The Weekly View (9/5/16 – 9/9/16)

What’s On Our Minds:

This weekend, we got some questions about investing in real estate vs. investing in the stock market. Clearly, investing in a home can be a great decision. But we maintain that for excess capital, the stock market is the right choice for almost everyone. Here’s some point to consider when making the decision.

First, if you don’t plan on moving in the next couple of years, owning the home in which you live is usually the right decision. Rent isn’t exactly “throwing money away” like some people have said, because home ownership brings with it taxes, maintenance, and very importantly, transaction costs. But, over many years, there is great value in owning a home as a major asset.

Second, the expected return on a piece of property, on average about 3%/year, is much lower than that of the market, at about 8% a year. People who invest in property often do so because they believe they’ve found a special deal or have some special knowledge about the development of the area. That may be true- but you have to be really sure, because the direction of a development plan or even an entire city can change overnight.

When investing in property, the real advantage comes from the leverage you get from your mortgage. If you put down $40,000 on a $200,000 home, your equity after closing costs on day 1 might be $15,000. If your equity in the first year rises to $22,500 (both repayment and appreciation) that is a 50% return on equity. In the last year, though, when your equity rises from $192,500 to $200,000, that is just a 4% return. Leverage seems like magic, but one must remember- leverage also works on the downside.

Also, when it comes to investment, buying a single property carries with it a lot of risks that one doesn’t get in the stock market. A single house can get flooded, or a school district can go downhill, or myriad other problems. With a diversified stock portfolio, the only comparable risk is that the entire U.S. economy collapses, and we return to a barter system before your retirement, in which case that property investment probably wouldn’t work out either.

One final thing we stress: there has never been a period of twenty years in the market in which a diversified investor would have not gained money. Over even the worst-timed thirty year period, there is no such investment that would not have appreciated greatly. The same cannot be said for property.

Of course, this very brief overview of the ins and outs of the decision to invest in property only begins to scratch the surface. There is much more to consider. But hopefully this post can give you a broad starting point to think about where to invest your money.

Below, as an example, we see the Case-Shiller home price index (red) vs. the S&P 500’s total return (blue). While the housing bubble seemed like the best investment around in the early 2000s, we all know how that turned out. Since then, the stock market has rebounded very nicely. A $100,000 investment 15 years ago in housing would be worth $157,760 now. The same investment in the market would be worth $276,160 now.

Last Week’s Highlights:

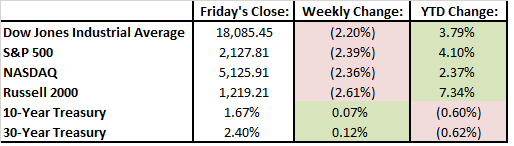

In a short week of trading due to the Labor Day Holiday on Monday, the market was rather flat until Friday when indexes took a big turn south. By the close on Friday, the Dow Jones had sold off 2.2% to finish its worse week since January. Investors were surprised by news that the European Central Bank decided against increasing its stimulus plans. Furthering selling pressure, Boston Fed President Eric Resengren, said that persistently low interest rates have “created excesses in the financial system”. This idea that the stock market is “addicted” to low rates is nothing new but his comments had the bears out in full force on Friday.

Looking Ahead:

While market moving news was hard to come by in August, volatility has returned to equity markets with uncertainty surrounding this month’s fed interest rates decision and the upcoming Presidential election. While awaiting 3rd quarter earnings season to begin in October, investors will continue to focus on fundamental economic indicators and monetary policy at home and abroad. Fed officials are not allowed to make public statements after Monday so investors will be listening intently to their last comments before their official decision is released at their Sept. 20-21st meeting. Some more important data comes across the wire this week that will factor into the Fed’s September rate decision. Retail sales numbers will be released on Thursday and producer price index numbers will be released on Friday. Currently, fed funds futures indicate there is a 27% likelihood of a September rate hike and a 46% chance of a December hike.