refers to as “absolute return” strategies. He is an avid supporter of hiring active managers and he believes their fees can be justified over the long term.

In last year’s annual letter, he wrote “Net performance matters. Strong active management has contributed to Yale’s outstanding absolute and relative performance. While passive investment strategies result in low fee payments, an index approach to managing the university’s endowment would shortchange Yale’s student, faculty, and staff now and for generations to come.” Swenson’s strong support for the active manager model is in stark contrast with Warren Buffet who believes most investors would be better off in an index fund.

It may seem tempting to try and mimic David Swensen’s strategy at Yale, but it’s important to remember that he has a few distinct advantages over individual investors, and unfortunately, it’s virtually impossible to copy his model. First, universities have a boundless time horizon, which means they can take much riskier investments than what would be prudent for an individual. Another consideration is that due to the size of endowments that utilize numerous complex strategies, they enjoy lower fees than even the wealthiest private investors. Lastly, universities don’t have to worry about Uncle Sam taking a piece of the pie. The tax free exemption is by far the biggest advantage that endowments have over everyday investors. With long term capital gains taxed at 15-20%, a school’s tax-free status makes a huge difference in their annual returns.

While it’s easy to get caught up in the notion that you might be able to beat the market over the short term, we suggest that our clients and friends take a note from Swensen and remain focused on the long term success of their investment portfolio. Yale’s endowment has underperformed in recent years but Swensen’s 20-year performance figures are extremely impressive.

Last Week’s Highlights:

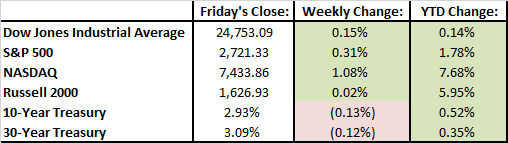

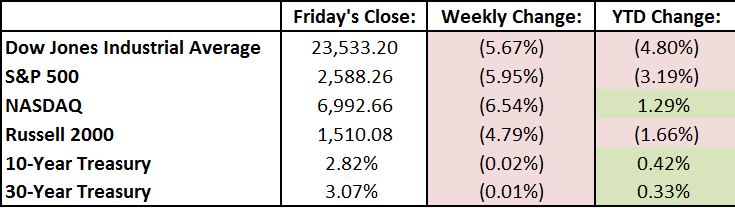

Stocks edged out slight gains last week. Stocks were up and down over the course of the week as both setbacks and developments were made in trade negotiations with China. Ongoing tensions with North Korea also weighed on investor sentiment last week. The Federal Reserve also came into play as it announced it planned to stay the course and gradually continue increasing interest rates.

Looking Ahead:

U.S. markets were closed on Monday in observance of Memorial Day. The Conference Board releases its index of consumer confidence for May on Tuesday and the Federal Reserve releases its beige book on economic conditions on Wednesday. The Federal Reserve will hold a meeting in Washington on Wednesday to discuss possibly changing the Volcker Rule, which could ease restrictions that ban proprietary trading by banks. U.S. nonfarm payrolls for May will be reported on Friday. Investors are expecting the unemployment rate to hold steady at 3.9%.

What’s On Our Minds:

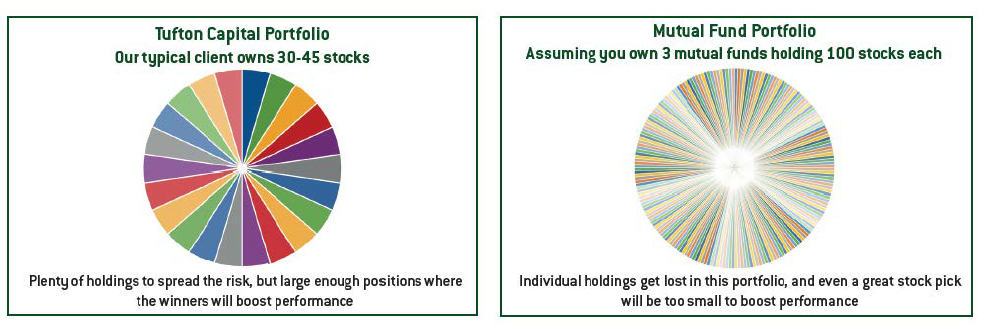

At Tufton Capital, we often bring in new accounts holding numerous mutual funds. It’s likely that the client’s previous advisor was “filling the buckets” by picking what they believed were the best funds for each category (large-cap, mid-cap, small-cap, international, etc.). It’s a common strategy that is not necessarily a bad one, but we believe investors with sizable assets deserve a higher level of service: a customized portfolio constructed with individual securities.

