Last Week’s Highlights:

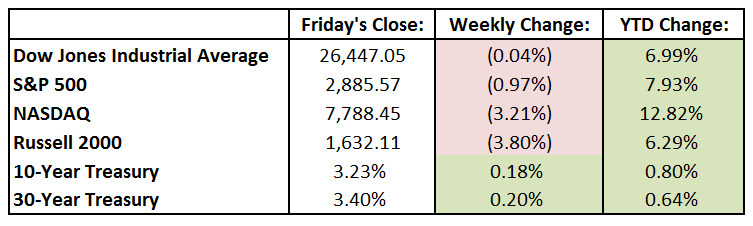

U.S. stocks were lower on the week, as volatility returned along with plenty of news and economic data for investors to digest. After hitting an all-time high early in the week, the Dow Jones Industrial Average (DJIA), along with many other indices, declined largely due to a sudden jump in the 10-year Treasury yield. The yield spiked from 3.055% to 3.227% last week, marking its highest level since May of 2011. As a result, the blue-chip DJIA dropped over 11 points for the week, to 26,447.05, while the S&P 500 fell 1%, to 2885.57. The tech-heavy NASDAQ felt even more pain for the week, dropping 3.2% to 7788.45. Why don’t stocks like these higher interest rates? Aren’t interest rates rising because of solid economic growth, which is a good thing? The answer is yet, BUT this uptick in bond yields brings on concerns that this good economic news may lead the Federal Reserve to tighten more aggressively than has been anticipated. We at Tufton Capital continue to believe that strong earnings and economic growth justifies this rising rate environment, and equities can still perform well despite the increased volatility.

Looking Ahead:

The U.S bond market is closed on Monday in observance of Columbus Day. Markets are closed in Canada for Thanksgiving and in Japan for Health and Sports Day. Proctor & Gamble (PG) holds its annual shareholder meeting in Cincinnati on Tuesday, and the National Federation of Independent Businesses reports its Small Business Optimism Index for September. On Wednesday, the Bureau of Labor Statistics releases its producer price index for September. Honeywell International (HON) hosts an investor conference in New York that day, where it will discuss its spinoff of Resideo Technologies. Thursday brings earnings reports from Commerce Bancshares (CBSH) and Walgreen Boots Alliance (WBA). We’ll also see plenty of economic reports that day, including the consumer price index for September and August’s real average weekly earnings results. The week ends with three of the four largest U.S. banks reporting their third quarter results: Citigroup (C), J.P. Morgan Chase (JPM) and Wells Fargo (WFC) all report results on Friday.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

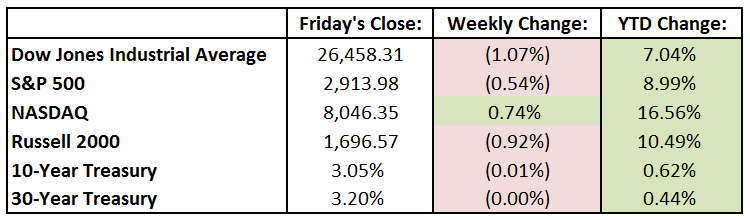

Most of the major US indices were down last week as tariff talks and the Federal Reserve weighed on strong quarterly performance. The Dow Jones Industrial Average was down 1.1% while the S&P 500 was down 0.5%. On the other hand, the technology heavy Nasdaq rose 0.75%. For the quarter, the three major indices posted their best quarterly performance since 2013. On the economic front, the biggest headline news was the Federal Reserve raising interest rates another quarter of 1%. The Federal Funds Rate now stands in a range of 2% to 2.25%. Housing was also in focus last week. New Home Sales were reported at 629,000 for the month of August, which was slightly below Wall Street’s estimate, but 21,000 higher than the number reported in July. Home Prices, as evidenced by the S&P/Case-Shiller Index, rose 0.1% for the month of July. Lastly, Durable Good Orders surged 4.5% in the month of August, beating the Wall Street estimate of 1.9%.

