The Weekly View (2/22 – 2/26)

What’s On Our Minds:

In the last two and a half weeks, the S&P 500 is up nearly 8%. This weekend, we were asked, “Does this mean that the market will go down again before it goes up more?” Our response was, “Yes, either that, or it will go up more before it goes down again.” The upward movement doesn’t seem to be because of any fundamental shift. Rather, what is improving is sentiment, the” wild card” of the market. The market recovered from its despondency that was building as a result of China worries, oil prices (fears of $20 crude), credit weakness, and more. Then, we got better US data, a rally in crude, waning China concerns, and the Fed came out against negative interest rates.

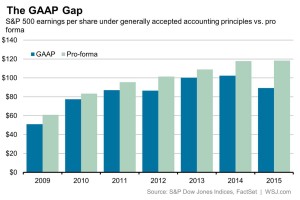

We are a bit worried, though, about pro forma (adjusted) earnings that have been reported over the last year vs. GAAP earnings (those adhering to strict accounting rules). While there can be good reason to present adjusted earnings that do not “reflect the realities of the business as a going concern,” a market-wide trend in the ballooning of these adjusted earnings is a bad sign. Adjusted numbers show that earnings grew just 0.4% last year, a very poor showing as it is. But the more-stringent GAAP numbers show a 12.7% earnings per share decrease, a number more reminiscent of 2008. Could stocks be more expensive than market participants believe them to be?

Last Week’s Highlights:

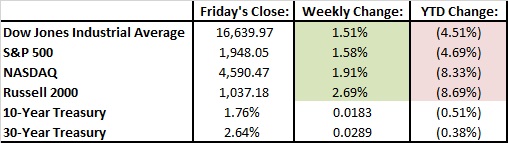

Last week was another relief, as stocks rose farther out of their earlier depths. While not as stellar as the previous week, it was still very rosy, with the Dow up 1.5%, the S&P 500 up 1.6% and the Nasdaq up 1.9%.

Looking Ahead:

Economic numbers come out this week- that is, real fundamentals. We will see the manufacturing price index PMI on Tuesday, auto sales also on Tuesday, and February US jobs on Friday. Something we will certainly be watching are the results of Super Tuesday’s primary races. We can’t make any hard calls at this point but the leaders in both parties are looking more and more inevitable…