It’s commonly said that “diversification is the only free lunch in investing.” In its most basic sense, diversification involves the accumulation of assets that have negative or low correlations to reduce risk and increase potential return. At Tufton, we believe in diversification, but we’re not for over-diversification, or what famous fund manager Peter Lynch coined as “diworsification:”

The process of adding investments to one’s portfolio in such a way that the risk/return trade-off is worsened. Diworsification is investing in too many assets with similar correlations that will result in an averaging effect. It occurs where risk is at its lowest level and additional assets reduce potential portfolio gains, as well as the chances of outperforming a benchmark.

Consider that the average mutual fund owns about 100 different stocks. If you own 5 to 10 different mutual funds, do you know exactly what you own? An account invested in 10 different mutual funds may own over 1,000 different securities, and you may even hold the same stocks in different funds. Moreover, the fund likely charges a management fee on top of the fee paid to the financial advisor playing “quarterback” and picking the funds. If an investor wants this type of broad diversification, why not just purchase an index fund? It would be much cheaper!

At Tufton, we believe that an equity portfolio made up of 30 to 45 stocks is a sweet spot where portfolio managers can limit volatility stemming from each security (company-specific risk) and still produce alpha in an account.

Last Week’s Highlights:

Stocks declined a bit last week as investors shifted their attention away from earnings and towards to interest rates, macroeconomic developments and global politics. The yield on the 10-year Treasury Note had a high during the week of 3.115%, after closing the previous week at 2.971%. Market pundits have been fixated on this 3% number as some believe investors may favor these bonds over stocks. On the other hand, borrowing costs are still low, and rates have not yet climbed to a level that will begin choking off economic growth.

Looking Ahead:

First quarter earnings season continues to wrap up this week and economic data will be on the light side. New home sales will be reported on Wednesday, existing home sales on Thursday, and then consumer sentiment will be reported on Friday.

What’s On Our Minds:

5-Point Portfolio Checkup

The goal of investing is to see your money grow over time. However, even though you can’t control how your investments rise and fall, your portfolio is anything but automatic. Like most things, it’s important to check up on your portfolio to make sure nothing is out of date and that its goals are still in line with your own. Tufton Capital’s portfolio managers are always available to help guide you through a quick “portfolio checkup”.

Update Your Goals

Naturally, your investment goals will change as you get closer to retirement. The first thing to do is determine where you want your investments to be headed. Do you have a new goal, like a child’s college fund, or have you decided to aim for higher retirement income?

Check Your Performance

Are your investments on track to meet your goals? Do you need to aim for increased investment returns or start contributing more? If your portfolio is lagging behind the appropriate benchmarks over a long period of time, it is probably time to reconsider your investment strategy.

Review Assets

Over time, some assets may grow to be an oversized or undersized part of your portfolio, or perhaps your appetite for risk has changed. Often times, individuals inherit a large position in a single company and it’s necessary to diversify. Or, perhaps someone has worked hard over the course of their career and amassed a sizable equity stake with their company. Either way, re-balancing your assets is often a smart strategy as you plan for the future.

Check Your Beneficiaries

Do all of your investment accounts have listed beneficiaries? While it may not be fun to think about, it’s very important to plan ahead. In the event of your death, having direct beneficiaries for your accounts will keep them from passing through your estate and incurring unnecessary costs.