Looking Ahead:

This week, stocks are off to a strong start as the US, Canada, and Mexico agreed on a new trade agreement that will replace the current North American Free Trade Agreement (NAFTA). Jobs will also be in focus this week starting with the ADP Employment Survey on Wednesday. On Friday, investors will gain further insight on the job market with Average Hourly Earnings, Nonfarm Payrolls, and the Unemployment Rate all being released by the Bureau of Labor Statistics. With the end of the calendar quarter, many companies will be preparing for quarterly earnings calls in the next coming weeks.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

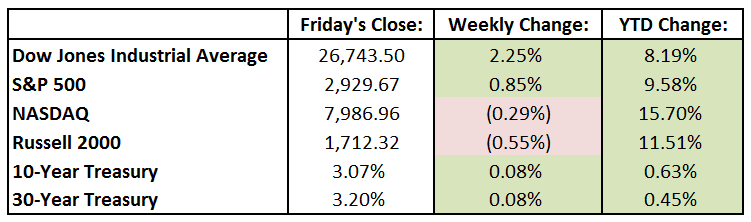

U.S. large-cap stocks edged higher Friday, finishing off their strongest two-week stretch since February. This recent strength in domestic equities reflects that inflation- and trade-related anxieties that have affected the markets in recent months may be abating. For the week, the Dow Jones Industrial Average gained 589 points, or 2.3%, to 26,743.50 – a record close. The S&P 500 rose 0.8% last week to 2929.67, narrowly missing a record of its own. It was an unusually weak week for the FAANG stocks (Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX), Alphabet (GOOGL)), as the tech-heavy NASDAQ dropped 0.3%, to 7886.96. There was an unusual move last week between the U.S. dollar and the 10-year treasury yield, as the two usually move up (or down) together. Last week, however, the yield on the 10-year rose to 3.068% (its sixth-highest close of the year), while the U.S. Dollar index fell 0.8%, its second consecutive weekly decline.

Looking Ahead:

The trade war heats up on Monday, as U.S. tariffs of $200 billion on Chinese goods are expected to take effect. China is also expected to impose tariffs of $60 billion on U.S. goods. The Federal Reserve meeting begins on Tuesday, and we’ll see earnings out of Nike (NKE) and comments from the General Mills (GIS) annual shareholder meeting in Minneapolis. On Wednesday, the Fed will announce its interest-rate policy decision: consensus estimates anticipate that the Fed will raise the federal-funds rate by a quarter percentage point, to 2%-2.25%. On Thursday, the Census Board reports durable-goods orders for August, and the National Association of Realtors releases its Pending Home Sales Index for last month. We’ll see earnings reports from McCormick (MKC), Accenture (ACN) and Conagra Brands (CAG) that day as well. The week ends with the Bureau of Economic Analysis’s release of personal income and outlays for August, as well as earnings reports from BlackBerry (BB) and Vail Resorts (MTN). The New York Film Festival officially opens on Friday.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

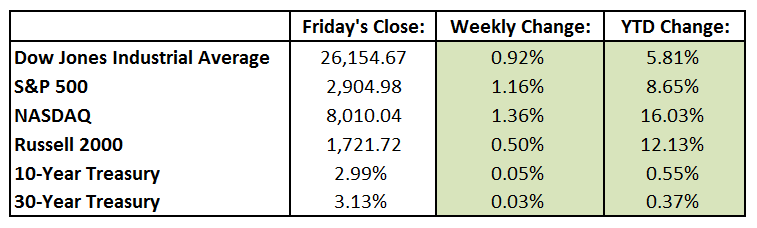

The major indices rose last week as investors expected that the U.S. and China were going to resume trade talks. The tech-heavy Nasdaq led the way, with Microsoft (MSFT) contributing the most to the index’s return by gaining 1.36%. A plethora of economic data was released last week. The Producer Price Index (excluding food and energy) fell 0.10% month over month, showing that the cost of producing goods declined. The Consumer Price Index (excluding food and energy) rose 0.1% month-over-month and 2.2% year-over-over. This rate of inflation is near the Federal Reserve’s target, signaling that the Fed will likely raise interest rates again later this month.

Looking Ahead:

While Monday does not bring market moving economic data, the housing market will be in focus throughout the remainder of the week. On Wednesday, information on Building Permits will be released for August. Wall Street is estimating that 1.3 million building permits were issued, on par with the 1.3 million building permits issued in July. Existing Home Sales information will be released on Thursday. Consensus estimates are for 5.4 million homes sales for the month of August. On the earnings front, there will not be many releases, as the third calendar quarter is coming to an end.

Have a wonderful week!

