The Weekly View (2/29/16 – 3/4/16)

What’s On Our Minds:

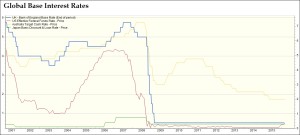

As talk about negative interest rates in Europe and Asia increases in the financial news, we’ve received more and more client inquiries asking what this means for global markets and their portfolios. After all, the financial system is built around positive interest rates, and the current overseas rate structure seems to be “upside down.” We spend a lot of time thinking about, discussing and structuring portfolios around various interest rate scenarios, whether they be positive or negative. We’ll first explain how and why rates can go negative, and then discuss the chances of negative rates entering our domestic financial system.

A negative interest rate policy means that a central bank will charge commercial banks negative interest: instead of receiving money on deposits, depositors must pay to keep their money with the bank. Central banks, specifically several in Europe and Asia, have introduced such a policy to stimulate their weak economies and increase inflation levels, which have been well below comfortable levels. By introducing negative interest rates, it is hoped that commercial banks will lend more money at very low interest rates. Doing so should entice bank customers to borrow more, spend more, and save less, thus boosting economic activity. As importantly, negative interest rates often drive down the value of a country’s currency, making its exports more affordable and competitive with overseas trade partners (which also helps economic growth). Banks must be careful, though, to avoid the specter of deflation.

While negative rates in the US are always a possibility, we think that such a scenario is highly unlikely, as the domestic economy would have to get much worse before the Fed would contemplate such a move. We are not forecasting such weakness or a related recession in the near term and therefore do not foresee negative rates in the US during this economic cycle. Moreover, introducing such a strategy would be an extreme move in the history of our country’s monetary policy. Such a move would likely have broad political implications, possibly provoking Congress to limit the powers of our country’s central bank.

Last Week’s Highlights:

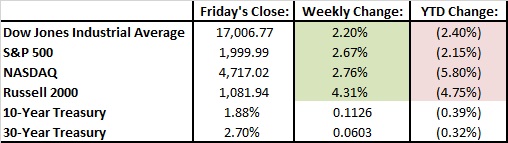

Strength continued in the equity markets, as stocks posted solid gains for the third week in a row. The Dow rose 2.2% for the week, the S&P 500 was up 2.7%, and the Nasdaq increased 2.8%. Many investors are becoming more confident in the US economy’s growth (slow growth though it is), and talk of a recession in the near term is less alarming.

Friday’s jobs report came in well above expectations, with the US economy adding 242,000 jobs in February (above economists’ 195,000 estimate). The unemployment rate remained 4.9% (as expected by the Street), and wages declined 0.1% for the month.

Looking Ahead:

Front and center for investors this week will be Thursday’s meeting of the European Central Bank (ECB), which is expected to push a key interest rate even further into negative territory. Doing so would boost its current stimulus program in order to help economic growth in the Eurozone. More volatility is expected with this week’s meeting, especially if the ECB provides less stimulus than investors are anticipating. Please read our thoughts on the negative interest environment and its impact on global markets (in the above “What’s On Our Minds” section).

There is little US economic data to be released this week, so all eyes will be on Europe.