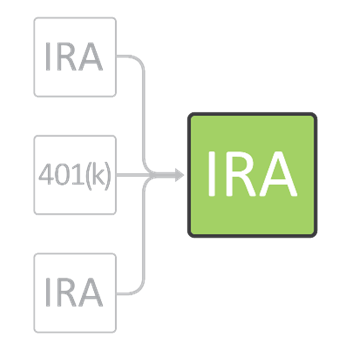

Consolidate Extra Accounts

Many people forget about old accounts (past IRAs, CDs and 401(k)s) and do not coordinate their holdings with the rest of their portfolio. Talk to your Tufton portfolio manager about rolling these accounts into a single IRA that will be easier to manage. Along with streamlining your investment strategy, you also may be able to lower your management fees by consolidating more assets with a single firm.

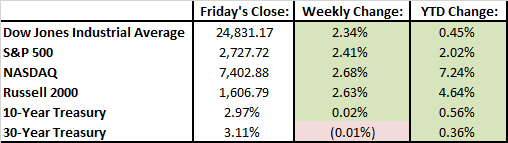

Last Week’s Highlights:

Investor sentiment turned bullish last week and stocks logged solid gains. Strong earnings results lifting the S&P 500 and Dow Jones by more than 2%. At this point, more than 90% of S&P 500 companies have reported earnings, and results from the quarter are on pace to be the strongest since the 3rd quarter of 2010. On average, we have saw an impressive 8.2% increase in revenue from S&P 500 companies in the first quarter.

Looking Ahead:

Earnings season begins to wrap up this week with only 10 companies in the S&P 500 reporting. Thus, investor attention will likely return to any pending political news and economic data. Retail sales figures are reported on Tuesday, housing starts on Wednesday, and the Leading Economic Index figure is released on Thursday.

What’s On Our Minds:

William Holbrook Beard was one of America’s finest animal painters. Many of his paintings employed animals to mimic and satirize human behavior. In 1879, Beard painted “The Bulls and Bears in the Market” which depicts a battle between bulls and bears on New York’s Wall Street. Over the past 140 years this fight continues!

There has been a bull vs. bear tug of war on Wall Street this year. On the bull’s side of the ring, analysts have been increasing their earnings expectations and yet companies are still beating their estimates at a record pace. 81% of S&P 500 have reported first quarter earnings this spring, with results on pace to be the strongest since the third-quarter of 2010. Furthermore, tensions on the Korean peninsula have eased in recent weeks which sharply reduces geopolitical tensions that have been weighing on investor sentiment this year. The market has been hesitant to read too much into the positive reporting trend though. A group that tracks bullish sentiment by way of survey, the American Association of Individual Investors, notes that bullish sentiment peaked back in January at 59.75% and has since decreased to 28.4%. Of course, this survey is useful with the benefit of hindsight, but clearly investors have become skittish this spring.

Which brings us to the bear’s corner of the ring. Heightened risk of trade wars, which could hurt manufactures of targeted goods and their suppliers are stoking investor fears. Investors are also worried about rising interest rates, which makes equities less attractive. An apparent lack of reinvestment of tax savings on the corporate level has also spooked investors. Instead of investing savings for long term sustainable growth, companies have prioritized stock buybacks and employee bonuses.

The constant back and forth between bullish and bearish sentiment this year may seem worrisome but it these types of conditions are expected as you invest over the long term. Remember, Tufton Capital’s portfolio managers are hard at work looking for undervalued companies, balancing your portfolio and trimming your winners. We’re not focused on short term performance, but rather, the long-term growth of your portfolio!

Last Week’s Highlights:

Daily moves were volatile last week but we finished the week close to where we started. It was a tough week until stocks rallied back on Friday. April’s Jobs report was released last week which showed that the U.S. economy added 164,000 jobs and the unemployment rate dropped to 3.9% from 4.1%. The report missed expectations though. Investors were expecting 190,000 new jobs. The Federal Reserve said it still plans to raise rates later this year.

Looking Ahead:

Earnings season begins to wrap up this week with only 9% of S&P 500 companies reporting first quarter results. Important economic updates this week include inflation on Thursday and consumer sentiment on Friday.

What’s On Our Minds:

The yield on the U.S. 10-year Treasury hit 3% last week: the highest level it has reached since 2014. Low interest rates have been a key ingredient for our current bull market’s run so recent increases have garnered plenty of attention from investors. The recent move higher puts upward pressure on borrowing costs and has driven investor attention back to the Federal Reserve’s plan to hike interest rates. Below, we break down the various levers that make this number so significant.