Last Week’s Highlights:

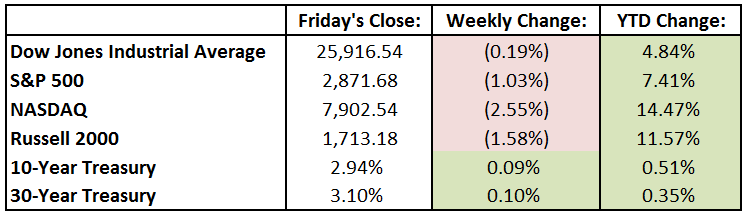

Technology stocks were hit last week, largely due to Wednesday’s congressional testimonies by senior executives of two leading social media companies (Facebook (FB), Twitter (TWTR)). Additionally, the Department of Justice said it would meet with state attorneys general on what it called the “stifling” of voices online by social media. As a result, the tech-heavy NASDAQ fell 2.55% for the week to 7902.54. August’s solid jobs report was released on Friday, showing that the economy added more than 200,000 jobs and that wages grew at the fastest pace since 2009. However, this strong report failed to overcome pressure of escalating trade tensions: the Dow Jones Industrial Average slipped 0.19% for the week, and the S&P 500 fell 1.03%, to 2871.68. Amazon.com (AMZN) briefly joined Apple (APPL) last week with a trillion-dollar-plus market capitalization on Tuesday, before slipping back to $995 billion. The pair are the first two U.S. companies to join the trillion-dollar club. Congratulations to Novak Djokovic and Naomi Osaka for winning tennis’s U.S Open – it was his third victory in the New York event and her first.

Looking Ahead:

Monday starts the first day of Rosh Hashanah, and AT&T will host an investor conference to discuss the recent acquisition of Time Warner. Tuesday marks the 17th anniversary of the 9/11 terrorist attacks. On Wednesday, Apple (APPL) hosts its annual Gather Round event, where the company is expected to unveil new iPhone models and a redesigned Apple Watch, among other products. Wednesday will be a busy day on the economics front, as we’ll hear from the Bureau of Labor Statistics on the August producer price index as well as the Federal Reserve, which will release its sixth of eight beige-book surveys for 2018. Thursday brings the consumer price index report for August and earnings reports from Adobe System (ADBE) and Kroger (KR). And on Friday, we’ll see more economic news, including the August retail sales report and the Consumer Sentiment survey for September.

Have a wonderful week!

Last Week’s Highlights:

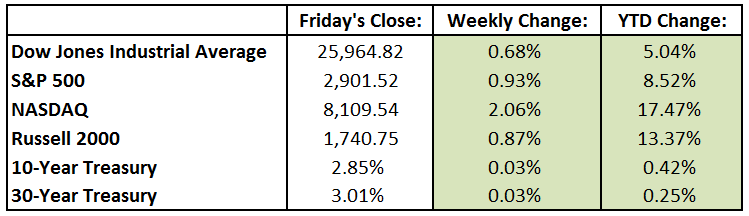

Last week, the major indices trekked higher as an agreement with Mexico signaled that new regulations could replace the North American Free Trade Agreement (NAFTA). The Dow Jones Industrial Average rose 0.7%, while the S&P 500 increased 0.9% and the Nasdaq jumped 2.1%. The S&P 500 and tech-heavy Nasdaq both reached all-time highs – surpassing their records set this past January. For the month of August, the Nasdaq surged 5.9%, the S&P 500 had a total return of 3.3% and the Dow Jones Industrial Average lagged with a total return of 2.6%. Of the 3.3% for S&P 500, Apple was the largest contributor representing 24% of the index’s return.

Looking Ahead:

This week, investors will be focused on the Trade Balance report, to be released at 8:30 AM Wednesday. Wall Street is expecting a deficit of $50 billion for the month of July. On Thursday, data on the Durable Good Orders for July, as well Unit Labor Costs for the 2nd Quarter, will be released. Consensus estimates forecast that Durable Good Orders declined 1.7% in July and Unit Labor Costs declined 0.9%, respectively. Friday is “Jobs Day” as a plethora of information is released regarding the Labor Market. Wall Street is estimating that the economy added 190,000 Nonfarm Payroll Jobs in the month of August. The Unemployment Rate is expected to decline from 3.9% to 3.8% and Hourly Earnings are expected to rise 0.3% month over month.

Last Week’s Highlights:

After almost seven months since its January 26th top, the S&P 500 once again hit a new all-time high. The S&P is now up over 7% for 2018, while the Dow Jones Industrial Average and NASDAQ are up 4.33% and 15.1% YTD, respectively. Stocks posted their largest gains on Friday, following Federal Reserve Chair Powell’s speech in Jackson Hole, where he noted that while the committee’s measure of inflation has moved near its 2% target, an inflation overshoot or an overheating economy does not seem likely. This will likely keep the Federal Reserve on pace to raise short-term interest rates at a measured pace, hopefully helping extend the bull market.

