The Weekly View (6/4/18)

What’s On Our Minds:

While Tufton Capital is focused on asset management and not legal or tax advice, we would like to take this opportunity to touch on some of the benefits of using a Donor-Advised Fund (DAF) to fulfill your philanthropic goals. The way we see it, if you are going donate to charities, why not make your good will as tax efficient as possible? In that light, donor advised funds have become increasingly popular under this year’s the new tax code.

Long before the contents of the 2017 tax overhaul were finalized, and in the context of a booming stock market, most tax advisors understood that DAFs would likely continue to grow significantly moving forward.

Charitable “clumping” has become popular under the new code, which allows taxpayers to claim a “standard deduction” that discourages itemized deductions. Given the challenge of having enough itemized deductions to exceed the standard deduction, it has become beneficial to lump together numerous years of donations into one tax year in order to take one larger deduction upfront. Furthermore, donor-advised funds can be funded with appreciated securities, which allows folks to avoid paying capital gains tax upon liquidating shares, while securities used to fund the venture can remain invested. In short, by clumping the charitable contributions together, donations that otherwise would have been itemized deductions that fell below the threshold for the standard deduction are at least partially above the threshold, thus providing an immediate tax benefit that simply would not have been received at all if the contributions had been made annually.

Along with the tax benefits, donor-advised funds are simpler to use than a family foundation, and require much less paperwork and bureaucratic maintenance.

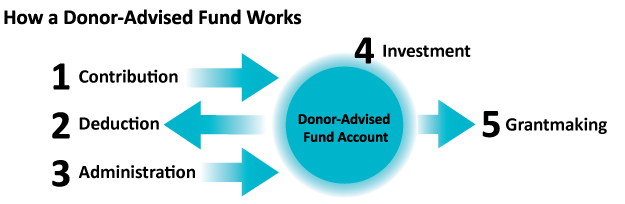

How a Donor-Advised Fund Works

1. You make an irrevocable contribution of personal assets.

2. You immediately receive the maximum tax deduction that the IRS allows.

3. You name your donor-advised fund account, advisors, and any successors or charitable beneficiaries.

4. Your contribution is placed into a donor-advised fund account where it can be invested and grow.

Last Week’s Highlights:

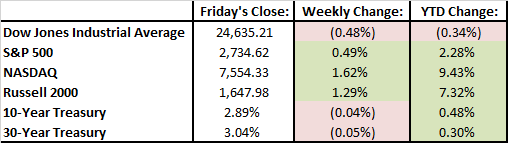

Political turmoil in Italy and continued uncertainty over trade tariffs made for a rocky week in the markets, but most indices finished strong. The May jobs report showed the lowest level of unemployment since 2000 at 3.8%. This beat most expectations, and paired with decent wage growth paint a strong picture of the overall economy. 10-Year Treasury prices were down slightly, as money began to flow back into equities due to increased confidence in the market.

Looking Ahead:

With fewer earnings reports to scrutinize, focus will turn to economic indicators and political events. Further labor data will be released throughout the week, and the consumer credit report is due to come out on Thursday. In the realm of politics, the G7 Summit begins on Friday where trade deals will be a hot topic.