Interest rates are, to put it mildly, a complex beast. There are a few mechanisms by which rates affect the economy and the stock market, not all of which are obvious, but which have large effects.

The first is the most obvious: a lower interest rate means it’s cheaper to borrow. Consumers borrow more money to buy houses or cars, businesses borrow money to expand production. And thus, we get economic growth. Everybody’s happy. Except, maybe, the people who get less money in interest for loaning out their hard-earned cash.

An interest rates increase, like the one that seems imminent, is a signal that rates are moving higher, might cause both consumers and Chief Financial Officers to cut back on spending. So, businesses earn less, and earnings fall.

Another very important but more abstract concept is the valuing of stocks via a discount rate. If I think a company is going to earn $10 million in ten years, the interest rate would have to be 0 for an investor to want to buy its stock now for with a $10 million valuation. But if interest rates are higher, investors would be better off just putting the money in the bank for ten years and earning some interest in those ten years. In this way, investors compare interest rates with their expectations for the earnings of companies. If interest rates are low, companies’ stocks are more attractive, and therefore worth more in today’s dollars.

The Federal Reserve must think about all of this, with the added complexity of inflation. The inflation target is 2-3%: at this level, prices are stable, but there is incentive to spend, rather than save, money, and to push the economy along. With inflation at zero, you know that the car you want to buy will cost about the same in year, so you might just think about it for a while, dampening economic activity.

Deflation, when inflation falls below zero, is a major problem: here, you might wait to buy that car, since it will be cheaper next year. And the year after that. This gives rise to the “pushing on a string” phenomenon that was one of our investment committee’s favorite metaphors. You can’t entice people to spend money by cutting rates indefinitely, since rates below zero (usually) are avoided by simply keeping the cash.

Last Week’s Highlights:

The S&P 500 was little changed last week and the Dow Jones was down just over half a percent. Crosscurrents continue to weigh on investor sentiment. We have seen strong first quarter earnings reports and improving economic growth but investors are skeptical because of rising interest rates. 10-year interest rates rose above 3% last week for the first time since 2014. On one hand, low interest rates have been a major factor for this bull market so recent increases have caused anxiety on Wall Street. On the other hand, corporate profits are still expanding and businesses are still realizing the benefits of last year’s tax reform.

Looking Ahead:

The flow of first quarter earnings reports continues this week. Analyst will be busy dissecting reports from 147 of the S&P 500’s components. So far, nearly 80% of the S&P’s companies that have reported have beaten consensus earnings forecast. The Federal Open Markets Committee will announce their interest rate decision on Wednesday. No rate increase is expected.

What’s On Our Minds:

A charitable remainder trust (CRT) is a powerful estate planning tool that can provide a variety of benefits. These accounts enable investors to move funds out of their taxable estate, they provide a steam of income, and they enable wealthy individuals to fulfill their philanthropic goals.

Contributing a portion of your estate to charity may be something that you and your family strongly believe in, whether or not you receive any benefit from it. Although generosity is the driving force behind philanthropy, there are also many benefits that a donor can reap from making charitable contributions.

Considering that federal government charges a 40% estate tax (on individual estates larger than $11.2 million), it’s important for wealthy families to consider the many estate planning strategies available that can help reduce the tax bite upon a generational wealth transfer. One strategy is the creation of a charitable remainder trust (CRT).

CRTs are an excellent option as they allow wealthy individuals to fulfill their philanthropic goals by moving assets out a taxable estate which can then grow, tax free, through investment. Meanwhile, during the life of the trust, it is required that the CRT distributes between 5 and 50 percent annually to the beneficiary of the trust (either the grantor of the trust or their family). These payments will last for a set number of years or the remainder of the grantor’s life, depending on how the trust document is written. The trust will end at the predetermined time and the remaining funds with go to the charity of your choice.

The tax advantages continue with the creation of a CRT. Along with moving funds out of a taxable estate, upon the creation of the trust, the grantor can take an income tax deduction for the full value of the trust that can be spread over five years. Finally, the creation of a trust helps individuals avoid capital gains taxes. Assets with large unrealized gains can be moved into the trust, sold, and reinvested into a portfolio of income producing investments.