Looking Ahead:

It’s the (unofficial) last week of summer and traditionally a slow one for Wall Street. After the U.S. Open tennis tournament kicks off on Monday, we’ll see earnings from Tiffany & Company (TIF) and Best Buy (BBY) on Tuesday. Wednesday will bring the GDP revision data, pending home sales, and earnings reports from Salesforce (CRM) and Dick’s Sporting Goods (DKS). On Thursday, we’ll get economic readings on personal income, consumer spending and core inflation. Warren Buffett will celebrate his 88th birthday that day, and we’ll get financial results from Dollar Tree (DLTR), Campbell Soup (CPB) and Abercrombie & Fitch (ANF). Friday will round out the week with the consumer sentiment index.

All of us at Tufton Capital wish you an enjoyable and safe Labor Day weekend!

Last Week’s Highlights:

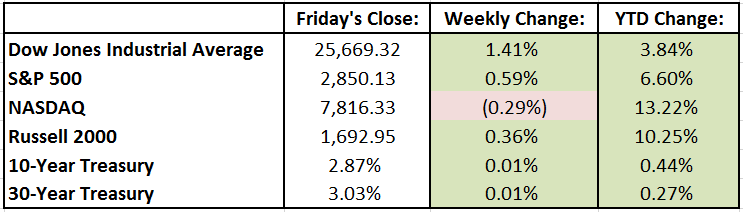

Last week, the Dow Jones led the major indices with a 1.41% increase week-over-week. Walmart (WMT) helped lead the index higher rising 8.5% after beating Wall Street estimates for both sales and earnings-per-share. The Arkansas-based company also raised their sales guidance for the year. Nielsen Holdings (NLSN) was the largest gainer in the S&P 500 increasing nearly 20% week-over-week. Activist Elliott Management took a stake in the information and data management company with intention of pushing the Board-of-Directors for a strategic review of the business. In economic news, retail sales beat Wall Street estimates rising 0.5% month-over-month versus a consensus estimate of 0.2%. Housing starts came in slightly below consensus at 1.17 million.

Looking Ahead:

This week, investors will get further results from the retail sector with Kohl’s (KSS) and TJX (TJX) both reporting quarterly results on Tuesday. Target (TGT) and Lowe’s (LOW) will report before the opening bell on Wednesday with Williams Sonoma (WSM) reporting after the closing bell. On Thursday, investors will hear from L Brands (LB), The Gap (GPS) and The Children’s Place (PLCE). On the economic front, housing will continue to be in focus with the release of July Existing Home Sales on Wednesday morning. July New Home Sales as well as July Building Permits will be released on Thursday Morning.

Last Week’s Highlights:

U.S large-cap stocks finished lower on the week, their first weekly decline since the end of June. The DJIA fell 149 points on the week (0.6%), while the S&P 500 declined 0.2% to 2833.28. The NASDAQ eked out a gain of 0.3%. Weighing on equities were worries of financial and currency turmoil in Turkey as well as continued tariff talks between the U.S. and China. Turkey’s lira tumbled 14% on Friday, as a standoff over an imprisoned U.S. pastor led to President Trump doubling tariffs on that nation’s steel and aluminum exports. From there, the strain in Turkey spread to other markets.

We also saw some active Tweeting last week, but this time it wasn’t just from the Oval Office. Elon Musk of Tesla Inc. (TSLA) informed his Twitter followers on Tuesday that he’d like to take his electronic car maker private for $420 a share. Tesla’s board is weighing the deal, and Musk claimed that the necessary funding has been secured, largely from the Saudi Arabian sovereign wealth fund.

Looking Ahead:

Earnings season continues to wind down this week, as we’ll see results from fewer than 3% of companies in the S&P 500 reporting their second-quarter numbers. Earnings that Tufton’s research team will be especially focused on this week include Home Depot’s (HD) results on Tuesday, Cisco (CSCO) and Macy (M) numbers on Wednesday, and Nordstrom (JWN) and Walmart (WMT) on Thursday. Important economic reports this week include retail sales (Wednesday), housing starts (Thursday), and the leading economic index to wrap up the week. And of course we can’t forget the very important “Left Handers Day” celebrated on Monday and “Men’s Grooming Day” on Friday!

