The Weekly View (10/1/18)

Last Week’s Highlights:

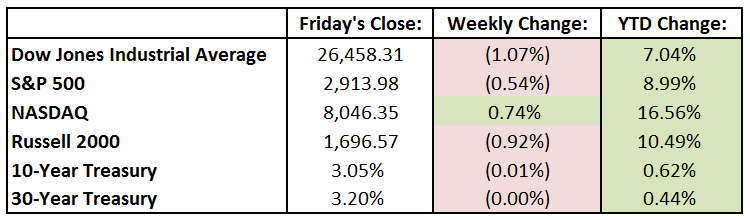

Most of the major US indices were down last week as tariff talks and the Federal Reserve weighed on strong quarterly performance. The Dow Jones Industrial Average was down 1.1% while the S&P 500 was down 0.5%. On the other hand, the technology heavy Nasdaq rose 0.75%. For the quarter, the three major indices posted their best quarterly performance since 2013. On the economic front, the biggest headline news was the Federal Reserve raising interest rates another quarter of 1%. The Federal Funds Rate now stands in a range of 2% to 2.25%. Housing was also in focus last week. New Home Sales were reported at 629,000 for the month of August, which was slightly below Wall Street’s estimate, but 21,000 higher than the number reported in July. Home Prices, as evidenced by the S&P/Case-Shiller Index, rose 0.1% for the month of July. Lastly, Durable Good Orders surged 4.5% in the month of August, beating the Wall Street estimate of 1.9%.

Looking Ahead:

This week, stocks are off to a strong start as the US, Canada, and Mexico agreed on a new trade agreement that will replace the current North American Free Trade Agreement (NAFTA). Jobs will also be in focus this week starting with the ADP Employment Survey on Wednesday. On Friday, investors will gain further insight on the job market with Average Hourly Earnings, Nonfarm Payrolls, and the Unemployment Rate all being released by the Bureau of Labor Statistics. With the end of the calendar quarter, many companies will be preparing for quarterly earnings calls in the next coming weeks.

The Tufton Capital Team hopes that you have a wonderful week!