At Tufton, we provide comprehensive planning services to portfolios of all sizes and complexities and give you objective solutions. Armed with a plan, you can plan how your assets can help forge your family’s legacy.

Last Week’s Highlights:

U.S. equity markets were in the green last week, adding to the previous week’s 2% rally. At this point, the S&P 500 is essentially flat for the year. Earnings continued its strong start which helped to distract investors’ attention away from political headlines that have caused investor anxiety recently.

Looking Ahead:

Earnings season continues this week with one third of the S&P 500’s companies reporting their first quarter results. Important economic indicators will also be reported this week. Home sales data will be reported on Monday, the new homes sales figure on Tuesday, and first quarter GDP will be reported on Friday. We’ll see if calm heads prevail during this important week of data released.

What’s On Our Minds:

Many investment companies will advertise their strategies as “value” or “growth.” According to standard definitions, these two types of investment strategies stand opposite to one another. Each uses its own elements and metrics to determine a sound investment, and each has its own standards and expectations for returns. That being said, both strategies feature similarities.

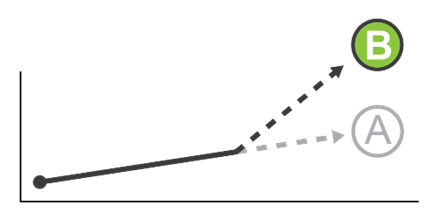

Defining “Value” and “Growth”

In traditional terms, “value investing” is the purchase of stocks or other securities that are currently undervalued by the market. To make a value investment, an investor must find a security that is being sold for less than what its calculated and/or historical value suggests. Value investing works off a person’s logical expectation that a security will return to a normal price. At Tufton, our value philosophy takes advantage of the emotions in the market. The price of a stock gyrates around its intrinsic value as investors’ emotions cause them to make irrational decisions. We buy securities when the market has given up on them – when it feels “dread” and “desolation.” Later, when the market is “deliriously” happy with an investment, we look to sell. Typically, our investment committee will not chase a hot stock higher.

On the other end, “growth investing” is the purchase of shares in a company that is expected to grow in importance or become more valuable than it is now. To pursue growth investment, an investor seeks out companies that have excellent potential to expand. The current cost of their shares are not undervalued, their growth has simply not yet been realized. Growth investing is based on the optimistic anticipation of a company’s future.

Differences

Investors will undoubtedly notice that several firms and funds will either label themselves “value” or “growth.” In general, this reflects the fund’s volatility: value funds are often less volatile than growth funds. Though growth funds make up for their risk by claiming to offer the potential for higher returns, economic downturn can cause them significant losses. By purchasing securities at a significant discount, Tufton provides a “margin of safety” which can provide downside protection.

Similarities

In recent years, several well-known investors, including Warren Buffet, have stated that the difference between “value” and “growth” investing are arbitrary. A company’s shares might be a good deal because they are undervalued, but an investor is expecting some form of growth or performance to push it back to its normal value. Similarly, if an investor feels a company’s growth is certain, then he or she sees its shares as undervalued at their current price.

The differences between “value” and “growth” are only noticeable if an investor is speculating on growth or continued performance. Any experienced and well-informed investor (growth or value) will consider a company’s past and future before purchasing a security. After taking everything into account, it becomes a simple judgment of whether the company’s expected future is worth the current price, market risk and length of time.

If you have questions about your current market positions or would like to learn more about Tufton’s value strategy, please give us a call today!

Last Week’s Highlights:

Fears of a looming trade war with China eased last week and stocks increased by nearly 2%. It was the sixth week in a row where we saw the S&P 500 move by more than 1%, up or down. It was a week chock full of headlines. The FBI seized records from President Trump’s personal lawyer; Facebook’s CEO, Mark Zuckerberg, appeared before congress to defend the company’s business practices; and the tariff spat with China continued. On top of all that, on Friday night, the U.S. led a missile strike on Syria. While these types of headlines won’t necessarily drive earnings higher or lower, they can affect investor sentiment overall.