Last Week’s Highlights:

Labor data was bittersweet, as the labor force added fewer jobs than expected during July but revisions to earlier months’ data brought the unemployment rate down below 4% again. The $1,000,000,000,000 question was finally answered on Thursday when Apple became the first company in history to hit trillion-dollar market cap. Indices were slightly up across the board, with the NASDAQ leading the way.

Looking Ahead:

In the revolving door of economic indicators, inflation is up next. The producer and consumer price indexes will be released toward the end of the week, giving us a hint at how well the Fed’s rate hikes have been keeping the economy from overheating. A fairly stellar earnings season continues to wind down, with most companies having already reported strong second quarter results. Media takes the spotlight this week, as investors will put Disney, Viacom, and Fox under the microscope in a shifting landscape of established names.

What’s On Our Minds:

As sure as the sun will rise in the east and set in the west, the stock market will go up and it will go down. Rather than getting caught up in these daily fluctuations, the investment professionals at Tufton Capital believe that a long-term buy and hold strategy is the safest and smartest way to build wealth. A disciplined adherence to this philosophy has proven time and time again to return exponential gains on invested capital, regardless of how the market is feeling on any given day.

Cultivating Your Portfolio

The term “buy and hold” doesn’t mean investing and forgetting about your portfolio for the next 20 years. There are ways to cultivate and prune your portfolio while still maintaining a long-haul investing strategy. For instance, if a company you invest in changes fundamentally, you may not want to continue owning that security. If the overall market changes dramatically, as it has in the past, you may actually benefit from selling an investment or group of investments. Finally, changing goals as you get closer to retirement may warrant a more conservative portfolio.

Bad Markets

The typical investor is tempted to get out of a bad market by selling when prices are low, which is a poor strategy. The economy fluctuates between good and bad all the time, and those who constantly buy and sell will be hit the hardest in a bad economy. By holding on to your investments, you’ll be better able to ride out a down market, especially if your portfolio is diversified.

Taxes and Fees

Frequent trading results in higher fees, so long haul-investors pay less while fees eat up much of a day trader’s profits. Additionally, short-term gains are taxed at a higher rate than long-term gains. Even if you have the fortune of timing the market successfully, your profits will be diminished by taxes and fees.

Investing for the long-haul is the best investing strategy for the majority of investors because it not only ensures modest gains but is also less likely to yield major losses. A long-haul investment strategy is based on informed, careful decision making and patience.

Last Week’s Highlights:

The Bureau of Economic Analysis released its GDP estimate for the second quarter of 2018, placing growth at 4.1% — the highest since 2014. Though there are a few one-time factors that have brought that number up, such as soybean and aircraft exporters rushing product out before retaliatory tariffs went into effect, increased spending by both businesses and consumers was the main driver. Indices flipped the familiar script last week, with the Dow posting the biggest increase and the NASDAQ losing just over 1%. The tech-heavy composite index came down from record highs after weak earnings reports and cautious guidance from Twitter, Intel, and Facebook, with the latter having the biggest single-day loss in value in the history of the stock market. Each of these tech giants experienced double-digit percentage losses in share price as spooked investors fled the technology sector. In a win for free trade, President Trump and the head of the European Commission agreed to working toward a zero-tariff solution, temporarily sidelining auto import taxes until a more detailed deal can be worked out.

Looking Ahead:

Earnings season is finally beginning to wind down, hopefully bringing some level-headedness to the markets. It’s not over yet, though, as big names like Apple, Caterpillar, DowDuPont, Procter & Gamble, Volkswagen, and Kraft Heinz report this week. The Federal Reserve, the Bank of England, and the Bank of Japan all have meetings before taking most of August off, making the next few days some of the most significant of the season in terms of macroeconomic policy news. Consumer Confidence and Employment reports are due by the end of the week, which, coupled with last week’s GDP numbers, should inform the Fed’s decision whether to raise rates again soon.

What’s On Our Minds:

Last week, Hunt Valley, MD based Sinclair Broadcasting (SBGI) faced stern criticism from the FCC on their proposed $3.9 billion purchase of Tribune Media Co. (TRCO) The mega-merger appeared to be on track to close this summer until last week when FCC Chairman Ajit Pai raised “serious concerns” on whether the deal served the public’s best interest. Pai is an appointee of President Trump who had previously been viewed as friendly to Sinclair and such a merger.

