The Weekly View (8/15/16 – 8/19/16)

What’s On Our Minds:

Contributing a portion of your estate to charity may be something that you and your family strongly believe in, whether or not you receive any benefit from it. Although generosity is the driving force behind philanthropy, there are also many benefits that a donor can reap from making charitable contributions.

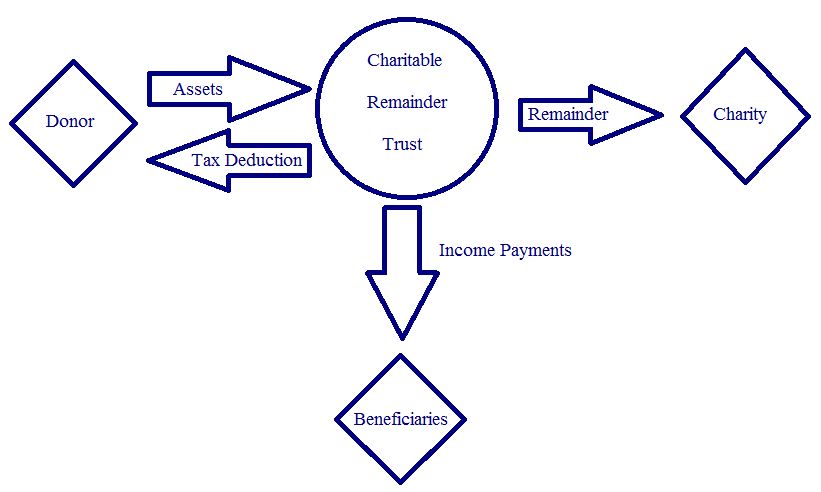

Considering that our firm’s home state of Maryland levies a 16% estate tax (on individual estates larger than $2 million) and the federal government charges a 40% estate tax (on individual estates larger than $5.43 million), it’s important for wealthy families to consider the many estate planning strategies available that can help reduce the tax bite upon a generational wealth transfer. One strategy is the creation of a charitable remainder trust (CRT).

CRTs are an option as they allow wealthy individuals to fulfil their philanthropic goals by moving assets out a taxable estate which can then grow, tax free, through investment. Meanwhile, during the life of the trust, it is required that the CRT distributes between 5 and 50 percent annually to the beneficiary of the trust (either the grantor of the trust or their family). These payments will last for a set number of years or the remainder of the grantor’s life, depending on how the trust document is written. The trust will end at the predetermined time and the remaining funds with go to the charity of your choice.

The tax advantages continue with the creation of a CRT. Along with moving funds out of a taxable estate, upon the creation of the trust, the grantor can take an income tax deduction for the full value of the trust that can be spread over five years. Finally, the creation of a trust helps individuals avoid capital gains taxes. Assets with large unrealized gains can be moved into the trust, sold, and reinvested into a portfolio of income producing investments.

At Tufton, we provide comprehensive planning services to portfolios of all sizes and complexities and give you objective solutions. Armed with a plan, you can be sure your loved ones are taken care of while minimizing taxes.

Last Week’s Highlights:

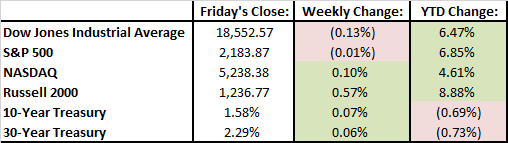

With earnings season winding down, market moving news was sparse last week. Markets reached another record high on Monday but by the end of the week, we were back where we started. The Fed released minutes from its July meeting on Wednesday which did not provide any excitement. The Fed did not strike down a September or December rate hike, but there is still uncertainty surrounding Brexit and inflation numbers.

On Monday night, Obamacare took a blow when news broke that one of the nation’s largest health insurers, Aetna, would suspend its offering of coverage in 70% of counties where it currently operates.

Looking Ahead:

Some important housing data will come across the wires this week with New Home Sales numbers on Tuesday and Existing Home Sales data on Wednesday. The Fed will hold its annual Jackson Hole Symposium beginning on Thursday. Big shots in the Central Banking world will gather to discuss their trade. The biggest speech of the week is on Friday when Janet Yellen will offer her incites. Per usual with her speeches, investors will be listening intently to hear what she has to say about the Fed’s interest rate policy moving forward.