Looking Ahead:

Global markets did not seem to worry over the weekend about the U.S. air strikes on Syria. This week, investor attention will return to company earnings reports with 10% of the S&P 500’s companies report their first quarter results. Blue chip companies reporting this week include Goldman Sachs, Proctor & Gamble, Johnson & Johnson, United Airlines, IBM, Bank of America, and General Electric. The economic reporting calendar is light but we will see retail sales figures on Monday.

What’s On Our Minds:

Receiving dividend payments from your equity holdings every quarter is similar to collecting interest on money in a savings account – it’s very nice but it’s not exciting. Buying a stock and betting its share price will increase is much more exhilarating, but today we will take this opportunity to remind our readers of the several advantages of owning dividend-paying stocks.

- Dividends provide passive income, which investors can either spend or reinvest. Dividend-paying stocks are particularly attractive to folks looking to benefit from supplemental income, especially retirees.

- Companies that pay a dividend tend to be mature and stable.

- Dividends can be viewed as a hedge against inflation. Many blue-chip companies pay a dividend higher than the rate of inflation. Unfortunately, a savings account simply cannot keep up.

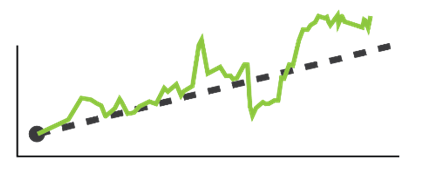

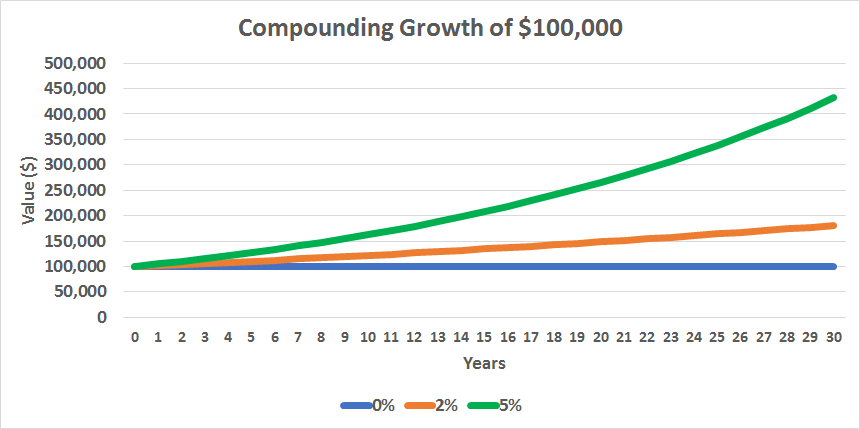

Investors who opt to re-invest their dividends, rather than spend them, have far better investment returns thanks to compounding interest. With compounding, your original investment is growing due to repeated reinvestment, and every year you are getting a larger and larger sum of interest. Imagine a snowball rolling downhill, growing bigger in size as it picks up more snow along the way.

Dividends are central to your long-term returns and studies have shown that if you don’t own dividend paying stocks, it is likely that you will underperform the market over the long term. Credit rating agency Standard & Poor’s recently conducted a study showing that over the past 80 years dividends were responsible for 44% of the S&P 500’s total return.