The issue at the center of the FCC’s criticism is that, under current laws, a single media company is limited to reaching 39% of American homes. This acquisition would have extended SBGI’s reach to 72% of American homes and therefore would have put SBGI’s reach well above the FCC’s limits. To remedy this, Sinclair planned to sell off certain stations to get under the 39% limit. Instead of selling stations to competitors, Sinclair planned on selling the stations to people loosely associated with the company who could would then be able to hire Sinclair to run the stations. Critics call this a “side car” arrangement. In this case, Sinclair would continue operating the station for a fee, handling everything from advertising sales to news programming. Under these arrangements, Sinclair has historically been able to skirt around the FCC’s ownership rules employing similar tactics. Regulators have occasionally taken issue with this growth tactic, but many believed that Ajit Pai would be friendly to the arrangements.

Not this time. The regulatory tides appear to have shifted for the Sinclair and Tribune merger. Pai has referred the case to the FCC’s lone administrative law judge for an evidentiary hearing that could take upwards of a year. The consensus on Wall Street appears to be that Sinclair pushed the envelope with the deal structure and therefore put the FCC in a tough position as they were facing political backlash for allegedly favoring Sinclair with previous deregulatory moves. As you can see in the charts below, shares of both SBGI and TRCO have taken a hit on this news.

Last Week’s Highlights:

It was a busy week packed with political drama. Donald Trump spurned Presidential custom by railing against the Federal Reserve chairman Jerome Powell and the central bank’s recent rate hikes. Over the past 20 years there has been a “Chinese Wall” between the Fed and the executive branch of the government, and ironically it seems to be tensions with China that have brought it down. The dollar has been appreciating against the yuan since the tariff rhetoric began, a change that does not bode well for the U.S. trade deficit. The President argued higher rates threaten to erase progress on that front. The market, however, seems to be ignoring the headlines more and more each passing week, as most indices gained ever so slightly on the back of mostly solid but not earth-shattering Q2 corporate earnings. Netflix’s share price tumbled 14% after-hours after the streaming media king announced it had missed its own new subscriber expectations by over a million users, marking at least a pause, if not an end, for the stock’s incredible run these past few years.

Looking Ahead:

Following financial institutions reporting earnings last week, large technology companies will dominate the earnings calendar in the week ahead. Notable companies reporting this week include Alphabet, Verizon, AT&T, Facebook, Comcast, and Amazon. Ford and General Motors also announce their second quarter results on Wednesday, hopefully giving us some insight into how the tariffs on steel and aluminum have affected their bottom lines. Economists continue keep a close eye on the yield curve for U.S. Treasuries, though many are saying a flattening curve (when short-term lending becomes riskier than long-term lending) is not the same glaring recession indicator it once was. The President’s administration will begin investigating China’s central bank activity for evidence of currency manipulation, and although the U.S. has declined to officially declare the country a currency manipulator, that seems likely to change with trade war tensions ratcheting up.

What’s On Our Minds:

Banks : Don’t Stress the Test

Our focus turns to financials this week, as the sector floods the newswires with reported earnings for the second fiscal quarter of 2018. Of the six largest American lenders, Wells Fargo, Citigroup, and JP Morgan released their results on Friday, and Bank of America, Goldman Sachs, and Morgan Stanley are slated to announce this week. For the most part, the “bulge brackets” took home record profits for the year’s first quarter, but the picture is a bit distorted from accounting changes due to the tax cut and relaxing regulations, making Q2 earnings a more accurate long-term indicator of financial health. It is not just the economic calendar, however, that has our minds on Wall Street. As a gloomy June has given way to clear blue skies these past couple weeks in the Tufton Valley, so too have the clouds lifted for most of the big banks in New York.

The Federal Reserve recently put 35 financial institutions through a series of tests intended to gauge their ability to survive a recession without requiring a government bailout a la the 2008 financial crisis. The test was implemented as part of the Dodd-Frank Act, and measures how well-prepared large (>$100 billion in assets) banks are to continue operating through adverse economic conditions. The results answered two questions:

1) Do these critically-important firms have enough capital to weather the storm of a severe crisis?

2) Is their proposed capital plan sufficient to keep them stable enough in the future through adverse economic conditions?

The Fed’s answer: yes, and maybe.

34 out of 35 passed the initial phase with no trouble, with Deutsche Bank’s U.S. arm being the only failure. Considering this is the first year DB has been subject to the entire process, it is certainly not a vote of confidence for the struggling German company. Others, such as Goldman Sachs and Morgan Stanley, passed the initial test but had their capital plans rejected. This is not a full rebuke, however, as the two firms are permitted to keep their dividends and share buybacks at previous year levels until an acceptable proposal is put forth.

