2010 Q4 | 2011: Our Crystal Ball

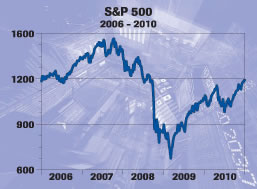

The economy and the financial markets performed well in the fourth quarter and for the full year 2010. The Standard and Poor’s 500 index increased 10.49% in the quarter and 14.79% for the full year, somewhat above the long-run average return for common stocks since records were established in 1926. Bonds also delivered positive returns, and the 10-year and 30-year treasuries provided returns of 7.9% and 8.7%, respectively.

The economy and the financial markets performed well in the fourth quarter and for the full year 2010. The Standard and Poor’s 500 index increased 10.49% in the quarter and 14.79% for the full year, somewhat above the long-run average return for common stocks since records were established in 1926. Bonds also delivered positive returns, and the 10-year and 30-year treasuries provided returns of 7.9% and 8.7%, respectively.

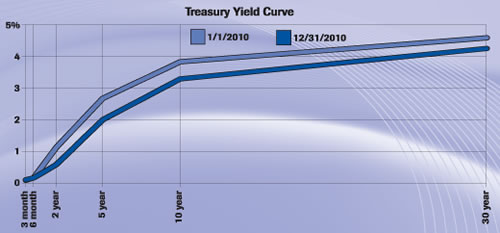

But in the fourth quarter of 2010, there was a significant divergence in the performance of stocks vs. bonds. The sharp fourth-quarter advance in stocks (10.49%) was not matched by treasury returns. In the final quarter of 2010, the ten-year treasury fell 5.6% and the thirty-year treasury declined 9.8%. The bond market appears to be reacting to a sharp rise in the projected fiscal 2011 federal deficit of $1.27 trillion ($1,270 billion), up from $480 billion in fiscal 2009. Calls for spending cuts, repeal of the health care program, and a contentious debate over increasing the government debt ceiling may have temporarily spooked the bond market.

Despite a sluggish recovery, we estimate real gross domestic product increased at a 2.5% to 3% rate for 2010. Housing, accounting for 20% of the economy on a normalized basis, remains stalled at very depressed levels. New housing starts and existing housing sales are at 30-year lows. Although signs of a cyclical recovery are scarce, at least the situation appears stable.

The automobile sector, which contributes 8% to our gross domestic product, has also experienced a significant decline in demand over the last three years. Automobile sales, which had been running at an approximate annual rate of 16.5 million units for several years prior to 2008, declined about 35% in 2009 to 10.4 million units. There was a slight recovery in 2010 of 1 million units to 11.6 million in sales. The average age of America’s existing car fleet is now ten years. This is a new record for the age of cars on our roads, providing the optimist with the view that there is some pent-up demand for automobiles in our country.

Arguments can be made about the severity of the current recession, but unquestionably this will be one of the longer economic adjustment periods on record. The recession resulted in a sharp increase in unemployment and a large increase in “shadow unemployment”—those who have withdrawn from actively seeking work and are therefore not counted in the official unemployment number. Some estimate that 20 million workers are either officially unemployed or are awaiting better times to seek jobs. This is a large issue when one considers the US civilian workforce is currently 150 million workers.

Though actual employment is moving slowly upward (138.9 million workers in November 2010 vs. 138.3 million in November 2009), the overhang of “shadow unemployment” will delay any significant improvement in reported unemployment for some time.

Why, then, did the stock market perform so well in 2009 and 2010? (see chart) In three words, the answer is “earnings and inflation.” Companies stepped up capital spending and cut costs. Despite the recession, earnings for both the Dow and S&P 500 are projected to be at record levels in 2011. Both are selling at approximately 12-13 times yearly earnings, at the low end of their historic range.

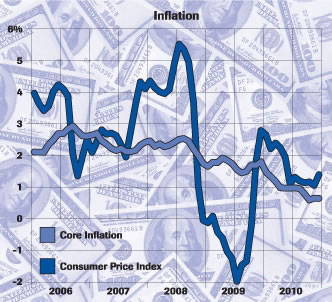

A second critical variable in valuing common stocks is the level of inflation (see chart). Taking a longer-term view, economists are divided on the outlook for inflation. However, for 2011, both economic commentators and our firm anticipate low levels of inflation (less than 2.5%). This level of inflation should contribute to higher valuation levels as measured by price/earnings multipliers.

Therefore, we believe 2011 could be another good year for stocks, with potential gains between 12 and 18%. Of concern is the virtual universal optimism of stock forecasters. I have found, as a contrarian investor, it is wise to be cautious when everybody agrees on anything. We continue to search for companies in the stock market that have been shunned by others. Though they are perhaps not in the more glamorous sections of the economy, we have uncovered many companies that could provide investors with satisfactory returns in the coming years.

Despite continuing strength in the emerging economic tigers (Brazil, Russia, India, China), foreign markets underperformed the US in 2010. We, like Warren Buffet, are seeking individual foreign companies to invest in, and are not focused on country-by-country sector funds. I would also point out that 52% of the S&P 500’s revenues are now coming from abroad, so our investors have an indirect stake in overseas markets.

Many uncertainties remain in 2011. President Obama has significantly altered his economic advisory team. Though unproven, his selections appear to be well qualified. The president also extended the Bush tax cuts after, in his words, his “shellacking” in the November midterm elections. These tax cuts and personnel changes will likely give the economy a shot in the arm.

As some of you know, I was hospitalized in December. I do want to thank the entire staff of the Greater Baltimore Medical Center for the superb care I was given. I was discharged in late December and was pronounced as good as new. I returned to the office on January 10th, appreciative of the many kindnesses that I received both in the hospital and when I returned home. I am grateful to our clients and my friends for their expressions of concern. It meant a great deal to me. I have returned to work, hopeful that we are off to another good year in the investment arena.

For some time, I have been thinking of devoting more time to the investment process and refining our investment strategies. With this in mind, I invited Steven L. Shea, former executive vice president of the regional brokerage firm Ferris, Baker Watts to join the firm in June 2010. Steven has a 30-year career in finance and is well-qualified to deal with the strategic direction of the firm. He is widely known both in the Baltimore financial community and the national financial community. Steve was named President of the firm on January 15, 2011, and I became Chairman of the Board, effective the same date. I am confident we have strengthened our organization, and I look forward to introducing you to Steven in the coming months. My partners and I appreciate your support of our firm, and we hope to be of continued assistance in managing your financial interests.