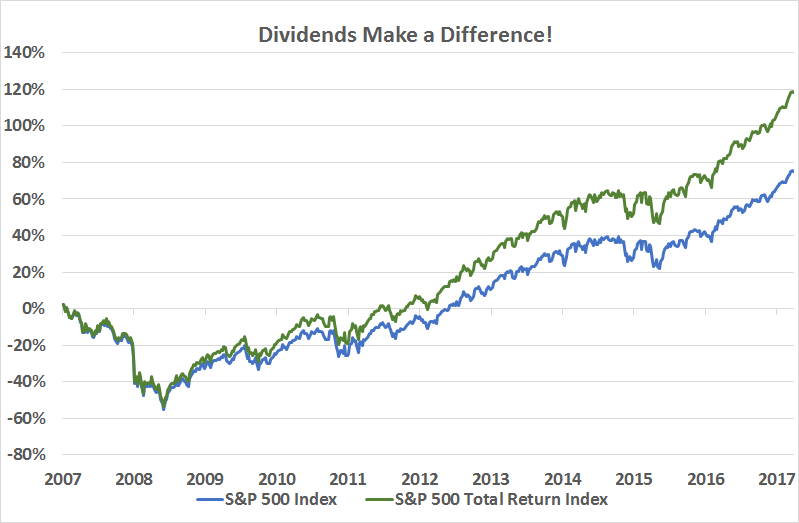

The chart below shows the S&P 500 Index’s return vs. the S&P 500’s total return which includes dividends. Dividends make a difference!

Last Week’s Highlights:

Ebbing and flowing concerns over a potential trade fight between the U.S. and China and the impact such a scuffle would have on domestic and global growth drove a series of ups and downs for the stock market last week. On Monday, China announced it would impose tariffs on $3 billion of U.S. goods in response to the steel and aluminum tariffs President Trump announced last month. The White House retaliated with a proposed tariff on 1,300 Chinese products worth about $50 billion. Then, the Chinese matched that with a $50 billion tariff on U.S. automotive, agriculture, and aerospace industries.

Looking Ahead:

While headline news from the White House may continue to drive market volatility this week, investors’ attention will also return to corporate earnings with large U.S. financial services firms reporting late in the week. This group includes Well Fargo, Citigroup, J.P. Morgan Chase, and Blackrock. Investors will also be watching the release of inflation data and the Federal Reserve’s minutes from March.

What’s On Our Minds:

Investor sentiment continues to swing between optimism and pessimism as new information about the technology sector, global trade, and monetary policy is released. Over the past two weeks, investors have not taken kindly to the data privacy controversy engulfing Facebook which, up until recently, was one of the most popular stocks on Wall Street. Recent turbulence in the tech industry adds another element of uncertainty to an existing combination of worries: that inflation might bubble up and prompt the Federal Reserve to hike interest rates faster than expected, and that President Trump’s protectionist views on trade could spark a trade war.

What does Volatility Mean for Investors?

Volatility is an inescapable part of investing. The future is uncertain and every investment carries risks. It is in the stock market’s nature to fluctuate sharply during the short term as market participants receive and digest new information. However, unless an investor is involved with buying or selling options, a brief increase in volatility (measured by the VIX) is unlikely to require any changes to his or her investments. A volatile market might cause stock prices to rise and fall by significant amounts, but it does not necessarily affect the future value of owning shares in a company. Investors should choose stocks based on the underlying value of a company, not a temporary price fluctuation. The fear associated with the VIX should not give way to irrational buying or selling.

So, what is an investor to do?

For starters, remember that success in the market does not depend on predicting the future over the short term and that timing the market’s ups and downs is nearly impossible. Instead, focus on staying diversified, understand your risk tolerance and stick to a long-term plan.

Above all, remember that market returns are driven by economic and earnings growth, and both continue to appear positive, in our view.

Last Week’s Highlights:

It was a shortened week of trading due to the holiday on Friday but equity markets rallied by more than 2% to close out the first quarter of 2018. Even though the week’s numbers ended up in the green, it was another volatile week where the S&P 500 moved by more than 1.5% on three of the four trading days. Concerns about privacy issues and regulatory scrutiny in the tech sector sent a ripple effect throughout the broader market.

Looking Ahead:

A good amount of economic data will be released this week, with the Purchasing Managers Index on Monday, vehicle sales on Tuesday, and a very important jobs report on Friday. The jobs report should provide clarity on the state of the U.S. labor market and levels of wage growth. The jobs report number will be watched closely by investors who have become cautious about the level of inflation in the economy, and whether the Federal Reserve might become more aggressive in raising rates to suppress a spike in inflation.

What’s On Our Minds:

What’s on our minds this week is the same thing that’s on everyone’s minds this week. And on their screens every day. And their phones. And, maybe, in their data, rummaging around: Facebook. “Lax Data Policies Haunt Facebook.” “Data Blowback Pummels Facebook.” As of this writing, Facebook (FB) is down a hefty 22.1% from its February 1st high.