So, what does it all mean for you? While we may shy away from concrete predictions on the timing of the next economic downturn, if history is indication, it is coming eventually. As we told you last week, the bull market is long in the tooth, and it is good to know that the organizations we depend on to spur economic growth can withstand gale force winds. Just don’t expect their stocks to go to the moon. Though most banks passed and had their plans accepted, they are still beholden to more restrictions than companies in most other sectors. The stress test process in general bodes well for the long-term health of the institutions involved and the economy as a whole, which we here at Tufton Capital will gladly take over short-term and perhaps short-lived quarter-to-quarter gains.

Last Week’s Highlights:

Celebrations erupted in Paris yesterday as France won the 2018 World Cup, beating underdog Croatian team 4-2. With little in the way of geopolitical news on the trade war front, it was a solid week for the markets. Most indices continued climbing up and to the right, and the Dow finally moved back into positive territory for the year, posting a 2.3% gain. The NASDAQ continued its 2018 tear reaching a record high, while the S&P 500 hummed along with solid gains as well. Government bonds stayed relatively unchanged, with overall trade volume staying low as expected for this time of year.

Looking Ahead:

Earnings season begins in earnest, with familiar giants like Netflix, Johnson & Johnson, General Electric reporting second quarter results. Financials lead the way this week, however, with many looking to Goldman Sachs, Bank of America, Morgan Stanley, BB&T, and BNY Mellon to see how the big banks have handled Q2 volatility. Retail sales data comes out today, giving us a clue into the larger consumer spending picture, followed by industrial production numbers tomorrow. Jerome Powell testifies in front of Congress on Tuesday and Wednesday, hopefully giving us more insight into the Federal Reserve’s intentions with monetary policy for the rest of the year, especially regarding the possibility of on economic downturn.

What’s On Our Minds:

Steps to Estate Planning

Setting up an expansive and secure estate plan can be difficult, time consuming and incredibly confusing. With such large values of property at stake, everyone wants to make sure their wishes are set in stone and that minimal money is lost in the process. Contrary to popular belief, a detailed estate plan is not about huge taxes and massive trust funds; many are as simple as a couple sheets of paper.

How much planning is enough? That depends on the goals you want to reach. Using a variety of methods, there is no limit to the amount of control you can put on your estate. And while not every estate requires every method of planning, it can be helpful to know the steps of planning available to you.

Benefits to Beneficiaries

The first and easiest step to planning an estate is establishing beneficiaries of private funds or policies, like life insurance policies, 401k plans and pensions.

This is the easiest step in estate planning because it is typically requested by most plans that a primary and secondary beneficiary be listed to receive funds in the event of a death. Though some plans, like life insurance, will require the beneficiary at signup, others may make it optional to do later. People often put off establishing beneficiaries, creating problems if they die suddenly. Whenever an option to name beneficiaries is offered, it should be handled immediately.

Wills

The next major step in estate planning is establishing a last will and testament. While a person who dies without a will (dying “intestate”) still has his or her property divided up among family, there are no guarantees over who gets what. A will is a simple way to make sure specific items get to the people who ought to have them.

Handing Over Power

Potentially as difficult as a death, the medical incapacitation of an individual can cause huge amounts of stress for a family. Living wills give instructions for the medical care of an individual given they are in an incapacitated, terminal condition. Though limited to these specific situations, living wills can spare a surviving family from difficult decisions and prevent conflict between members who have different views on treatment.

The creation of a “power of attorney” is a much more in depth document that gives a named individual the ability to act on behalf of the disabled in legal matters.

Trusts

Though many people think trusts are financial bodies that are only meant for the wealthy, the truth is they can be used by most people to create detailed control over an estate. A trust is simply a legal entity that holds property for the benefit of a few named individuals.

Gifting

Individuals looking to reduce their estate before death should consider simply giving money away to loved ones later on in life. Each year, a person can give up to $15,000 tax-free to each unique individual or institution they choose. As long as the gifts stay below this amount, they will remain tax-free and still not count against the lifetime gift tax exemption. There are no transfer taxes on gifts made to public charities, regardless of size.

Securing Estate Documents

After necessary estate documents are prepared, they should be adequately stored and protected. Wills are the most difficult to protect. Most states recognize only the original signed document as having any legal power. If the original is destroyed, a new will must be drafted. Typically, the law firm where the document was created will offer to keep the will in an extremely secure safe.

