The Weekly View (8/1/16 – 8/5/16)

What’s On Our Minds:

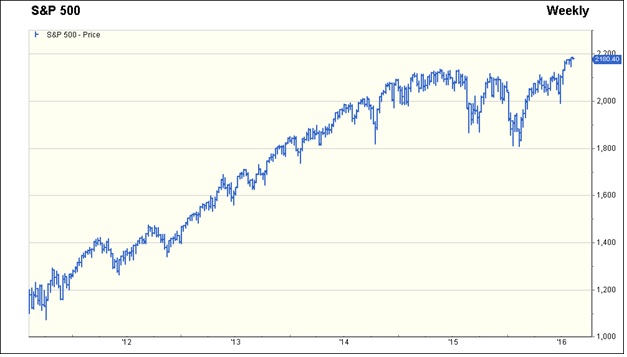

On Friday, the S&P 500 and Nasdaq both climbed to an all-time high after the Bureau of Labor Statistics reported that the US economy added 255,000 nonfarm jobs in July – beating Wall Street’s expectation of 175,000. Job growth in June was revised higher from a previous reading of 287,000 to 292,000. On previous jobs report Fridays, the markets have surged higher whether or not the report was strong or weak. A “bad news is good news” report typically held the belief that the Fed would continue accommodative policy and not increase interest rates. The response from the markets this past Friday was “good news is good news” as it appears the economy is strong enough to withstand further interest rates hikes from the Fed this year.

The other employment reports were strong as well with average hourly earnings rising 2.6% year over year and the labor force participation rate increased from 62.7% to 62.8%. This is encouraging as the rate hit a multi-decade low in late 2015. For August, let’s hope those seeking employment continue to avoid the beaches.

Last Week’s Highlights:

The stock markets rose on the week with all the major indexes in the green. The Dow Jones increased 0.6% while the S&P 500 and the Nasdaq increased 0.4% and 1.1%, respectively. With the rise in expectations of interest rate hikes, the financial sector jumped 1.2% and the utility sector declined 2.6%. Investors are betting that banks will make more money on their loans that they offer at a higher interest rate and that utility companies will have to pay higher interest rate on the debt they currently owe or will owe in the future.

Earnings season is winding down as approximately 87% of S&P 500 companies have reported their quarterly results. 69% of S&P 500 companies reported better than expected results. Furthermore, 53% of S&P 500 companies had their earnings estimates for 2016 revised higher, however, 56% of the companies had their 2017 earnings estimates revised lower.

Looking Ahead:

Looking ahead, the week is somewhat light on economic and company data. Pharmaceutical company Allergan and Tyson Foods report quarterly earnings on Monday. On Tuesday, Walt Disney and the troubled Valeant Pharmaceuticals International will report. Valeant’s stock has fallen from a high of $262 per share last August to $22 per share on Friday due to a government investigation on price increases of their drugs. Thursday will offer guidance and results from the battered retail stores will Macy’s, Nordstrom and Kohl’s all reporting. The report on July’s retail sales will be released on Friday giving investors a gauge of the US consumer – let’s hope all had too much fun on vacation.