The trouble last week initially centered on the issue of how Cambridge Analytica used millions of users’ information that it collected over the years. It tied in with the Trump campaign, Russia, and raised hackles in Congress, where lawmakers called for CEO Mark Zuckerberg to explain himself. The ire spread across the pond, where British MPs similarly demanded an explanation. Each day, Facebook dropped precipitously.

At Tufton, we are watching carefully. Not because we own Facebook in spades- FB is a ticker that rarely passes over a value investor’s desk. But rather, we watch because the calls for regulation and oversight of how data is used will affect not just Facebook, but other big-tech names. Notably, Google. We expect that we’ll see if GOOGL’s “Don’t Be Evil” motto did, in fact, prevent data from being used improperly.

No company wants to see an article about itself that includes the phrase “The Federal Trade Commission is investigating…” If the FTC finds Facebook violated terms of a 2011 settlement, it will face large fines, to be sure, but it will also call into question its business model generally. Further, it will raise questions over the business practices of Silicon Valley generally.

The Technology team at Tufton continues to believe that the United States’ strength in the world is in its superior brainpower and knowledge in tech (the Technology team, who is writing this piece, also recognizes it may be biased). As the world moves away from manufacturing and toward automation and services as the highest value-add, superior technology will be integral throughout all of business. However, as with any major change, we do not expect there to be a smooth ride to get there.

Last Week’s Highlights:

Stocks were lower last week on sharpening fears of a trade war with China. And of course, as we detailed above, high-flier Facebook was pummeled.

Looking Ahead:

Tufton’s economic team will be interested in the GDP numbers released Wednesday. Otherwise, it will be a short and largely uneventful week with Good Friday leading into the holiday weekend.

What’s On Our Minds:

What is an activist investor? Well, sometimes companies just need a little push.

As activists, investors look to maximize their own returns by taking large enough positions in the company’s stock that they can influence management decisions. Often, they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist thinks they have a better capital allocation strategy, such as buying back stock or raising the dividend. Activist investing continues to gain supporters (and investment capital), according to Hedge Fund Research, activist funds’ assets under management increased by four times over the past 9 years, from a level of $32 billion to $176 billion.

Recently, activists have achieved increased success and gained credibility as the size of their targets have grown. Last year, Nelson Pletz was successful in his fight for a seat on the board of directors at Proctor and Gamble, a mega-cap blue chip company.

Often, activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut: some activist may just be greedy, while others want to maximize shareholder value over the long term. In 2016, billionaire investors decided to take on these attacks from Washington by launching their own lobbying group to fight these attacks, The Council for Investor Rights and Corporate Accountability (CIRCA). Bill Ackman, Paul Singer, Carl Icahn, Daniel Loeb, and Barry Rosenstein are the group’s largest backers. Together, they manage over $90 billion and believe that lousy corporate performance is a drag on the US economy.

Activists take positions in different types of companies across many different industries and of various market caps. Often, though, activists target companies that have been under pressure and are considered value stocks. At Tufton Capital, we are not activist investors, but we do look for undervalued stocks. Therefore it’s not uncommon for companies in our equity portfolio to have activist involvement. As a result of this overlap, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only 50% of targeted companies outperformed their peers- that is, the same as chance.

Last Week’s Highlights:

Stocks were lower last week and we continued to see elevated volatility. Partisan reaction to President Trump’s proposed steel and aluminum tariffs grabbed headlines. In a partisan flip flop, Congressional Republicans discussed limiting Presidential power on tariffs, while Democratic Senator Elizabeth Warren supported them. Technology stocks, which have been the best-performing sector so far in 2018, experienced a pullback last week as President Trump also proposed tariffs on Chinese imports.

Looking Ahead:

While tariff fears and political headlines influenced the market last week, investors will likely refocus on the Federal Reserve this week. The Fed will hold its two-day policy meeting on Tuesday and Wednesday where it is expected that Jerome Powell will increase interest rates for the first time in 2018. Investors will be listening to his comments Wednesday to hear how they might deviate from his predecessor, Janet Yellen. The federal funds futures market expects three rate increases by the end of the year, with a more than 30% chance of four.