Other documents, such as living wills and power of attorney, can typically be copied and notarized to create duplicates that carry the same legal power as the original. As with wills, loved ones should be informed of the documents’ location so they can be accessed when needed.

Conclusion

Estate planning can be a difficult process for people. The concept of preparing property for an accident or death is hardly something people want to spend time considering. Though its creator will never see it used, a well-written, well-conceived estate plan can make all the difference for friends and family.

Last Week’s Highlights:

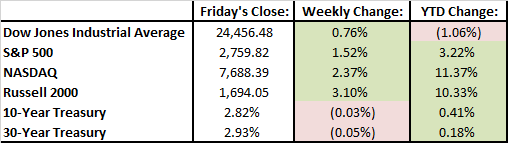

Last week marked the first week of the third quarter, and opened up the start of the second half of the fiscal year. June’s job report expressed strong results in the labor market, as unemployment is hovering around 17-year lows, despite ticking up slightly to 4% in the month of June due to increases in the labor market. Further, the economy added 213,000 jobs during the month, marking nearly eight straight years of monthly gains. Job increases were coupled with wage growth, as hourly earnings grew 0.2% during the month and are up 2.7% for the year. On the international front, trade tensions escalated as the 25% tariff on the first $34 billion of Chinese goods and corresponding retaliatory tariffs went into effect on Friday.

Looking Ahead:

This is the first full business week of Q3 2018, coinciding with the first effective week of new tariffs on Chinese imports. After months of back-and-forth rhetoric and posturing, we will finally see how significant their impact will be on the economy. President Trump is expected to announce his pick for Supreme Court Justice at 9 PM on Monday. The Bureau of Labor Statistics is set to release inflation data on Thursday, amidst concerns the Consumer Price Index may have seen its highest year-over-year rise since 2012. Earnings season is ramping up for companies reporting their second quarter results, and with it we should be able to gain a clearer picture of how effectively businesses have been using their extra cash from the tax cut.

What’s On Our Minds:

Bull Market Long in the Tooth?

Market pundits have recently turned their attention to the growing age of the bull market. Don’t fear what the specialists say; it’s their job to sell papers and they’re likely growing tired of writing about President Trump’s trade policies. In fact, they have been saying this since the bull market began 9 years ago!

Just this past weekend, Barron’s cover story was titled: “Why the Bull Market Could End in 2020.” This harks back to the old saying “a bull markets climb a wall of worry”. For years, the pundits have been saying the bull has gotten “long in the tooth” and that we are in the latter innings of the market cycle. While the threat of a looming recession always warrants a bit of caution for investors it’s not time to head for the exits. In fact, trying to time the market can be a dangerous (and costly) game.

Remember, bull and bear markets are not random or left up to chance and investor sentiment over the long-term is based on fundamentals. While all good things must come to an end and even though the current bull market has lasted longer than the historical average, the current strength of economic and earnings fundamentals suggest that this phase can be extended. Since 1950, the average stock market returns in the final two years of a bull market was 20% per year. While that’s certainly not indicative of what we may see in the near future, it goes to show that serious money can be made at the end of a bull market.

As long-term investors, it’s not our job to predict these market cycles but rather, it’s our job to position our clients’ portfolios for success over the entirety of the market cycle. Remember, as active managers focused on the long term, the Tufton Capital Investment Committee embraces the market cycle and even welcomes volatility. Both bull and bear markets offer unique opportunities that can lead to future success. We don’t head for the exits when good stocks are going on sale, nor do we go on a shopping spree when prices are at all-time highs.

Last Week’s Highlights:

Major indices continued to take a hit this past week, each losing over 1%. Of these indices, the Russell 2000 took the worst of the beatings, followed closely by the tech-heavy NASDAQ Composite, and the Dow Jones Industrial Average, which was pulled lower by poor performance from its latest addition, Walgreens. On the bright side however, the S&P 500 finally broke its 13-day losing streak, which was the longest of the index’s history. Moreover, we are starting to see some interesting ripple effects in the wake of international tariff tensions, as the dollar surged and China’s stock market tanked, giving the United States a strong vote of confidence in the ongoing back-and-forth between the two countries.

Looking Ahead:

The 3rd fiscal quarter began today, but it looks to be a quiet week on Wall Street, as the markets close early on Tuesday and remain closed on Wednesday in observance of Independence Day. We are wishing you and yours a fun and safe July 4th from all of us here at Tufton Capital Management.